A dormant Cardano wallet true vaporized bigger than $6 million in a single swap after executing one of the necessary necessary coarse slippage occasions the network has seen this three hundred and sixty five days.

The holder — whose address had no longer shown any activity since September 2020 — reappeared on-chain Sunday and swapped 14.4 million ADA (price roughly $6.9 million) for true 847,695 USDA, a runt-identified Cardano-native buck stablecoin.

The commerce became once first flagged by on-chain investigator ZachXBT of their Telegram channel.

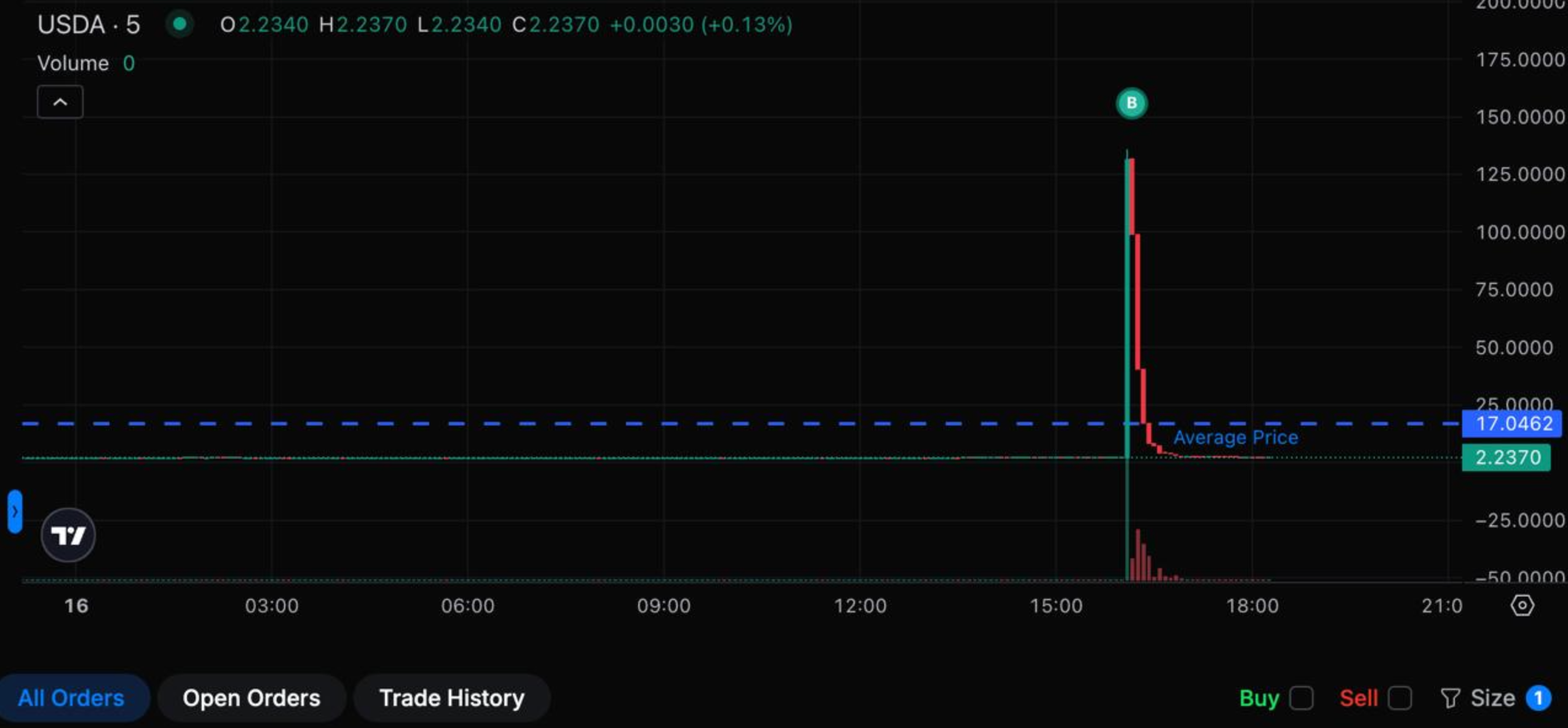

The user effectively paid bigger than $8 per USDA at execution — a disastrous mark, on condition that USDA is supposed to be pegged advance $1 and has a market cap of perfect around $10.6 million. The transaction straight away wiped out around $6.05 million in price.

With perfect thin on-chain depth readily accessible, the expose ripped the stablecoin’s mark to almost $1.26 on Cardano DEXs, in step with CoinGecko. USDA swiftly floated above peg sooner than retracing to roughly $1.04, as liquidity normalized once the whale-sized expose performed clearing.

The address had no prior historical past with USDA, making it unclear whether the user misclicked, puzzled the stablecoin ticker, or assumed liquidity would retain for a market-expose type swap. A flawed ticker selection is plausible — USDA is no longer widely traded, and the Cardano ecosystem has quite a lot of USD-denominated property with an identical tickers.

The episode is a textbook example of why mountainous traders steer clear of illiquid pools and by no method route size through automated market makers without slippage assessments. Even about one million greenbacks in ADA can overwhelm decentralized liquidity if the opposing side of the pool is barely funded.

In earlier cycles, traders have ceaselessly misplaced seven-figures due to the depraved tickers, zero-liquidity pools, or overly aggressive market orders carried out through aggregators.

On Cardano, the mistake is reverberating through vendor circles no longer thanks to the stablecoin alive to, however for the reason that wallet had been untouched for 5 years — perfect to reawaken and burn thousands and thousands in a single mispriced swap.

That makes for a stark reminder that dormant capital can silent meet fashionable liquidity traps, and that on-chain execution stays unforgiving to size, tempo, and run.