A top analyst at the funding big Fidelity thinks Bitcoin (BTC) is primed to take market share from gold.

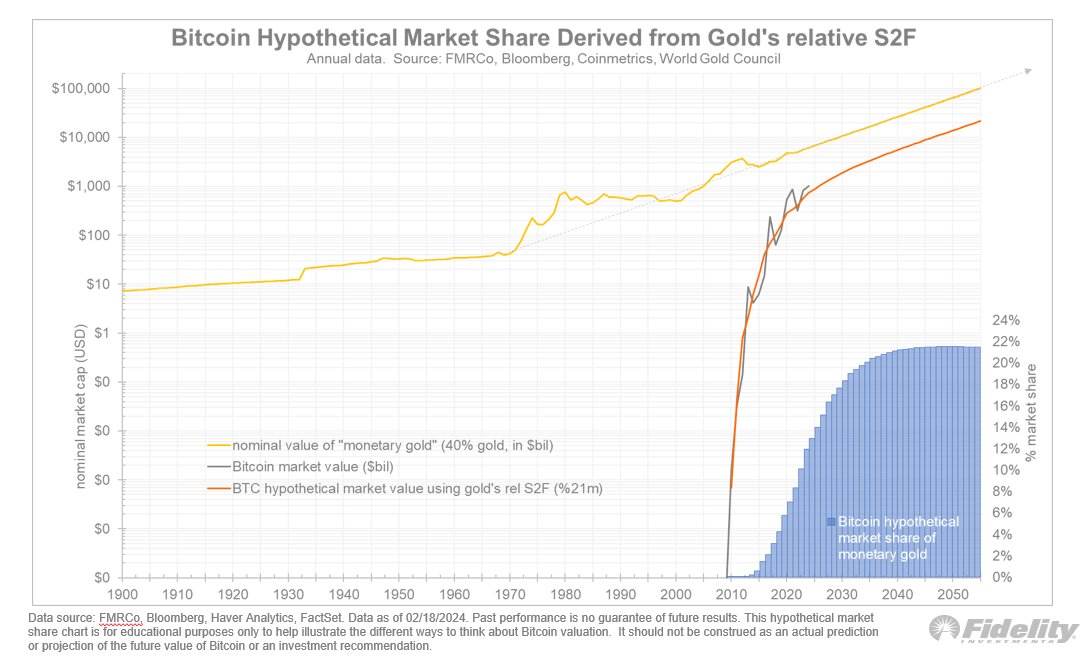

Jurrien Timmer, Fidelity’s director of world macro, shares a chart on the social media platform X that examines the value of “monetary gold.”

The term refers back to the gold that’s explicitly held by central banks and non-public investors as a monetary asset and isn’t aged for jewellery or industrial functions.

“Right here’s an admittedly inexact science, but in step with records published by the World Gold Council, I am guessing that the percentage of financial gold is around 40% of total above-ground gold.

In accordance with the calculations outlined in my outdated threads, I estimate that Bitcoin will at closing snatch around a quarter of the monetary gold market. At 40%, monetary gold is currently worth around $6 trillion, whereas Bitcoin is worth $1 trillion.”

A quarter of $6 trillion is a $1.5 trillion market cap, which would equate to a designate per Bitcoin of around $76,000. Timmer, nevertheless, also assumes that by the time BTC reaches that level of gold’s market share, the value of the treasured steel would possibly maybe be “worthy bigger,” suggesting that his estimated market cap for Bitcoin would possibly maybe be bigger than $1.5 trillion.

Bitcoin is procuring and selling at $56,306, up over 9.30% in the closing 24 hours.

Generated Disclose: Midjourney