The crypto market currently skilled its first altcoin season in additional than 10 months. This transient rally noticed many altcoins outperforming Bitcoin. Nonetheless now, the altcoin season index has dropped over again.

This shortened momentum has left investors fascinating, because the rapid fading of optimism raises questions on the sustainability of altcoin traits within the sizzling market.

Is Altcoin Season Over?

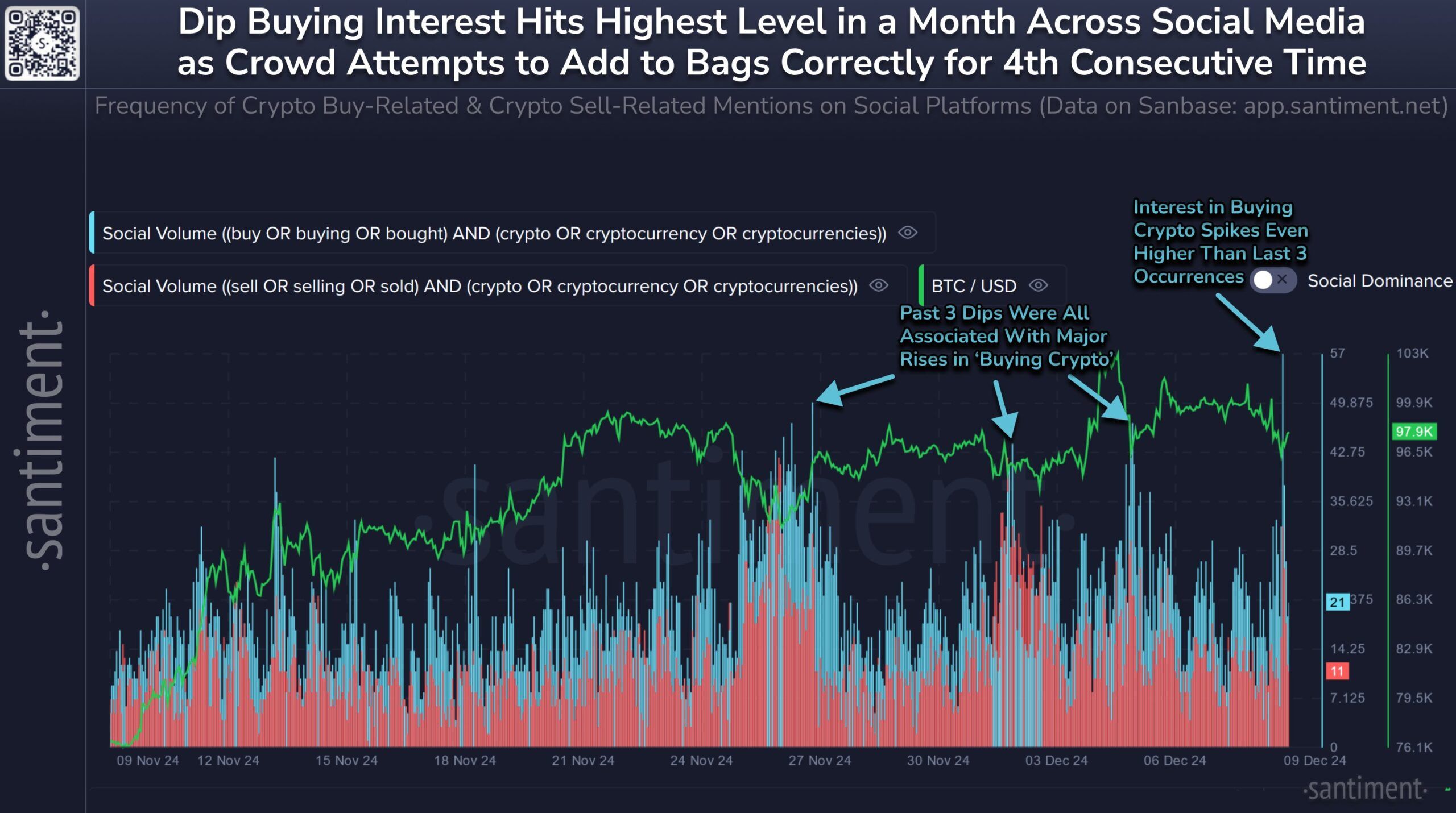

In accordance to recordsdata from Santiment, primarily the most modern plunge in altcoin prices brought on a surge in procuring for interest. This spike in procuring for job became the supreme in weeks, even surpassing the stage of interest considered when Bitcoin became gearing up for its rally.

Such spikes usually signal crypto investors’ sentiment is driven by wretchedness of lacking out (FOMO), severely when altcoins tell indicators of quick-period of time gains. This habits usually ends in elevated market volatility as investors are attempting and capitalize on what’s also a fleeting opportunity.

No topic the heightened procuring for interest, the undeniable truth that the altcoin season can also had been quick-lived leaves a sense of uncertainty out there. FOMO-driven procuring for can create an unsustainable build a matter to for altcoins, severely when the broader market sentiment remains hesitant. The surprising plunge in prices after the altcoin season indicates that many investors can also had been overzealous, inflicting the market to ultimate itself fast.

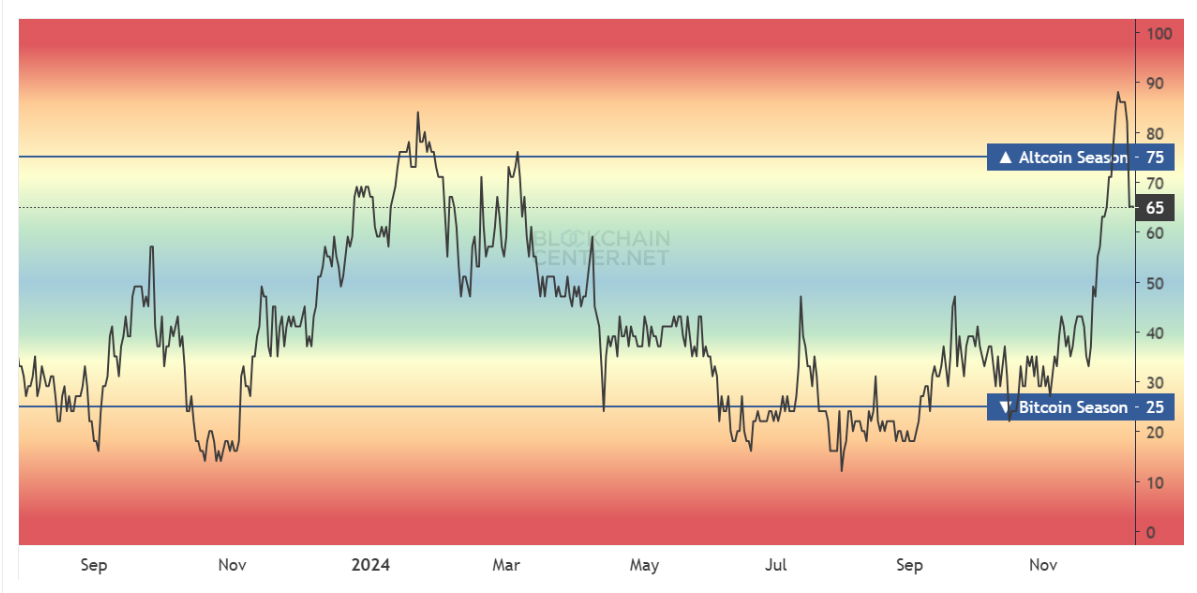

The final macro momentum of the altcoin market suggests a shortage of sustained bullish sentiment. The Altcoin Season Index, which measures the efficiency of the top 50 altcoins as in contrast with Bitcoin, has dropped a great deal.

This decline is a obvious designate that altcoins are losing ground against Bitcoin, which has reasserted its dominance out there. Because the Altcoin Season Index falls, the broader altcoin market tends to disappear, as considered with this recent altcoin season, which perceived to handiest final about per week.

The waning altcoin season highlights the challenges altcoins face in sustaining momentum when Bitcoin continues to screech real efficiency. The market’s heart of attention on Bitcoin usually overshadows altcoin rallies, main to a snappy return to Bitcoin’s dominance. This dynamic means that, unless a main shift in investor sentiment happens, altcoins can also warfare to withhold real momentum within the near future.

Altcoin Value Prediction: Strengthen Forward

The complete crypto market cap, with the exception of Bitcoin (TOTAL2), has skilled a main decline, dropping by $140 billion within the final 24 hours. This downturn in altcoin prices has heavily impacted the final market. If altcoins continue to tumble, TOTAL2 can also face extra losses, main to more market uncertainty.

For the time being, the crypto market cap is making an are attempting to reclaim the $1.57 trillion stage as reinforce. This designate point is a truly unparalleled for affirming a bullish outlook within the quick period of time. If the market cap can defend this stage, it will also space the stage for a capacity uptrend, stabilizing investor self belief.

Nonetheless, a deeper correction in altcoins can also meander the market cap the total model down to $1.22 trillion. This kind of plunge would a great deal undermine the sizzling bullish scenario, doubtlessly triggering a broader market correction. A failure to withhold key reinforce ranges can also lead to a more extended bearish building.