Erik Voorhees’ crypto substitute ShapeShift has agreed to pay a $275,000 comely as portion of its settlement with the US Securities and Alternate Rate after it used to be discovered to be dealing unregistered securities.

ShapeShift has also agreed to desist from violating the Securities Alternate Act of 1934.

Three of the five commissioners concurred that ShapeShift dealt unregistered crypto securities from 2014 till early 2021. To boot they ruled that as antagonistic to working a platform for purchasers to alternate with one one other, ShapeShift held crypto asset securities itself and traded towards its like users. It did this by promoting these assets in securities transactions from its like stock.

As a results of this habits, the Rate has voted that in step with the Securities Alternate Act of 1934 Fragment 3(a)(5)(A), ShapeShift would possibly perhaps well presumably per chance even be classified as a dealer.

A dealer is ‘any individual engaged in the business of shopping for and promoting securities (no longer including security-primarily primarily based swaps, diverse than security-primarily primarily based swaps with or for individuals which shall be no longer eligible contract members) for such person’s like account thru a dealer or in every other case.’

ShapeShift misleadingly branded itself as a easy ‘merchandising machine’ when, in truth, it acted as a advanced counterparty, market-making spreads all thru thousands and thousands of securities transactions.

SEC settlement handiest for early 2021 and prior

Any fines tell handiest to ShapeShift’s old corporate actions which manner that subsequent ShapeShift DAO or ShapeShift.com actions from slack 2021 onward are no longer focused on the settlement.

In January 2021, ShapeShift announced that it used to be integrating Ethereum-primarily primarily based decentralized exchanges and taking away KYC requirements. Voorhees had beforehand complained that enforcing KYC had ticket it 95% of its usage.

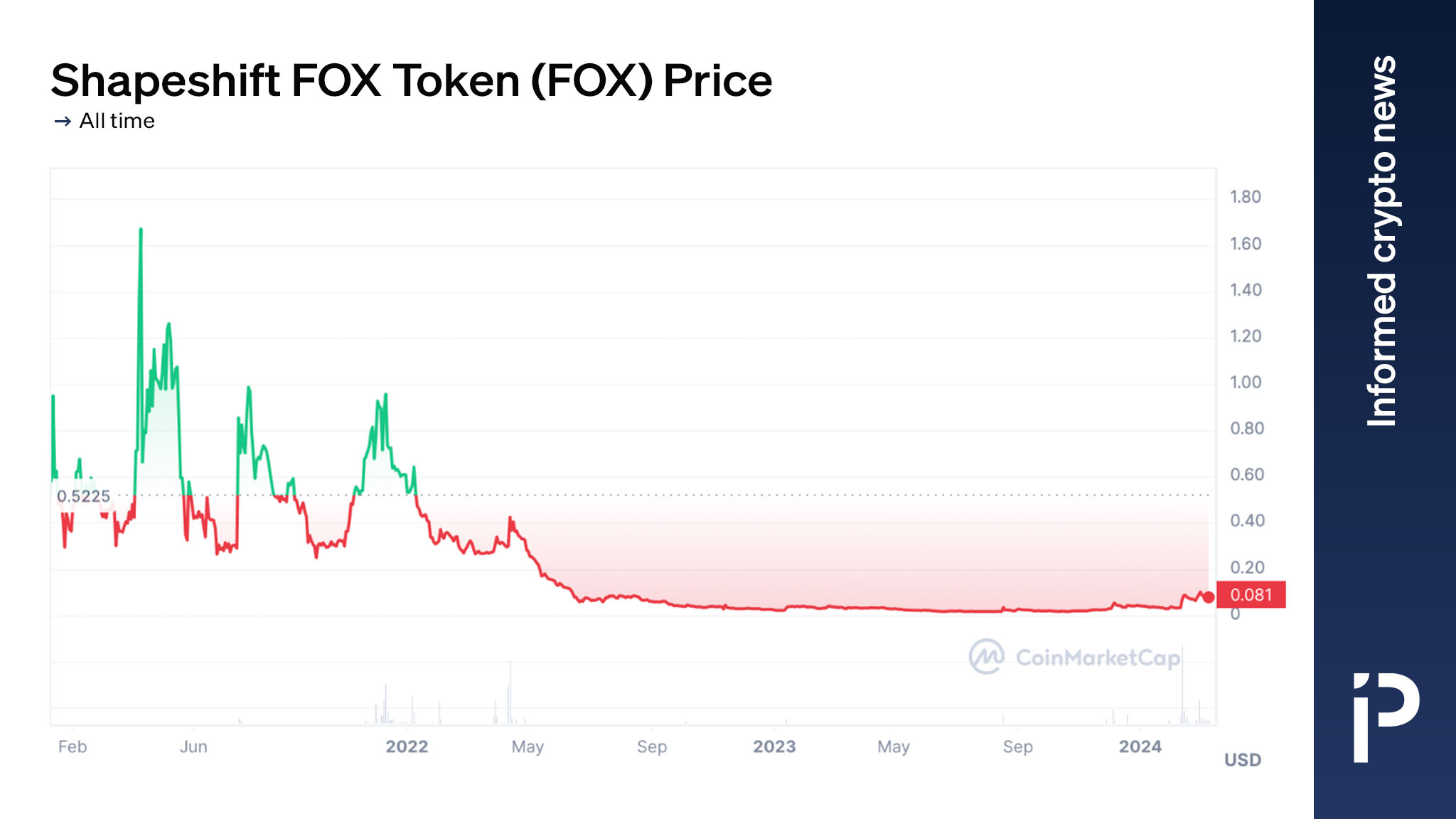

For the period of the first half of 2021, ShapeShift effort down its corporate structure and switched to a so-referred to as decentralized group governed by FOX token holders. Voorhees for my share claims that the FOX token is never any longer a security and used to be no longer expressly named in the settlement.

ShapeShift had beforehand significantly surprised the digital asset neighborhood by enforcing KYC requirements in 2018 — a possible strive to take care of sooner than regulatory ire. It had also delisted privateness money Monero, Zcash, and DASH to downplay anti-money laundering (AML) points.

Three ‘aye’ and two ‘nay’ votes for ShapeShift settlement

The three majority conception commissioners — Gary Gensler, Caroline Crenshaw, and Jaime Lizárraga — maintain that ShapeShift by no manner registered as a securities dealer, thereby violating Fragment 15(a) by making “utter of the mails or any manner or instrumentality of interstate commerce to develop any transactions in, or to induce or strive to induce the purchase or sale, of any security.”

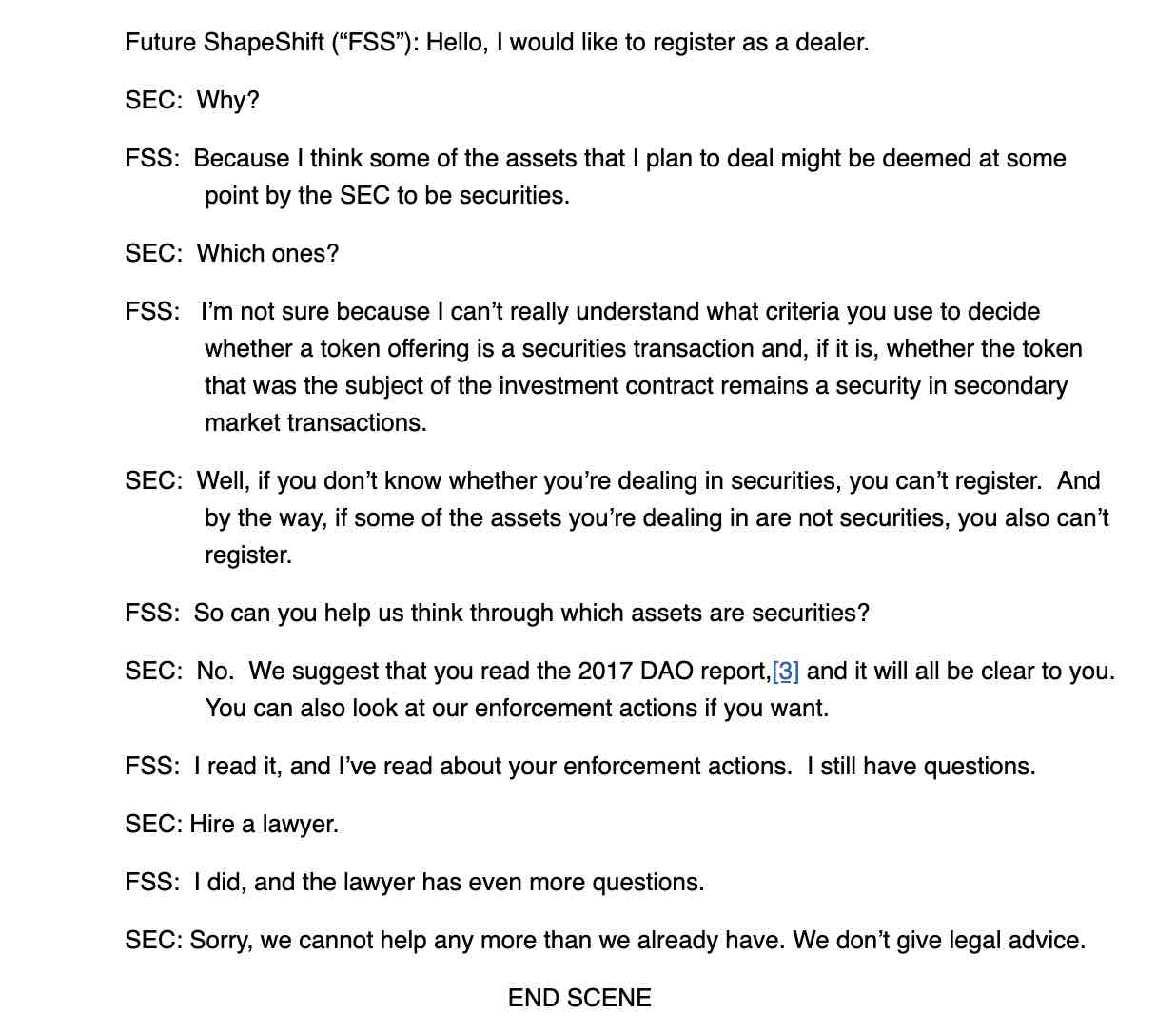

The two minority conception Commissioners Hester Peirce and Trace Uyeda published a joint dissent. They disagree with the enforcement action and the settlement phrases. In explicit, they be apologetic in regards to the SEC’s failure to specify which assets it believed represented investment contracts.

The SEC has named crypto asset securities

Needless to whisper, the SEC has named dozens of explicit crypto assets that it considers unregistered securities. Certainly, in old enforcement actions, akin to its complaints towards Coinbase, Binance, Bittrex, and Gemini, the SEC has named many unregistered crypto securities that ShapeShift also sold to users.

By simply comparing an inventory of SEC-designated crypto asset securities to the listings on ShapeShift from 2014-2021, there are a quantity of overlapping tokens, including ATOM, XRP, BNB, DASH, and loads of others. ShapeShift listed these tokens, which the SEC later designated as unregistered securities offerings with a fat rationale in public court filings.

However, in their minority conception dissent, Peirce and Uyeda wrote a misleading play joking about how the SEC would come what would possibly perhaps no longer establish explicit securities to a hypothetical ShapeShift inquiry. Here’s a queer take given the on the subject of 100 crypto asset offerings designated as securities by the SEC.

The overwhelming majority of crypto reactions on X (beforehand Twitter) quoted the SEC, Voorhees, the dissenting opinions of commissioners, or media coverage of these sources.

Many professional-altcoin accounts parroted the unsuitable belief that the SEC has aloof no longer named explicit crypto tokens listed for buying and selling on ShapeShift as unregistered securities.

Be taught more: Outlined: Crypto assets deemed as securities by the SEC

Legal professional feedback on ShapeShift securities settlement

Curiously, there would possibly perhaps well presumably per chance even be strategic causes for the settlement.

Legal professional Zack Shapiro, managing partner at law company Rains LLP, wrote to Protos referring to possible SEC motivations for settling with ShapeShift.

“In the present settlement between the SEC and ShapeShift, it looks the regulatory body is strategically orchestrating ‘slap on the wrist’ settlements to cultivate favorable precedent, which is indicative of a broader tactical agenda to support its accurate posture in more consequential litigation towards industry behemoths esteem Coinbase,” stated Shapiro.

“This reach underscores the SEC’s tactical recalibration, in quest of to staunch incremental victories that will per chance presumably per chance also bolster its regulatory dominion in the advanced and evolving digital asset panorama in the face of immoral precedent in its landmark case towards Ripple Labs.”

ShapeShift founder Voorhees didn’t at once answer to Protos’ demand for commentary nonetheless in his first public response to the settlement, he simply quoted an excerpt from the Federalist Papers.