A monetary professional has known as consideration to an entire lot of issues likely contributing to the most smartly-liked XRP label stagnation.

Despite optimism among investors, XRP has no longer experienced the explosive label motion many anticipated, largely consolidating at $2. Consultants attribute this stagnation to elements love market disinterest, low liquidity, and an absence of critical catalysts.

Market Cases Limit XRP’s Development

In accordance to monetary analyst Austin Hilton, the most smartly-liked instruct of the crypto market is due to a frequent lack of enthusiasm. In a most smartly-liked video prognosis, he explained that many investors beget withdrawn their capital and are ready for a critical tournament to dwelling issues in motion.

“There are millions upon millions of present crypto investors who beget pulled their money out and are sitting on the sidelines ready for something huge to happen,” Hilton infamous. This fall in hobby is a critical cause why XRP has struggled to manufacture momentum.

Meanwhile, institutional investors are quietly amassing digital resources, together with XRP. Despite excessive on a typical foundation shopping and selling volumes, reaching over $4 billion at one level, the label has remained largely unaffected.

Hilton infamous that except a huge particular tournament happens, the market is no longer susceptible to appear for critical label actions. Nonetheless, events equivalent to progress within the XRP ETF merchandise initiating, the resolution of the SEC vs. Ripple lawsuit, and XRP reserve disclosures beget did now not trigger any sustainable bustle due to the disinterest.

Summer season Market Slowdown

One other aspect influencing XRP’s label is the seasonal development of crypto investing. In accordance with Hilton, the summer season months are usually dull for the market, as many investors model out non-public actions in its place of shopping and selling.

Hilton pointed out that Can also thru July in general examine diminished shopping and selling activity, and this 365 days is susceptible to bid the identical sample. Nonetheless, because the 365 days progresses, consultants imagine the fourth quarter may maybe likely maybe bring renewed momentum.

Hilton pressured that whereas non eternal actions may maybe likely maybe live restricted, the long-term outlook for XRP stays particular.

XRP Resistance and Give a enhance to Phases

Hilton pointed out that XRP is within the intervening time inner an actual nook. Resistance comes in at $2.60 and $2.80, which implies that except shopping and selling volume will improve with huge aquire tension, XRP will battle to interrupt previous these barriers.

On the diversified hand, the market capabilities pork up ranges at $2.24 and $2.30. If prices topple beneath these ranges, the asset may maybe likely maybe traipse beneath $2, extra dampening investor sentiment.

Hilton pointed out that low liquidity within the market is a critical articulate, combating XRP from achieving upward momentum. He furthermore cautioned in opposition to staring at for a dramatic label surge within the near term, particularly due to there are no critical particular catalysts within the intervening time using the market forward.

Historic XRP Patterns Imply a Doable Uptrend

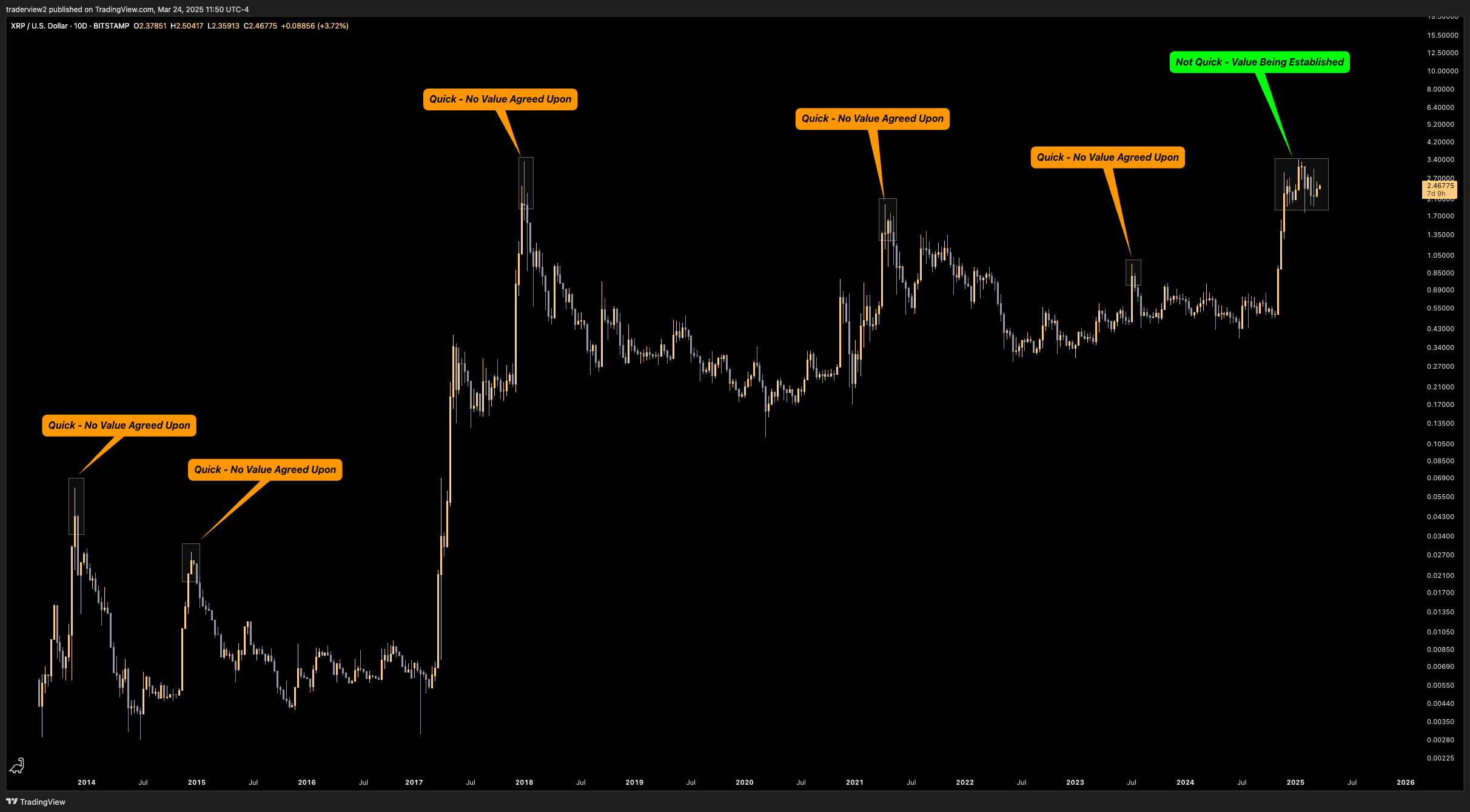

Meanwhile, yet every other market professional, Dom, believes that XRP’s label action is behaving in a completely different way this time when in contrast to outdated cycles. On the total, XRP label has risen snappy to fresh highs but has no longer spent noteworthy time consolidating at those ranges. This time, alternatively, issues seem diversified.

“The longer label spends time at a level, it’s persistently precise reflective of how noteworthy market contributors ‘agree’ on that label,” Dom infamous.

Unlike previous market cycles the put XRP’s label skyrocketed and then snappy declined, the most smartly-liked label differ above $2 has confirmed more stability. He infamous that label consolidation at these ranges suggests that XRP may maybe likely maybe be building a stable sinful for a future breakout.

This behavior contrasts with outdated cycles, the put XRP would attain a top and all precise now decline, providing diminutive replace for investors to exit at excessive prices.

In accordance with Dom, “Now we beget got been seeing differ building, acceptance, and volume holding up above $2.” He suggests that this stability may maybe likely maybe end result in a doable upward growth once the market gains self assurance. Presently, XRP trades for $2.47, up 3.33% within the previous 24 hours.