After a interval of heightened shopping exercise and elevated bullish momentum, Ethereum has successfully reclaimed primarily the most well-known resistance zone, particularly the old main yearly high at $3.6K.

This breakout, if confirmed by a retest, items the stage for ETH to presumably put a brand recent all-time high in the conclude to future.

Technical Diagnosis

By Shayan

The Weekly Chart

An in-depth prognosis of the weekly chart unearths a chief bullish sentiment surrounding Ethereum, as evidenced by an limitless and impulsive upward movement surpassing the severe resistance represented by the prior main yearly high of $3.6K.

This ticket movement displays a solid curiosity from market participants in ETH, ensuing in heightened inquire of.

Within the event of a a success retest of the breached level, Ethereum’s ticket is anticipated to continue its upward trajectory, targeting the severe all-time high of $4868.

Despite the bullish outlook, Ethereum could presumably presumably bump into major enhance around the $3.6K threshold, with extra enhance phases chanced on within the 0.5 ($3066) and nil.618 ($2870) Fibonacci phases, serving as capability zones for corrective actions.

The 4-Hour Chart

Additional prognosis of the 4-hour chart confirms Ethereum’s total bullish sentiment and elevated market self belief, riding the value to its highest level since April 2022. This surge, accompanied by heightened market volatility, displays huge shopping curiosity aimed toward surpassing the vital resistance level of its ATH at $4.8K.

Then yet yet again, following a rejection on the lots of $3.6K resistance, Ethereum chanced on enhance within severe regions marked by the 0.5 and nil.618 Fibonacci phases, prompting an rapid reversal. Then yet yet again, the value surged previous $3.6K, bolstered by prevailing market inquire of, indicating the investors’ dominance in the market.

For the time being, ETH approaches a chief psychological resistance zone conclude to the $4K threshold. Given the flexibility of this ticket differ and the hasty ascent of the novel bullish rally, elevated volatility and fluctuations are anticipated.

Despite capability immediate to mid-term corrections, the total sentiment remains positive, with Ethereum poised for additional upside capability.

Sentiment Diagnosis

By Shayan

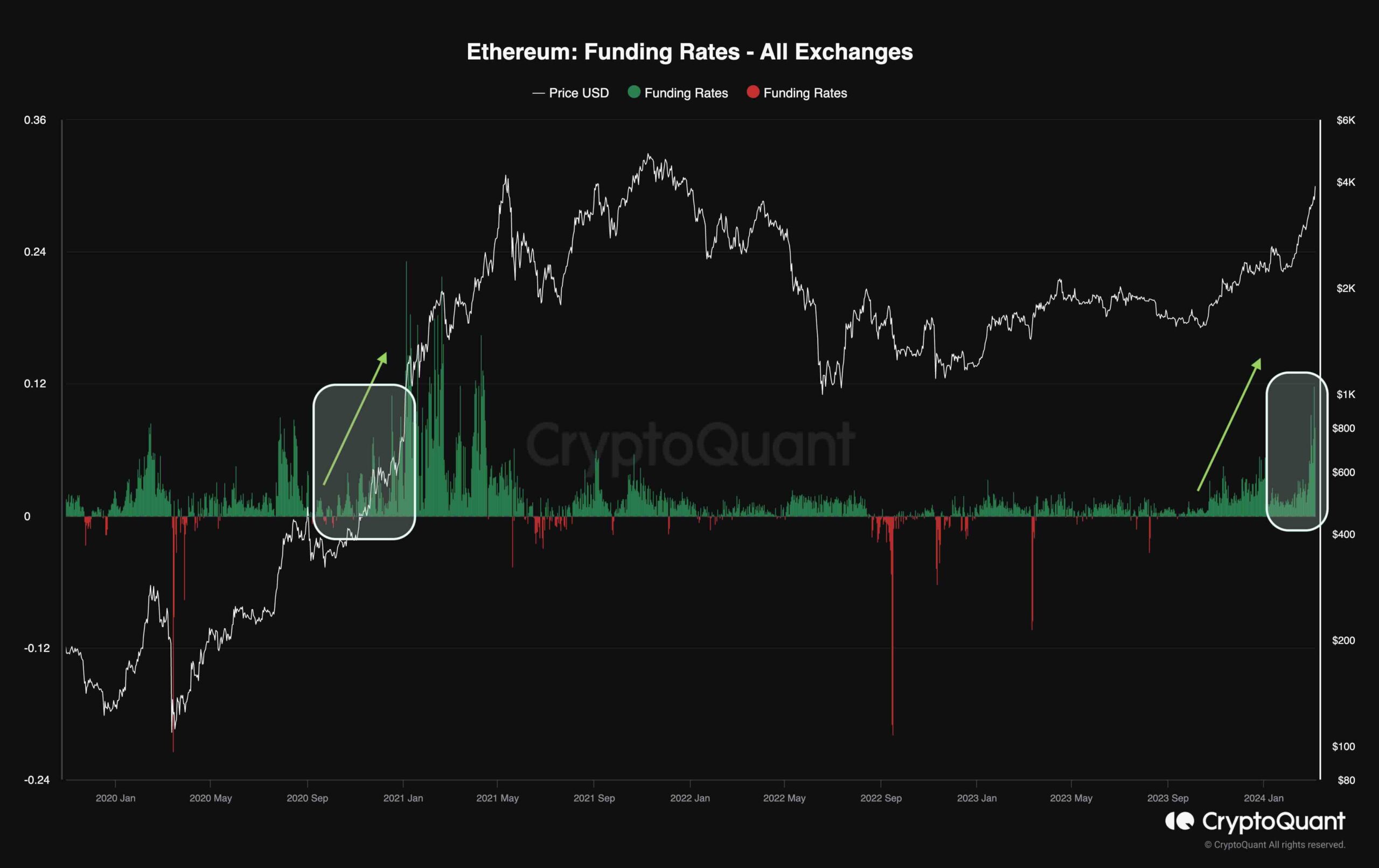

Ethereum’s recent surge highlights an amplify in investor self belief and heightened shopping exercise. A indubitably well-known indicator reflecting market dynamics is Ethereum’s funding rates, which measure the aggressiveness of trades in the futures market. Positive rates ticket a bullish outlook, while detrimental rates indicate bearish sentiment among traders.

Particularly, this metric has seen a chief uptick, reaching phases corresponding to slack 2020 when Ethereum became once poised for a grand bullish rally toward its all-time high. This surge in funding rates signifies a solid bullish sentiment among futures traders, presumably ensuing in a sustained upward kind.

Then yet yet again, while rising funding rates generally accompany a bullish market sentiment, excessively high values will doubtless be unhealthy.

Elevated rates amplify the threat of long liquidation cascades, which would maybe lead to heightened market volatility and surprising corrective actions. Therefore, traders could presumably presumably nonetheless carefully computer screen funding rates amidst Ethereum’s bullish momentum and effectively voice up threat to evaluate market situations and stay up for capability ticket fluctuations.