FLR, the native token of the EVM-essentially based totally mostly Layer 1 blockchain community Flare, is currently’s high gainer, climbing virtually 10% in the previous 24 hours.

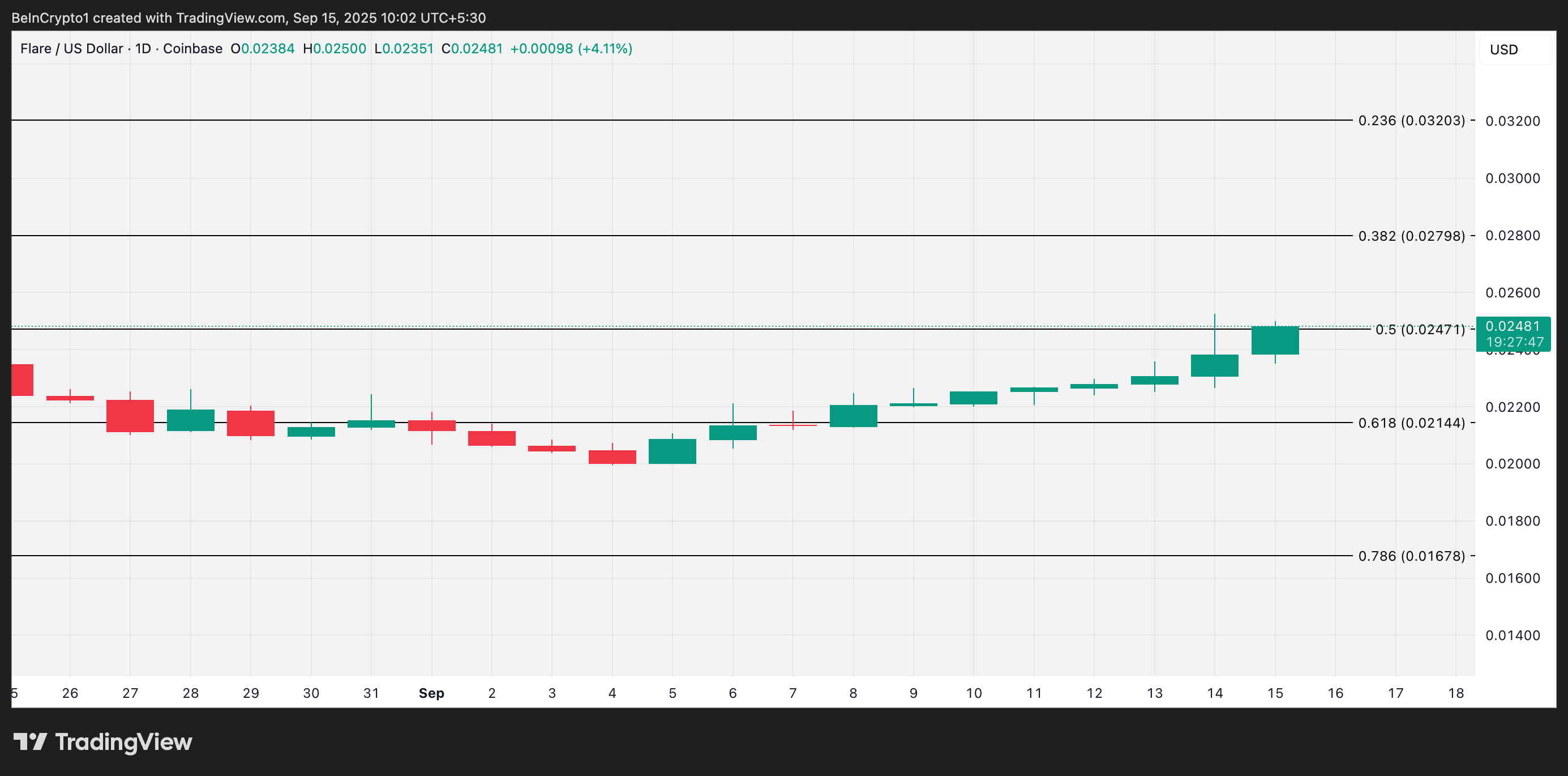

The token has steadily risen since early September, and present label motion suggests it’s going to also attain a two-month excessive of $0.02798 in the arrival shopping and selling classes.

FLR Eyes Bigger Floor as Investors Dominate Market

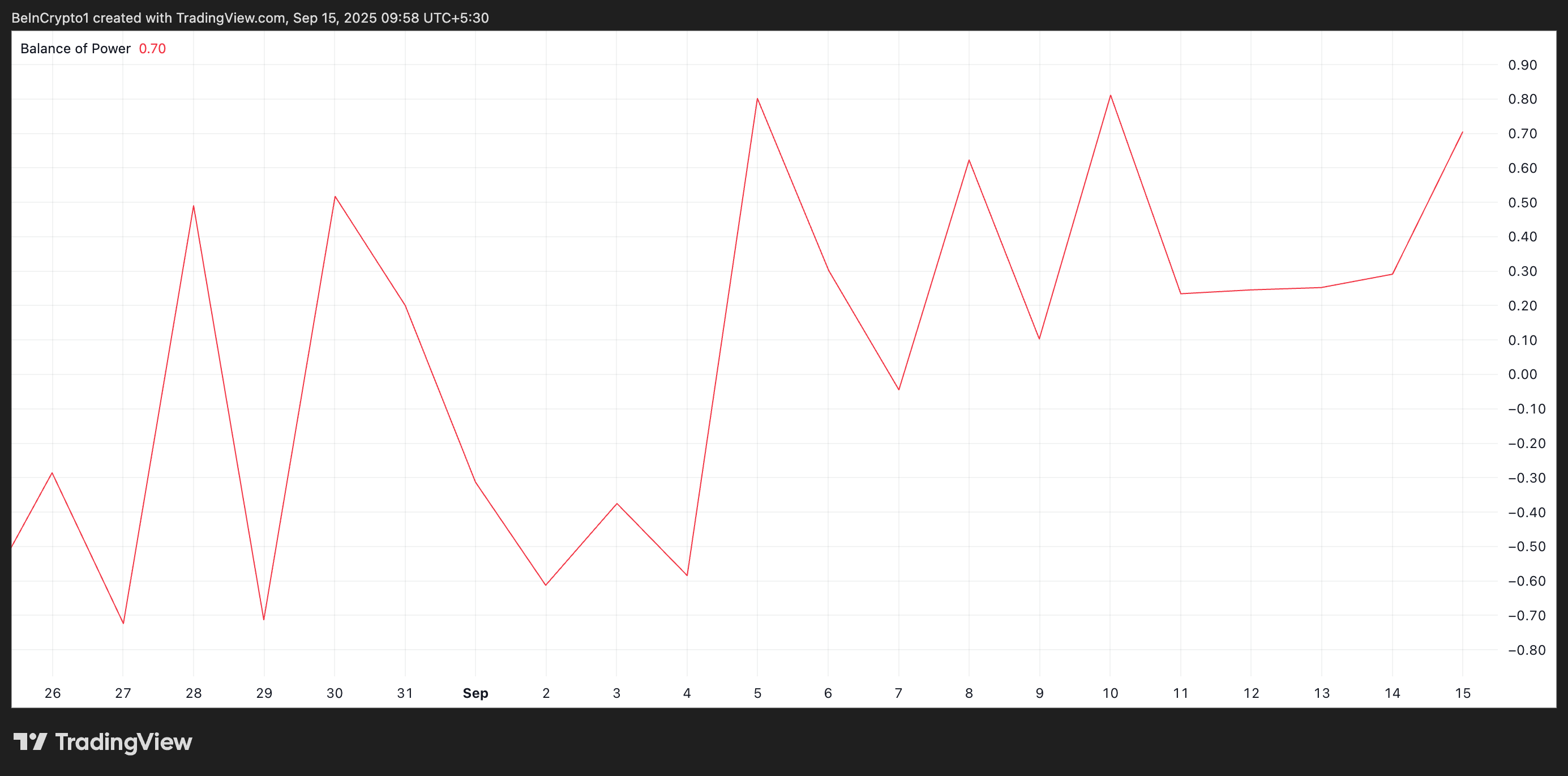

FLR’s sure Steadiness of Vitality (BoP), seen on a one-day chart, signifies stable shopping momentum. As of this writing, the metric is at 0.70, reflecting that investors are currently dominating the market.

For token TA and market updates: Desire more token insights treasure this? Be half of Editor Harsh Notariya’s On each day foundation Crypto E-newsletter right here.

The BoP measures the strength of investors versus sellers over a given interval. When an asset’s BoP is definite, it signals that shopping tension exceeds selling tension, pointing to bullish circumstances.

Conversely, a negative BoP implies that sellers are on high of issues, a vogue that in total precedes label declines or periods of consolidation.

FLR’s present sure sentiment suggests investors are actively pushing the label higher, strengthening the probability of a sustained rally.

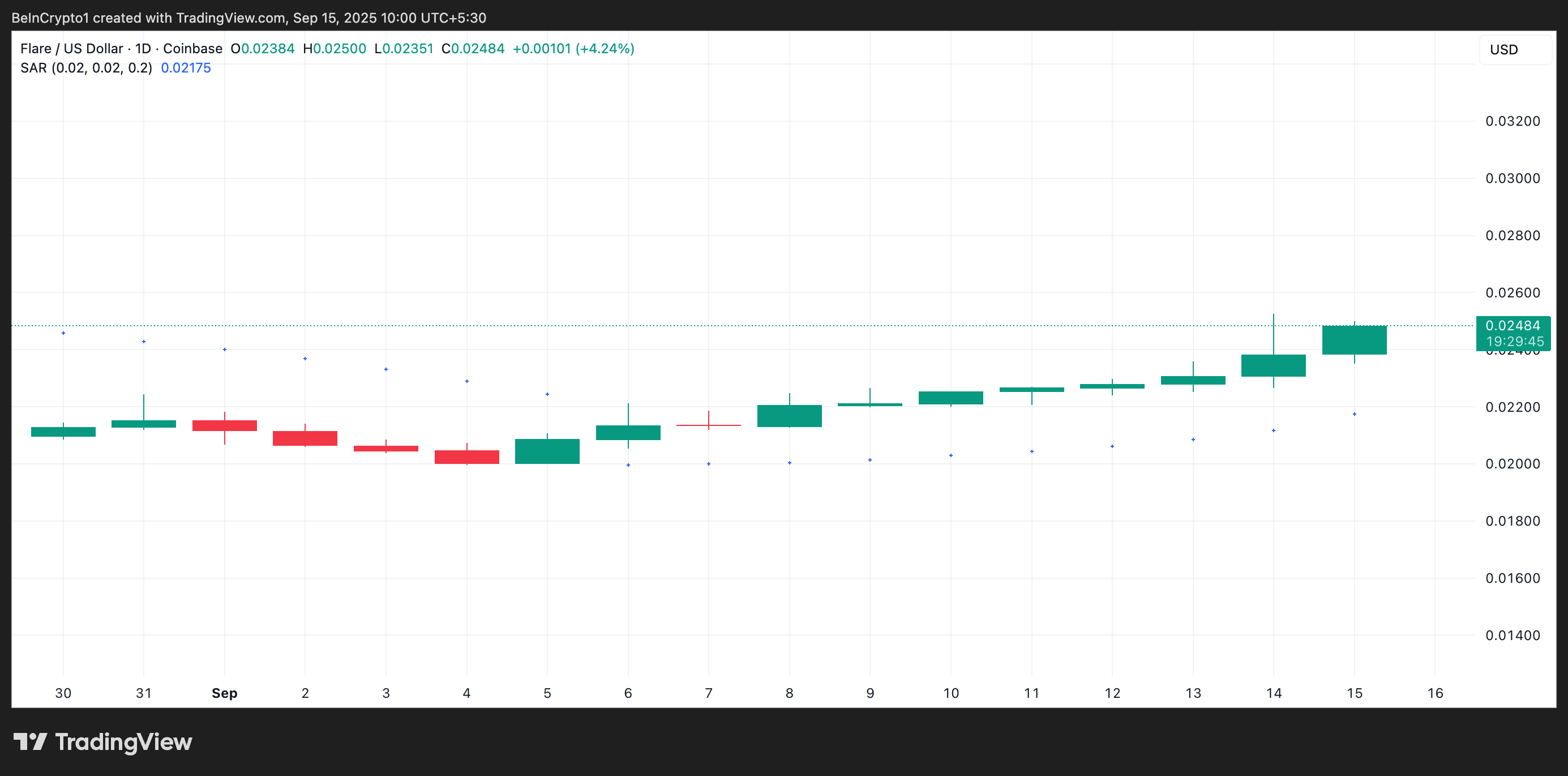

Moreover, on the each day chart, the token sits above its Parabolic Quit and Reverse (SAR) indicator, along with to this bullish outlook. As of now, the SAR forms dynamic strengthen below the token’s label at $0.02175, performing as a potential safety rep for investors.

The Parabolic SAR helps identify potential vogue reversals and the total route of an asset’s label. It plots a chain of dots both above or below the label to signal market trends.

When the dots are positioned below the label, as with FLR, it signifies an ongoing uptrend and that shopping tension is dominant. This implies the bullish momentum is restful stable and the token can even proceed climbing in the short time frame.

FLR Climbs, However Bears in Derivatives Aren’t Ready to Quit

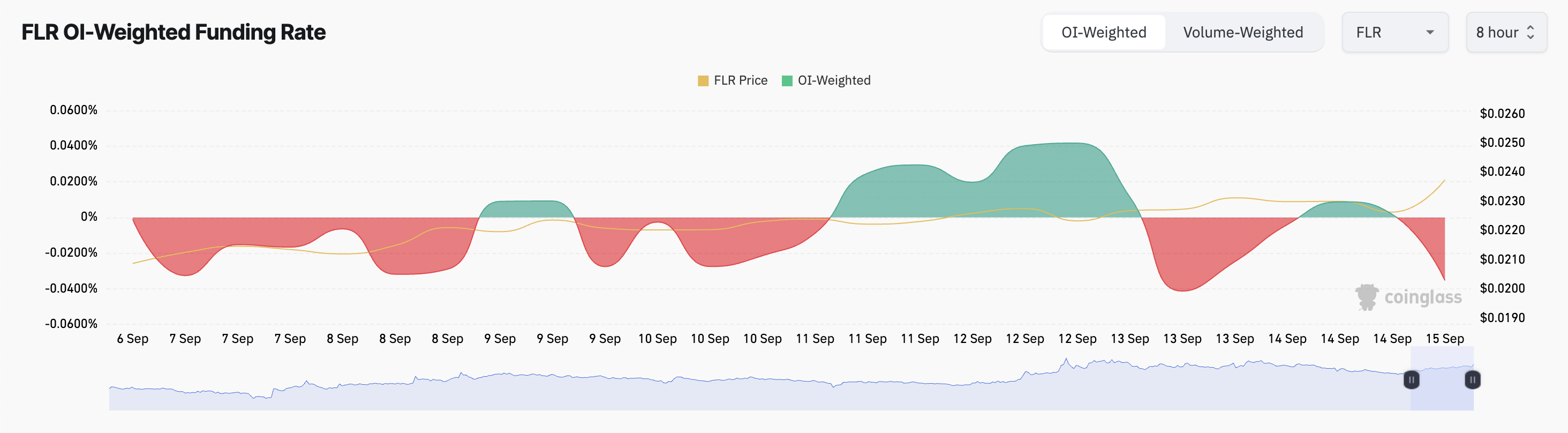

Alternatively, on-chain knowledge suggests that derivatives merchants are less optimistic about FLR’s present rally. Right here is reflected in the token’s time and again negative funding charges, even as its label has surged over the last week. As of this writing, FLR’s funding fee stands at -0.0353%, essentially based totally totally on Coinglass.

Funding charges are periodic funds exchanged between lengthy (buy) and short (sell) positions in perpetual futures markets. They are designed to motivate the contract label shut to the put label. A selected funding fee implies that lengthy positions are paying shorts, signaling bullish sentiment among derivatives merchants.

Conversely, a negative funding fee come that shorts are paying longs, suggesting bearish sentiment or warning in the futures market.

For FLR, the negative funding fee implies that whereas put merchants are utilizing the label higher, derivatives merchants are hedging against a potential pullback, highlighting a split in market confidence.

FLR Rally Hangs in the Steadiness—$0.028 Inner Reach or Retreat to $0.021?

This divergence between put momentum and derivatives sentiment can even lead to short-time frame volatility, impacting FLR’s sustained rally.

If the bearish tilt in market sentiment spreads and put merchants resume profit-taking, the altcoin can even shed some positive aspects and tumble to $0.02144.

Alternatively, a sustained rally can even trigger a rally toward a two-month excessive of $0.02798.

The post Flare (FLR) Label Targets Two-Month Excessive, However Market Sentiment Is Split looked first on BeInCrypto.