Welcome to the Asia Pacific Morning Short—your predominant digest of overnight crypto traits shaping regional markets and world sentiment. Monday’s edition is final week’s wrap-up and this week’s forecast, brought to you by Paul Kim. Take a green tea and study this home.

Bitcoin fell below $117,000 after hitting a brand original all-time excessive above $124,000, as hot inflation files reduced expectations for Federal Reserve rate cuts. Markets now demand handiest two rate cuts this 300 and sixty five days as an different of three.

Fed Price Slash Hopes Fading

The cryptocurrency market skilled critical volatility final week, driven by a series of unsettling macroeconomic indicators which possess dampened expectations for aggressive passion rate cuts by the Federal Reserve. After surging to a brand original all-time excessive above $124,000, Bitcoin saw its trace retreat, at one level falling below $117,000.

The downturn in sentiment follows a string of inflation experiences that came in hotter than anticipated, casting doubt on the likelihood of persisted financial easing from the U.S. central financial institution.

Final week’s well-known financial epic arrived on Tuesday with the originate of the July Client Price Index (CPI). The market reacted positively because the headline CPI was lower than Wall Avenue’s expectations. Nonetheless, a more in-depth eye at the main points unearths that the assert was no longer factual.

Tariff Costs Indirectly Hit Client Prices

The facts of the CPI epic showed a important acceleration in both Core CPI (which excludes food and energy) and “Supercore” CPI (which measures services inflation ex-housing). The steep ascent of Supercore CPI since April, severely, parts to with out warning accelerating service sector inflation.

The larger shock was Thursday’s originate of the July Producer Price Index (PPI), which measures inflation at the wholesale stage. The PPI with out warning surged by 0.9% month-over-month, a file spike and the first of its kind in three years. This was a surprise, as producer prices had remained pretty stable in Would possibly perchance perchance well perchance and June, even because the US “tariff war” intensified.

Change specialists teach this most trendy surge as a delayed response to US tariff protection. Whereas corporations before all the issues gave the impression to soak up the charges by building inventories, the July files imply they are able to now no longer dangle the financial rigidity. The trace is that corporations are now passing these tariff-related trace increases on to the next production stage, with services inflation all over again being a most predominant driver. In particular, the upward thrust in prices contained in the services sector was moreover famed in the PPI.

Possibly essentially the most alarming indicator for the market was the July US Import Price Index. In accordance to oldschool financial belief, tariffs veritably pressure import prices greater. The Trump administration cited the muted Would possibly perchance perchance well perchance-June outcomes to argue that its substitute insurance policies shunned inflation.

Nonetheless, July’s though-provoking lift in import prices suggests a predominant turning level. This implies that import and export corporations, which possess been provocative tariff charges, are now passing them on to customers.

The Federal Reserve has expressed critical scenario about tariffs’ inflationary attainable in its final two Federal Launch Market Committee (FOMC) conferences. If import prices proceed to climb in August due to substitute protection, the Fed’s further rate cuts would possibly well change into more and more tense to elaborate.

Price Slash Expectations Scaled Motivate from Three to Two

The transferring macroeconomic panorama straight affects Bitcoin’s trace and market efficiency. The transferring macroeconomic panorama straight affects Bitcoin’s trace and market efficiency.

This correlation was on beefy show hide Thursday, when Bitcoin’s trace soared previous $124,000 after Treasury Secretary Scott Bessent mentioned the chance of a 50-foundation-level rate in the good deal of all the draw via a media interview in September. The PPI epic originate straight worn out these earlier market positive aspects. Bessent retracted his comments and suggested a more conservative 25-foundation-level rate in the good deal of.

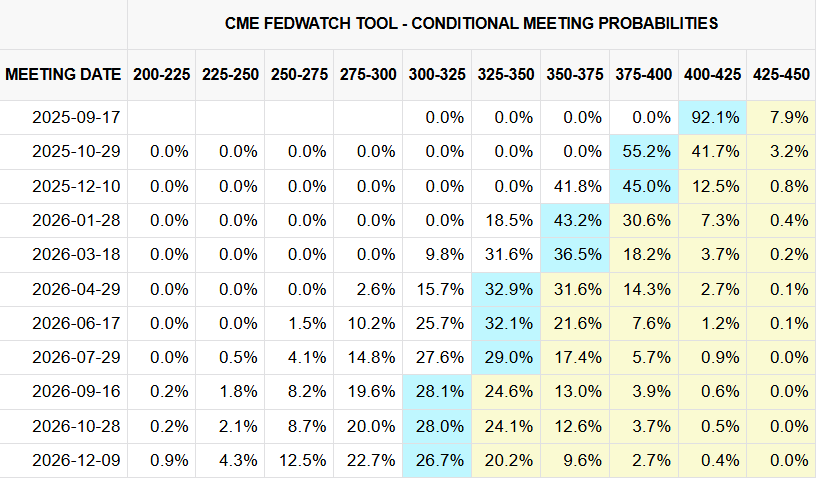

Market expectations possess since been recalibrated. In accordance to the CME FedWatch Instrument, as of Friday, investors are now pricing in handiest two rate cuts for the relaxation of the 300 and sixty five days, down from three. Fund float files moreover displays this predominant shift in investor sentiment.

On Friday, around the time of the import trace index originate, there was a surge in Bitcoin deposits on the Binance alternate. A sudden lift in Bitcoin deposits is often thought a few stride of funds for selling. After recording discover inflows all week, Bitcoin and Ethereum problem ETFs skilled a discover outflow.

Altcoins possess no longer been immune. Final week, the sphere’s 2nd-largest cryptocurrency, Ethereum, broke its all-time excessive on Monday. Nonetheless, it did not surpass its all-time excessive in USD ($4,860) for the length of the week. As of 00:00 UTC on Monday, Ethereum trades at round $4,460.

All Eyes on Jackson Hole for Powell’s Next ‘Tag’

What gave the impression devour a easy task upright final week—three Fed rate cuts this 300 and sixty five days—has now entered the realm of uncertainty.

Whereas deteriorating July US employment files had built a stable case for relieving, the resurgence of inflation has given the Fed end. The choice-making now falls squarely on the shoulders of Fed Chair Jerome Powell.

The financial world shall be purchasing for clues at the Federal Reserve’s annual Jackson Hole Financial Symposium, which runs from August 21 to 23. The well-liked event, hosted by the Federal Reserve Monetary institution of Kansas Metropolis, brings together central bankers from world large.

Chair Powell will lift a speech on US financial protection at 02:00 am UTC on Friday. He mentioned the Fed’s financial protection shift at the Jackson Hole assembly. A effectively-identified example is when he alluded to a 50 foundation level in the good deal of in his Jackson Hole speech final September.

Two famed ‘doves’ will moreover be speaking this week: Vice Chair Michelle Bowman (Wednesday) and Governor Christopher Waller (Thursday). Both possess previously advocated for preemptive rate cuts, citing concerns over a slowing financial system and a weakening labor market. Merchants shall be searching at closely to eye if essentially the most trendy inflation files has tempered their dovish stance.

About a excessive-affect macroeconomic indicators shall be released this week. Nonetheless, the July FOMC assembly minutes, which is ready to be released on Wednesday, would possibly well vastly affect the market, reckoning on their contents.

If assorted FOMC participants moreover supported rate cuts alongside Bowman and Waller, markets would possibly well revive in the good deal of expectations. This scenario would possibly well bring yet any other round of volatility to Bitcoin markets. We would like all our readers a successful week of investing.

The put up Fading Fed Price Slash Hopes: Is a Bitcoin Price Drop Next? looked first on BeInCrypto.