Ethereum (ETH) ticket has only in the near previous skilled a 13% decline, with prices dipping in the direction of the cessation of September. Despite this tumble, Ethereum is for the time being keeping stable above its endure market increase ground, suggesting that the cryptocurrency may perchance well additionally be poised for a recovery.

Traders are now shopping for bullish alerts that may perchance well additionally push ETH previous the six-week barrier, bringing contemporary opportunities for ticket growth.

Ethereum Traders Are Resilient

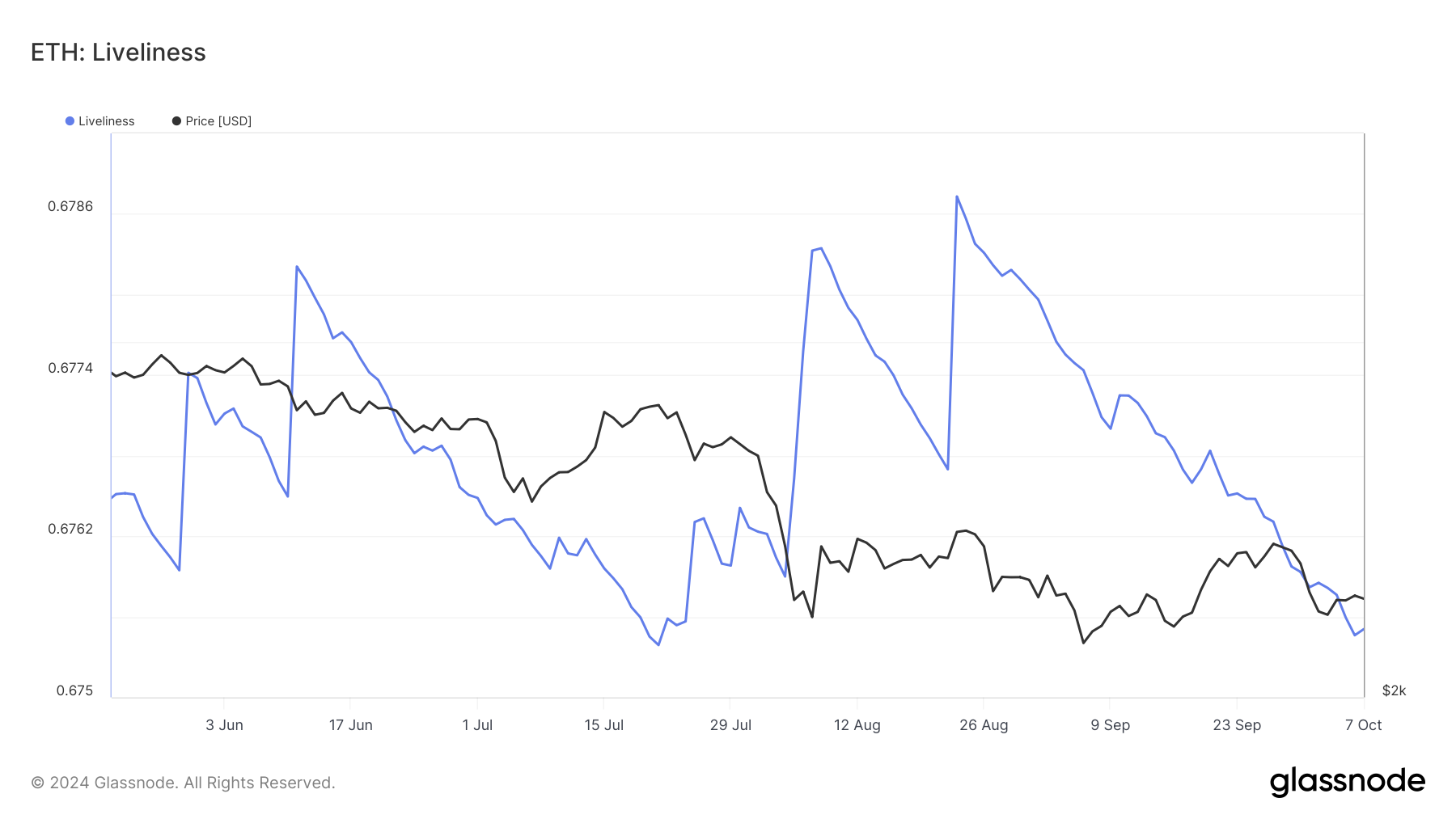

Ethereum’s lengthy-time-frame holders (LTHs) are showing renewed strength, as indicated by the Liveliness metric. This indicator tracks LTHs’ habits, declining as soon as they accumulate and rising as soon as they liquidate their holdings. At level to, the LTHs are in accumulation mode, a definite stamp for Ethereum’s ticket trajectory.

As extra holders resolve to HODL, the chance of a bullish breakout increases, signaling lengthy-time-frame self assurance in the cryptocurrency. This balance may perchance well additionally be the inspiration Ethereum wishes to interrupt thru its present resistance levels.

Be taught extra: The model to Make investments in Ethereum ETFs?

From a technical level of view, Ethereum can also be showing signs of macro-bullish momentum. The Relative Strength Index (RSI) has been trending positively for the explanation that origin of August, hovering cessation to the neutral line at 50.0. As soon as this line is flipped into increase, Ethereum’s bullish momentum will seemingly originate extra strength, pushing prices larger.

The macro momentum, supported by technical indicators love the RSI, suggests that Ethereum is constructing a stable basis for extra gains. If the broader cryptocurrency market remains stable, Ethereum may perchance well additionally capitalize on this momentum and aim larger ticket levels in the upcoming weeks.

ETH Mark Prediction: Faded Boundaries, Fresh Highs

Ethereum is for the time being trading at $2,431, keeping above the intense 23.6% Fibonacci Retracement level at $2,401, in total is believed as the endure market increase ground. As lengthy as ETH remains above this level, it’s seemingly to proceed consolidating while staring at for a bullish trigger that may perchance well additionally force its ticket larger.

Ought to the expected bullish alerts attain, Ethereum may perchance well additionally surge in the direction of $2,591. This level coincides with the 38.2% Fibonacci line, and flipping it into increase may perchance well additionally enable ETH to upward push in the direction of $2,745. Seriously, this ticket level has remained unbreached for the previous six weeks, making it a key aim for Ethereum’s subsequent breakout.

Be taught extra: Ethereum (ETH) Mark Prediction 2024/2025/2030

On the other hand, if Ethereum fails to catch ample momentum to surpass $2,591, the associated fee may perchance well additionally consolidate within this fluctuate, remaining above $2,401. This lack of motion would invalidate the bullish outlook, ensuing in a prolonged period of sideways trading.