Ripple is actively promoting the XRP Ledger (XRPL) because the appropriate blockchain for tokenizing right-world sources (RWA) on an institutional scale. Ripple emphasizes security, scalability, and interoperability, positioning itself as a right platform for decentralized finance (DeFi) and managing tokenized sources.

In a most contemporary engrossing interview with BeInCrypto, Ross Edwards, Senior Director for Solutions and Provide at Ripple, gives insights into why the XRPL is uniquely positioned to bridge former finance with DeFi.

Immediate Settlement, Steadiness, and Lower Chance: Why XRPL is Lawful for Financial Establishments

When discussing the XRPL’s role in reworking institutional finance, Ross Edwards became unequivocal about its foundational advantages. He identified the engrossing advantages that create the blockchain stand out for establishments having a observe to tokenize RWAs.

For Edwards, the predominant to XRPL’s success lies in its manufacture. As an illustration, he highlighted that the XRPL’s transaction lunge—settling in upright 3 to 5 seconds at minimal price—addresses the excessive costs and delays in general linked with former monetary systems.

“The XRP Ledger enables immediate settlement of mark, along with transparency and auditability that can if truth be told change the threat profile of transactions,” he defined.

He also elaborated that the XRPL employs a solid governance mechanism. This permits the community to introduce amendments to meet its wants, along side these of monetary establishments.

Moreover, it eliminates the want for customized writing, deploying, and managing orderly contracts, apart from to the linked audits. These functionalities finally will lower dangers, which is mandatory for monetary establishments.

“It became constructed for creating mark and sources on-chain, for keeping these securely, for trading and transferring these sources. So, it’s natively constructed for this. The XRP Ledger is a confirmed know-how. It’s been working for 11 to 12 years. It’s extraordinarily right. […] You merely have to name the APIs of the XRP Ledger to enable these utilize cases,” Edwards argues.

Additionally, the Automatic Market Maker (AMM) is one among Ripple’s core enhancements on the XRPL. This feature, integrated straight into the protocol, allows establishments to absorb interaction with DeFi securely with out the want for doubtlessly unreliable third-celebration orderly contracts.

What items the XRPL’s AMM apart is its ability to mixture liquidity all the design via the protocol. Ripple’s liquidity intention is particularly designed to meet the wants of institutional customers.

By incorporating the AMM into the XRPL’s decentralized change (DEX), the route of for establishments to rob half in DeFi is simplified. One of these mechanism ensures both security and efficiency for orderly-scale operations.

The XRPL’s AMM can have the selection to consolidating liquidity from all the design via the protocol. This intention ensures that establishments absorb access to substantial liquidity swimming pools and might possibly maybe likely manufacture transactions at the most favorable costs. Moreover, it successfully minimizes slippage—a valuable difficulty for establishments executing orderly transactions—and ensures continuous liquidity for trading functions.

Additionally, the introduction of the Multi-Cause Token (MPT) frequent will enable establishments to originate complex token constructions representing a total lot of asset classes. Train for initiate in Q3, MPT will present better flexibility for establishments having a observe to tokenize and take care of diverse portfolios of sources on the XRPL.

Ripple will likely be having a observe to elongate the utilize of the XRPL for institutional DeFi with the upcoming initiate of Ripple USD (RLUSD), a fully-backed stablecoin pegged to the US dollar. Edwards sees this stablecoin as a valuable step in direction of making improvements to liquidity and corrupt-border transactions for establishments the usage of the XRPL.

“In case you’re going to work in the right-world asset tokenization home, stablecoins are needed. It’s going to proceed to develop in significance, now not upright significance in the crypto world however in fact significance in the monetary world. And that’s why Ripple believes that issuing Ripple USD will add to the present stablecoins available in the market. They’d likely suit explicit establishments and explicit utilize cases and if truth be told lend a hand gas or proceed the event of tokenization general,” he talked about.

Leveraging DIDs and Strategic Partnerships for Rising Impact in Tokenized Resources

Besides solid infrastructure and applied sciences, security and compliance are paramount for establishments, significantly in tokenized sources. In a outdated dialog with BeInCrypto, Ripple’s Markus Infanger, Senior Vice President of RippleX, highlighted how the XRPL leverages Decentralized Identifiers (DID) to take care of these concerns successfully.

By integrating DIDs, the XRPL enables establishments to soundly and verifiably take care of user identities, facilitating compliance with Know Your Client (KYC) and Anti-Money Laundering (AML) requirements. This integration helps lower the hazards of faux transactions by streamlining KYC/AML processes. Which implies that, it enhances both security and regulatory adherence for tokenized asset transactions.

“The mix of these aspects, apart from to others proposed to toughen institutional DeFi on the XRPL, akin to a native Lending Protocol and Oracles, are making it more easy to combine tokenized right-world sources into on-chain monetary infrastructure. Within the damage, DeFi gives unique monetary rails for actions akin to trading, collateralizing, investing, and borrowing. Bringing right-world sources on-chain and exposing them to these rails opens up unique alternatives—which is the right mark of tokenizing right-world sources,” Infanger elaborated.

The increasing utilize of the XRPL in institutional finance stands out via its partnerships with key enterprise avid gamers. To illustrate, Ripple’s partnership with OpenEden resulted in the introduction of tokenized US treasury bills (T-bills) on the XRPL.

Similarly, Ripple has partnered with Archax, the UK’s first regulated digital asset change, dealer, and custodian. Archax plans to ship hundreds of hundreds of hundreds of bucks in tokenized RWAs onto the XRPL in the upcoming year.

Balancing Immediate-Length of time Beneficial properties and Long-Length of time Articulate in Tokenization

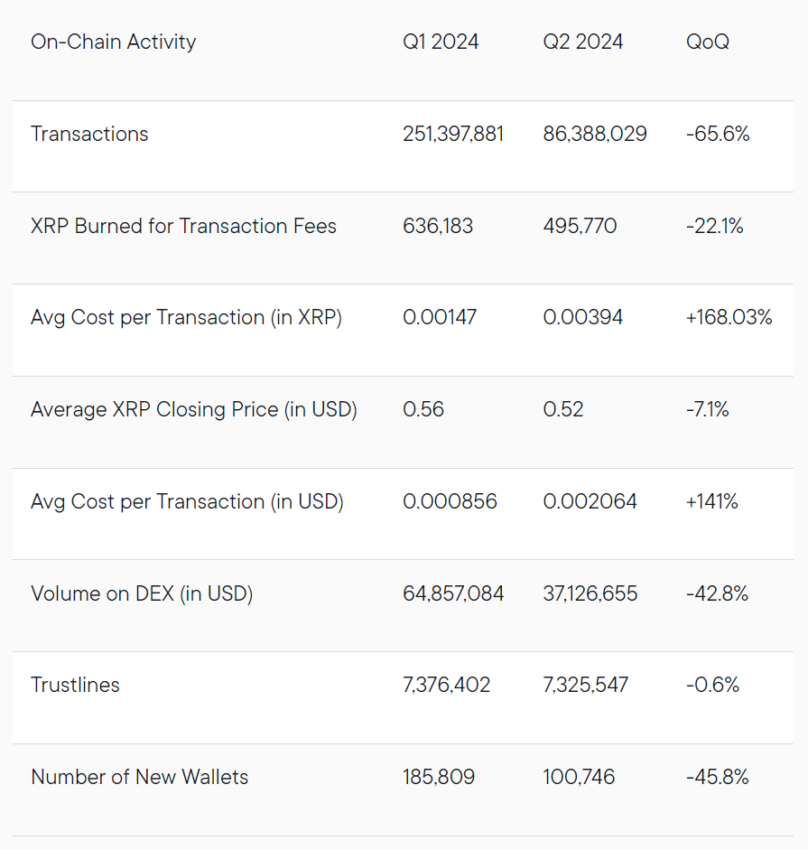

In spite of the XRP Ledger’s solid foundation for institutional adoption, it has confronted some challenges, significantly in on-chain task. A most contemporary document printed that in the 2nd quarter of 2024, the collection of transactions on the XRPL fell by over 65% when in contrast with the first quarter. This lower will likely be viewed in transaction volumes and general DEX engagement, the attach trading volume fell by practically 43%.

The frequent transaction price on the XRPL also increased considerably. In Q2, the associated price of transactions greater than doubled when in contrast with Q1, rising by 168%, which might possibly maybe likely well contribute to the tumble in task. Additionally, fewer unique wallets had been created on the network, with pockets development reducing by Forty five.8%.

Furthermore, Edwards remarked that the challenges of tokenization are beyond the XRPL itself. He acknowledged that one among the largest challenges in tokenization is its long-time duration nature. Consistent with him, this requires persistence and tedious ecosystem building.

“Tokenization is now not one thing that might possibly maybe likely well additionally be finished straight away. It’s now not counting on someone’s resolution or ability to rob an asset, write a share of code, and retailer it somewhere, even supposing it’s a blockchain or regardless of. That’s in fact a pretty straightforward route of. It’s about building the ecosystem and connecting collectively these mark chains,” he talked about.

Edwards emphasized that monetary establishments want instantaneous, tangible returns. This means every step in the tokenization route of have to ship momentary mark whereas setting the root for long-time duration development.

He also renowned that this requirement is a gentle balancing act that Ripple and the broader enterprise have to navigate in moderation. Furthermore, Edwards highlighted that monetary establishments have to play a key role in getting this balance apt, as their participation is crucial for the success of the tokenization ecosystem.

Nonetheless, in the approach time duration, Edwards believes that increasing search files from and figuring out the drivers at the lend a hand of tokenization will likely be distinguished. As the utilization of tokenized sources grows—transferring beyond upright procuring and keeping to broader utilize cases—the market will initiate to elongate posthaste.

“We’re going to survey, as soon as that happens and unlocks, as soon as there’s extra utilization of these tokenized sources, moderately than upright like and like, we’re going to initiate to survey this home ramp up considerably. And it’s going to alter into crucial to the long speed of the monetary machine,” he concluded.