The successfully-known Trouble and Greed Index re-entered the territory of rude greed above 75 this day. Though this form of grunt in the cryptocurrency market would possibly most seemingly additionally last for weeks and months, the similarities with the 2019-2020 fractal indicate the likelihood of a deeper correction.

If Bitcoin experiences a fascinating decline earlier than halving, it is miles going to additionally retest the $20,000 predicament. This is in a position to be per the associated fee action and events earlier than the outdated halving. There would possibly most seemingly even be the likelihood of a moderate correction (about 21%) after halving, which proved to be an finest procuring more than just a few the outdated time.

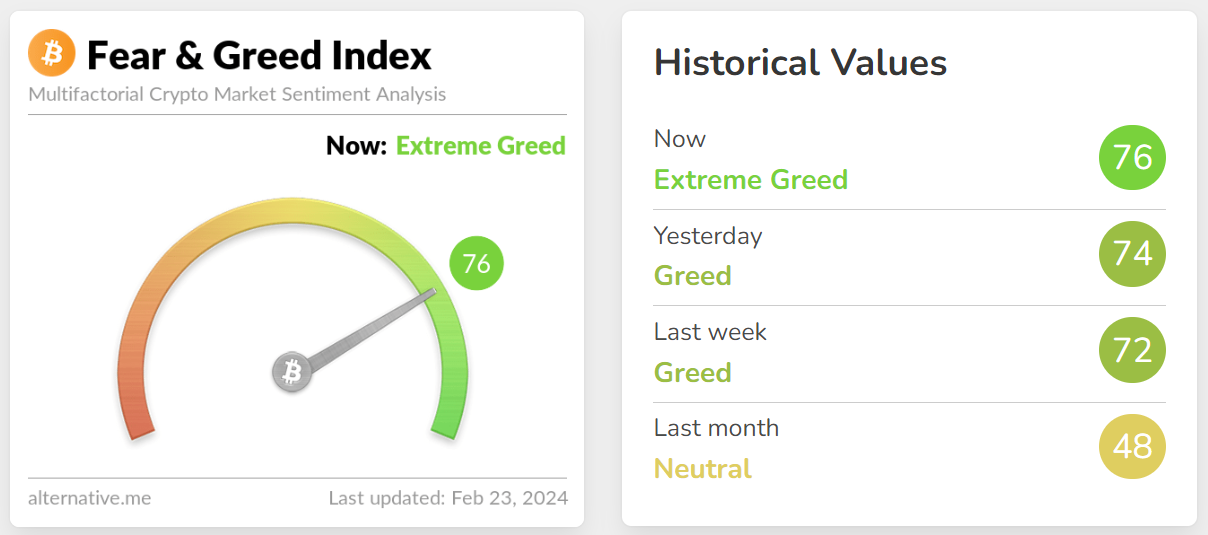

Trouble and Greed Index Returns to Hideous Greed

This day’s readings from the Trouble and Greed Index show 76. Right here is a fee from the sad green enviornment of rude greed. In overall, such sentiment indicators an impending correction, nevertheless it is going to last for a quite very long time in the cryptocurrency market.

Curiously, the frequent indication of the Trouble and Greed Index for the outdated month reveals 48. Right here is a moderately fair sentiment of market participants, which most incessantly accompanies sessions of consolidation and sideways trends.

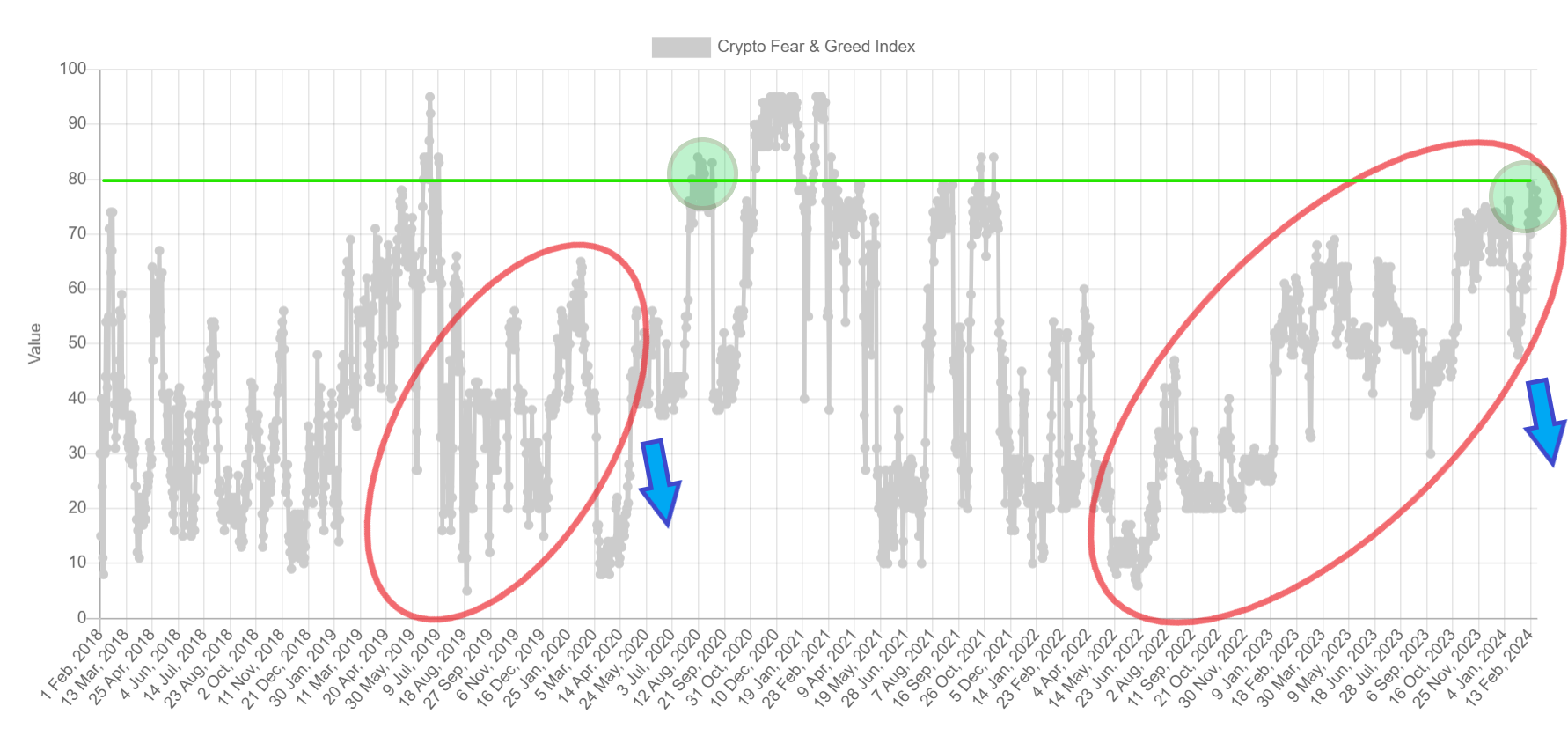

Next, we must always examine at the actions on the Trouble and Greed Index chart for the previous three hundred and sixty five days and compare them with the corresponding interval earlier than the outdated halving. This one occurred in Would possibly well also fair 2020 and used to be preceded by extremely unstable BTC label action. The fruits of this volatility used to be the 62% drop in Bitcoin label in March 2020. It used to be naturally triggered by the shatter in the sizable financial markets attributable to COVID-19.

Regardless of this sad swan, we witness similarities in the two fractals (red areas). First, the rise in Trouble and Greed Index readings used to be linked to the systematic BTC label surge, counting from the macro lows. 2020, this boom introduced the index into greed territory (above 55). On the thoroughly different hand, we’re reaching a chunk of increased this day, as several days rep already resulted in readings above 75 in 2024.

The 2020 shatter ended with the Trouble and Greed Index returning to rude grief territory, in the neighborhood of 10. This took location 3 months earlier than Bitcoin’s outdated halving. Below the hot conditions, 2 months earlier than the halving and with the market quite heated, the likelihood of a deeper correction (blue arrow) stays excessive.

Hideous Greed and the BTC Imprint

As well, it is miles price noting that in the outdated cycle, the Trouble and Greed Index did not attain the realm of rude greed earlier than halving. Unlike now, the index indicated values above 75 biggest after halving when the BTC label reached the $12,000 enviornment (green enviornment).

It turn out to be out that the first check of this resistance (green line) led to rejection, and Bitcoin dropped quick below $10,000 for the last time in September 2020. If this form of design back had been to happen now as successfully, a roughly 21% correction in the associated fee of BTC stays in play. At that level, the Bitcoin label would check the $41,000 enviornment, moderately above the 0.382 Fib retracement of the total one-year upward slip.

If, on the thoroughly different hand, there had been a inventory market shatter same to the COVID-19 events even earlier than the halving, BTC would possibly most seemingly additionally rep fallen by about 62%. Then the associated fee of BTC would rep reached $20,000 again, which seems extremely doubtlessly not below recent market conditions.

Nonetheless, despite these fractal similarities, every Bitcoin cycle runs moderately another way. Per chance the unprecedented readings on the Trouble and Greed Index won’t discontinuance in a deep correction this time.

With the SEC approving Bitcoin ETFs, the oldest cryptocurrency is becoming an increasingly recognized and relied on world asset. This, in turn, eases the volatility of the sizable cryptocurrency market, making deep corrections and absurdly excessive breakouts less and no more overall events.

For BeInCrypto’s most well-liked crypto market prognosis, click right here.

Disclaimer

In holding with the Have confidence Project guidelines, this label prognosis article is for informational capabilities biggest and would possibly most seemingly additionally not be realistic financial or investment advice. BeInCrypto is committed to beautiful, self ample reporting, nevertheless market conditions are topic to commerce with out witness. Always behavior your have learn and seek the advice of with a professional earlier than making any financial decisions. Please label that our Terms and Prerequisites, Privateness Protection, and Disclaimers rep been updated.