Lido, whose share of the Ethereum staking market became once so orderly it raised concerns the protocol became nearing a level regarded as a harmful focus of energy, has dropped to a yarn low as opponents from rivals intensifies and the enchancment of infrastructure tailor-made for institutional finance opens new avenues into the enterprise.

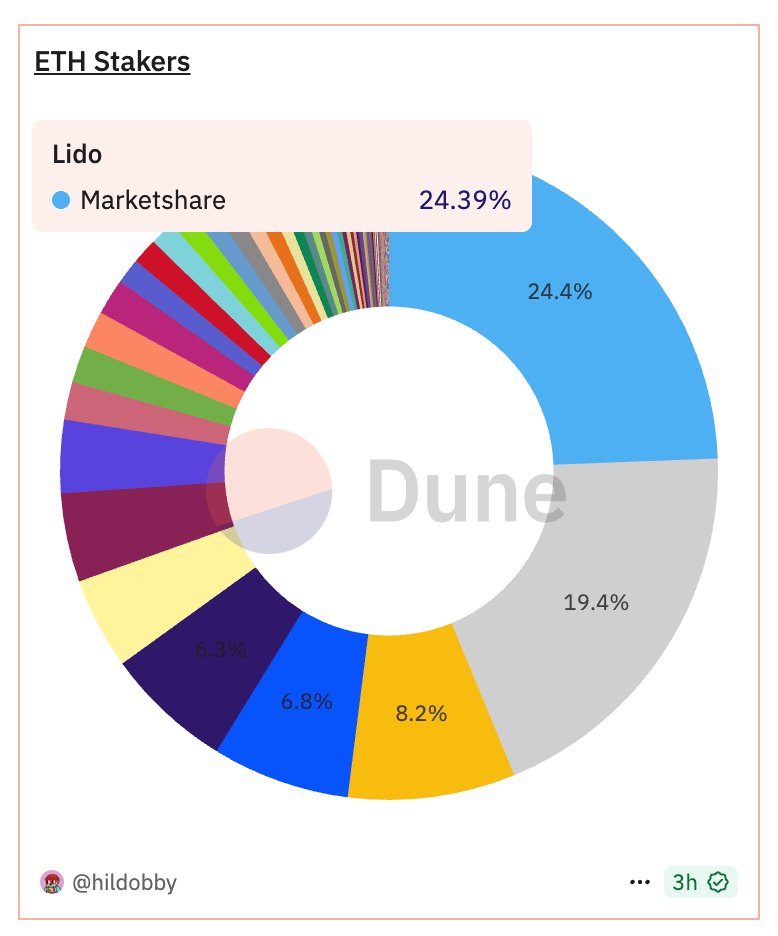

While it be restful the dominant power, Lido’s market share is now 24.4%, down from its highs in unhurried 2023 when it held 32.3%. That’s within striking distance of the 33% level many researchers and Ethereum core developers acknowledged would allow a single liquid staking supplier to exert disproportionate have an effect on over the blockchain’s consensus mechanism.

The shift points to a staking ecosystem that’s maturing. The set up Lido once looked unshakable, it now faces a mixture of institutional-grade operators, community-urge decentralized protocols and alter-hosted staking merchandise.

For Ethereum, this diversification will likely be a signal of improved blockchain health. If these traits proceed, Ethereum staking in 2025 is likely to be defined less by concerns of single-supplier dominance and additional by opponents among specialised carrier units.

“Lido’s share reduced considerably as a result of stake centralization concerns and protocol safety,” acknowledged Darren Langley, the final supervisor of Lido-competitor Rocket Pool. “There became a mammoth community effort to make certain that that Lido didn’t reach 1/3 of complete stake.”

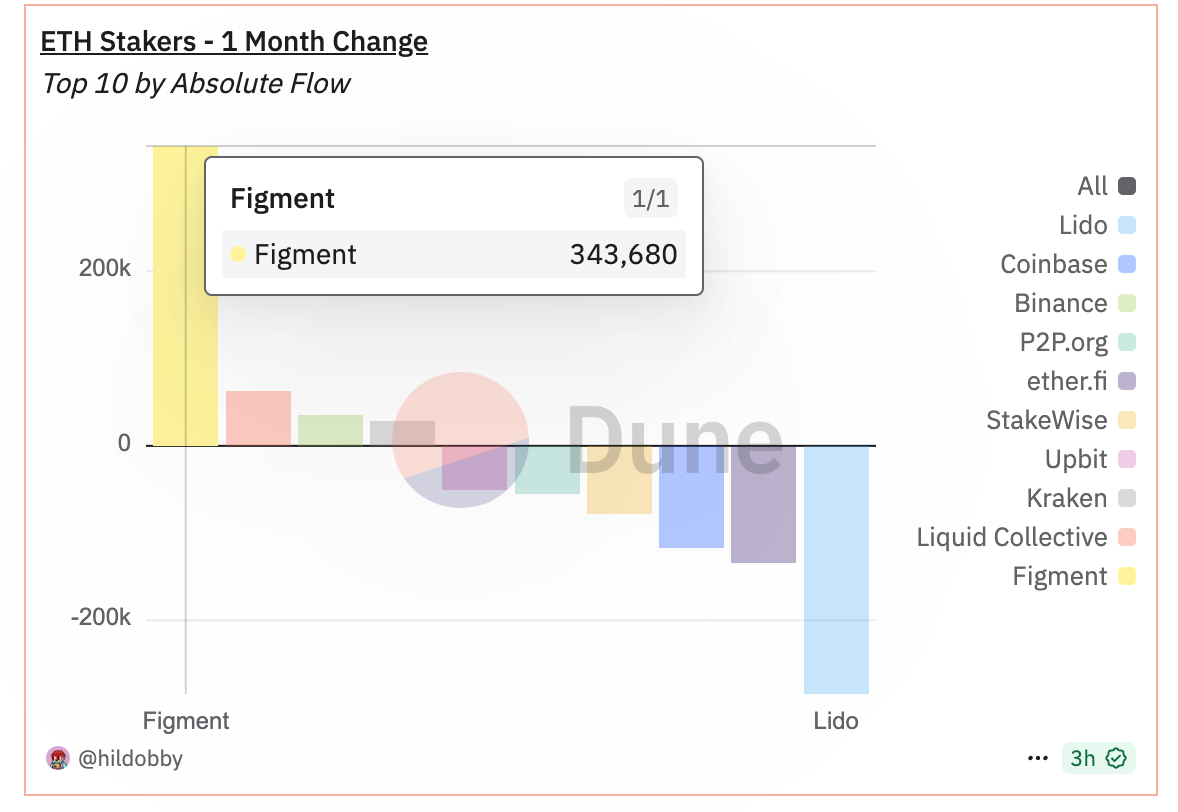

Truly appropriate one of many clearest beneficiaries of the rebalancing is Figment, a staking infrastructure supplier with a solid institutional client base. While Figment has long ranked among the largest validator operators on Ethereum, the past year has brought a marked acceleration in ETH deposits from funds, custodians and orderly-scale asset managers.

According to recordsdata from Dune Analytics, Figment became the largest gainer of new stakers over the final month, including roughly 344,000 and now defending 4.5% of all staked ETH. Lido misplaced the largest number, about 285,000. Ether.fi, Coinbase (COIN) and Binance additionally resolve among the largest holders.

Figment acknowledged ETH staking query from its institutional purchasers doubled after the U.S. Securities and Substitute Commission (SEC) acknowledged in Might per chance presumably well also neutral that staking didn’t bid a securities exercise, a surge mirrored in rising validator queue wait times across the network. Final week, the SEC clarified that these taking allotment in liquid staking would additionally now not have to pain about securities regulations, a choice that’s likely to begin the doors to extra staked merchandise.

“Now that the largest institutions on the earth are embracing digital assets, we’re busier than ever onboarding them,” Figment CEO Lorien Gabel acknowledged in an interview. “We’ve constructed our enterprise from day one on compliance, regulation, and threat-adjusted efficiency, exactly for customers love digital asset treasuries and neobanks. It’s working. If we weren’t a hit the bulk, I’d fireplace myself as CEO.”

Read extra: SEC Green Gentle on Liquid Staking Sends ETH Past $4K, Spurs Gigantic Staking and Layer-2 Rally