The European Commission’s proposal to enhance the powers of the European Securities and Markets Authority (ESMA) is elevating concerns regarding the centralization of the bloc’s licensing regime, despite signaling deeper institutional ambitions for its capital markets building.

On Thursday, the Commission printed a equipment proposing to “teach supervisory competences” for key devices of market infrastructure, including crypto-asset carrier companies (CASPs), procuring and selling venues and central counterparties to ESMA, Cointelegraph reported.

Concerningly, the ESMA’s jurisdiction would delay to every the supervision and licensing of all European crypto and monetary know-how (fintech) companies, potentially main to slower licensing regimes and hindering startup kind, consistent with Faustine Fleuret, head of public affairs at decentralized lending protocol Morpho.

“I am even extra interested that the proposal makes ESMA chargeable for every the authorisation and the supervision of CASPs, no longer only the supervision,” she suggested Cointelegraph.

The proposal accumulated requires approval from the European Parliament and the Council, that are within the intervening time under negotiation.

If adopted, ESMA’s position in overseeing EU capital markets would extra closely resemble the centralized framework of the US Securities and Alternate Commission, a notion first proposed by European Central Financial institution (ECB) President Christine Lagarde in 2023.

Associated: Financial institution of The United States backs 1%–4% crypto allocation, opens door to Bitcoin ETFs

EU draw to centralize licensing under ESMA creates crypto and fintech slowdown concerns

The proposal to “centralize” this oversight under a single regulatory physique seeks to handle the variations in national supervisory practices and uneven licensing regimes, but dangers slowing down overall crypto alternate kind, Elisenda Fabrega, overall counsel at Brickken asset tokenization platform, suggested Cointelegraph.

“With out ample resources, this mandate can also neutral turn into unmanageable, main to delays or overly cautious assessments that can also disproportionately personal an impact on smaller or progressive companies.”

“Within the discontinuance, the effectiveness of this reform will depend much less on its ethical fabricate and extra on its institutional execution,” including ESMA’s operational ability, independence and cooperation “channels” with member states, she talked about.

Associated: Grayscale Chainlink ETF draws $41M on debut, but no longer ‘blockbuster’

The broader equipment goals to rob wealth introduction for EU voters by making the bloc’s capital markets extra competitive with those of the US.

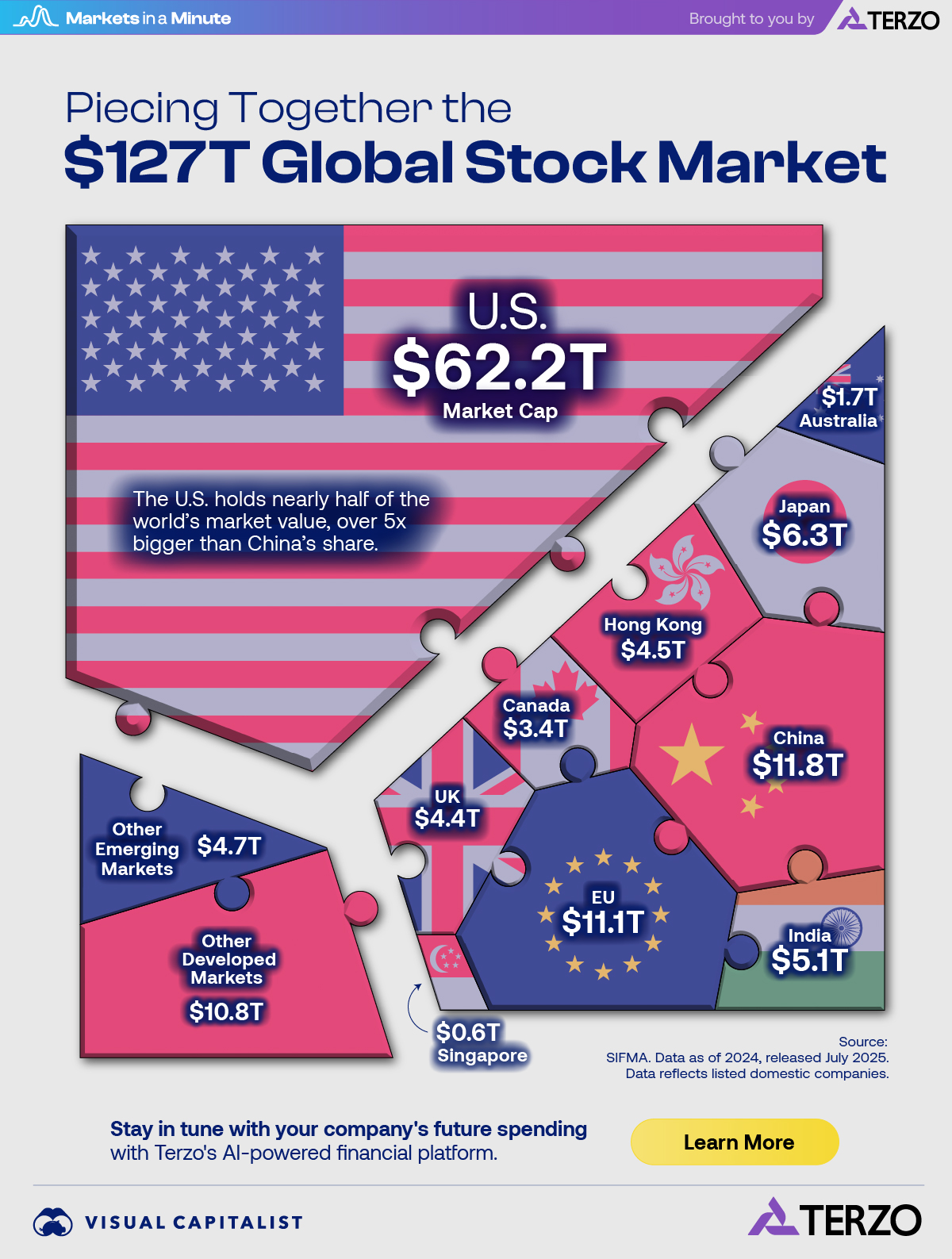

The US stock market is worth roughly $62 trillion, or forty eight% of the worldwide equity market, while the EU stock market’s cumulative mark sits around $11 trillion, representing 9% of the worldwide fragment, consistent with files from Visible Capitalist.

Journal: EU’s privateness-killing Chat Adjust bill delayed — but strive in opposition to isn’t over