A stale Monero lead developer sparked controversy after revealing that a shut buddy—beforehand skeptical of crypto—wanted to buy XRP, believing banks may well be fashioned within two years.

Igniting the XRP Debate: A Skeptic’s Inquiry

The claim by Riccardo Spagni, stale lead developer for Monero, that a shut buddy and longtime crypto skeptic had expressed hobby in procuring XRP ignited debate between the digital asset’s fervent supporters and its continual critics. The conversation changed into additional fueled by the unnamed buddy’s putting belief that former banks may well be fashioned in decrease than two years, a sentiment that has introduced renewed scrutiny to the marketing and marketing solutions of the XRP crew.

After years of staunch entanglements that jeopardized issuer Ripple’s imaginative and prescient of organising XRP as a key bridging forex, the corporate has viewed a more favorable setting emerge below the Trump administration. Shall we dispute, the U.S. Securities and Substitute Price (SEC) has since agreed to quit its staunch action against Ripple, and President Donald Trump took the considerable step of naming XRP as a skill candidate for the nation’s digital asset stockpile.

These events and many assorted distinct inclinations for Ripple private raised XRP’s profile and attracted the hobby of first-time cryptocurrency investors. The elevated hobby has viewed XRP bounce from below $1 on Nov. 16, 2024, to better than $3.60 on July 22, 2025. Though the cryptocurrency therefore reversed some of its good points, it is serene one amongst basically the most involving-performing excessive-cap altcoins over a 12-month length.

Furthermore, some pro- XRP analysts on the social media platform X are serene projecting it to whole the twelve months around $4 or more, prompting current customers like Spagni’s buddy to see publicity to the cryptocurrency.

“A shut buddy, who has repeatedly been skeptical of crypto and has never owned any, has beautiful asked how he can accumulate a pockets and an commerce account to buy…are looking ahead to it… XRP, because it’s modern and the banks are all going to be long past in 18 months,” Spagni stated.

Critics and Accusations

Reacting to Spagni’s submit, some X customers seemed bowled over by the truth that the developer changed into being asked about procuring XRP and no longer Monero’s privacy coin XMR. Mild, many of those reacting to the submit perceived to be resigned to the truth that “normies” seem intent on procuring XRP in spite of what critics are asserting about it.

Others, nevertheless, slammed the account that Ripple’s XRP, which is the amount three digital asset by market capitalization, can also replace banks, asserting this reveals proponents’ apparent lack of idea of how the blockchain works.

“The foundation of XRP and Ripple working out as banks has repeatedly boggled me so remarkable. You may well per chance like to private basically iq below shoe stage and 0 world idea. What financial institution will desire this, and why give vitality to a non-public company that outsources price to the launch market. Then the whole probability and responsibility is in that one company. How? Doesn’t manufacture sense in launch permissionless blockchains to private a single point of failure like CEO and company structure. Brainrot,” one particular person wrote.

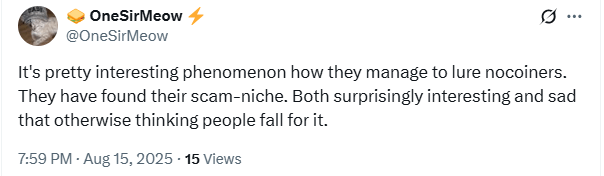

Nevertheless, even basically the most vocal detractors looked as if it would agree that XRP’s promotional crew is aware of solutions to fabricate an affect. They display the engagement ranges of social media posts stating Ripple and XRP as neatly as series of up to date crypto enthusiasts inquiring in regards to the digital asset. Mild, no longer all americans appears to be like to be in admiration of the Ripple/ XRP marketing and marketing machine.

One particular person, Fish Catfish, suggested that the whole lot of XRP’s market cap relies on misinformation about banks and the “spurious belief that being a ‘bridge forex’ makes a token helpful.” Catfish also seemed displeased by investigative journalists whom the actual person accused of failing to identify parties occupied with what they known as a misinformation campaign.

“It’s incredible that investigative journalists haven’t dug down the rabbit gap to make a selection out the build the total funding of these misinformation campaigns is coming from and the build the money accelerate leads,” Catfish stated.