Wyoming Senator Cynthia Lummis, a decent-crypto United States lawmaker, acknowledged the most up-to-date proposal from Federal Reserve Governor Christopher Waller to provide crypto corporations access to “skinny” master accounts would end debanking below Operation Chokepoint 2.0.

Waller proposed the premise at the Funds Innovation Conference in October, allowing crypto and fintech startups, along with price-perfect banks, access to accounts at the Federal Reserve related to the “master accounts” worn by banks, but with restrictions. Lummis acknowledged:

“Governor Waller’s skinny master anecdote framework ends Operation Chokepoint 2.0 and opens the door to real payments innovation. Sooner payments, decrease costs, better security — right here is how we fabricate the future responsibly.”

Operation Chokepoint 2.0 used to be described as a coordinated effort to dispute banking products and services to crypto corporations and their founders. More than 30 tech founders had been debanked below the operation, in step with mission capitalist Marc Andreessen.

The proposal from Waller highlights the regulatory shift within the US, with officers and lawmakers now embracing cryptocurrencies and other original fintech startups as mandatory upgrades to the payments machine and the blueprint in which forward for finance.

Linked: Fed seeks enter on anecdote kind impartial to crypto corporations

Operation Chokepoint 2.0 never ended, crypto alternate executives explain

US President Donald Trump signed an government expose in August prohibiting banks from debanking People and businesses without impartial correct purpose.

The expose additionally suggested US banking regulators, along with the Federal Deposit Insurance Company (FDIC), to call banks and monetary institutions that engaged in debanking and doubtlessly slap these institutions with fines or other punitive actions.

On the replacement hand, crypto executives, project founders, and Web3 corporations persisted to symbolize debanking points no topic the expose and the Trump administration’s pro-crypto stance.

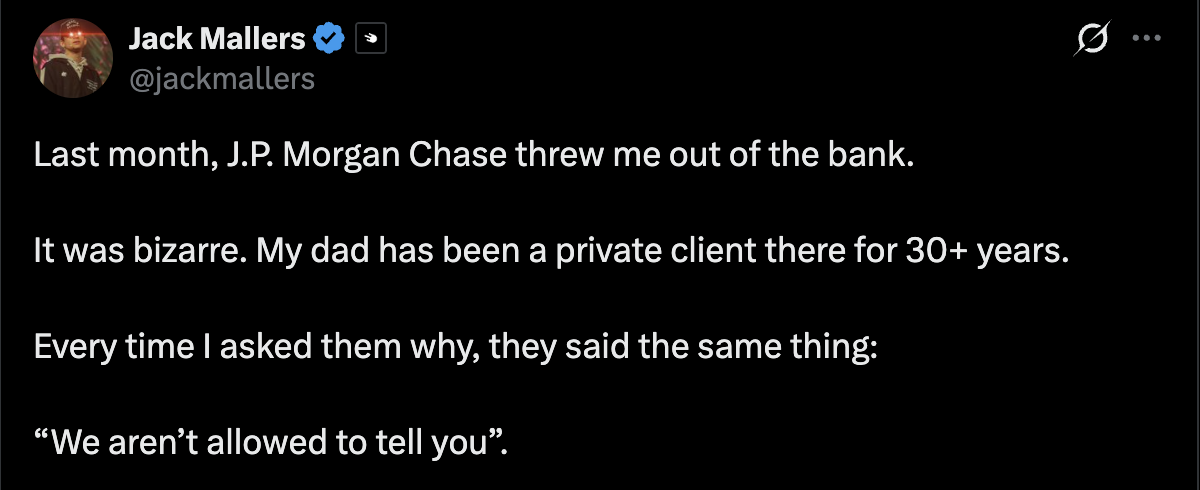

In November, Jack Mallers, the CEO of Bitcoin (BTC) payments firm Strike, acknowledged he used to be debanked by monetary products and services firm JPMorgan without clarification.

“Each time I requested them why, they acknowledged the identical thing: ‘We aren’t allowed to expose you,’” Mallers acknowledged in a separate X put up.

JP Morgan Streak additionally iced up the monetary institution accounts of stablecoin startup corporations BlindPay and Kontigo in December, citing these corporations’ alleged exposure to sanctioned jurisdictions because the reason.

Journal: The one thing these 6 global crypto hubs all enjoy in frequent…