Ethereum costs are trusty at scheme rates, involving horizontally even after the United States Securities and Substitute Rate (SEC) licensed the list and shopping and selling of scheme Ethereum ETFs on July 23.

Ethereum is trending below the needed resistances at $3,500 and $3,700 at press time. Nevertheless, traders bear kept costs above $3,300 as price action strikes horizontally.

Even supposing there are expectations of volatility, finding out from solutions info, now that scheme Ethereum ETFs are readily accessible for shopping and selling, one analyst picked out a principal pattern that will presumably perhaps well bear an price on the BTC-ETH dynamic.

Ethereum Whales Taking, ETH Outperforms BTC

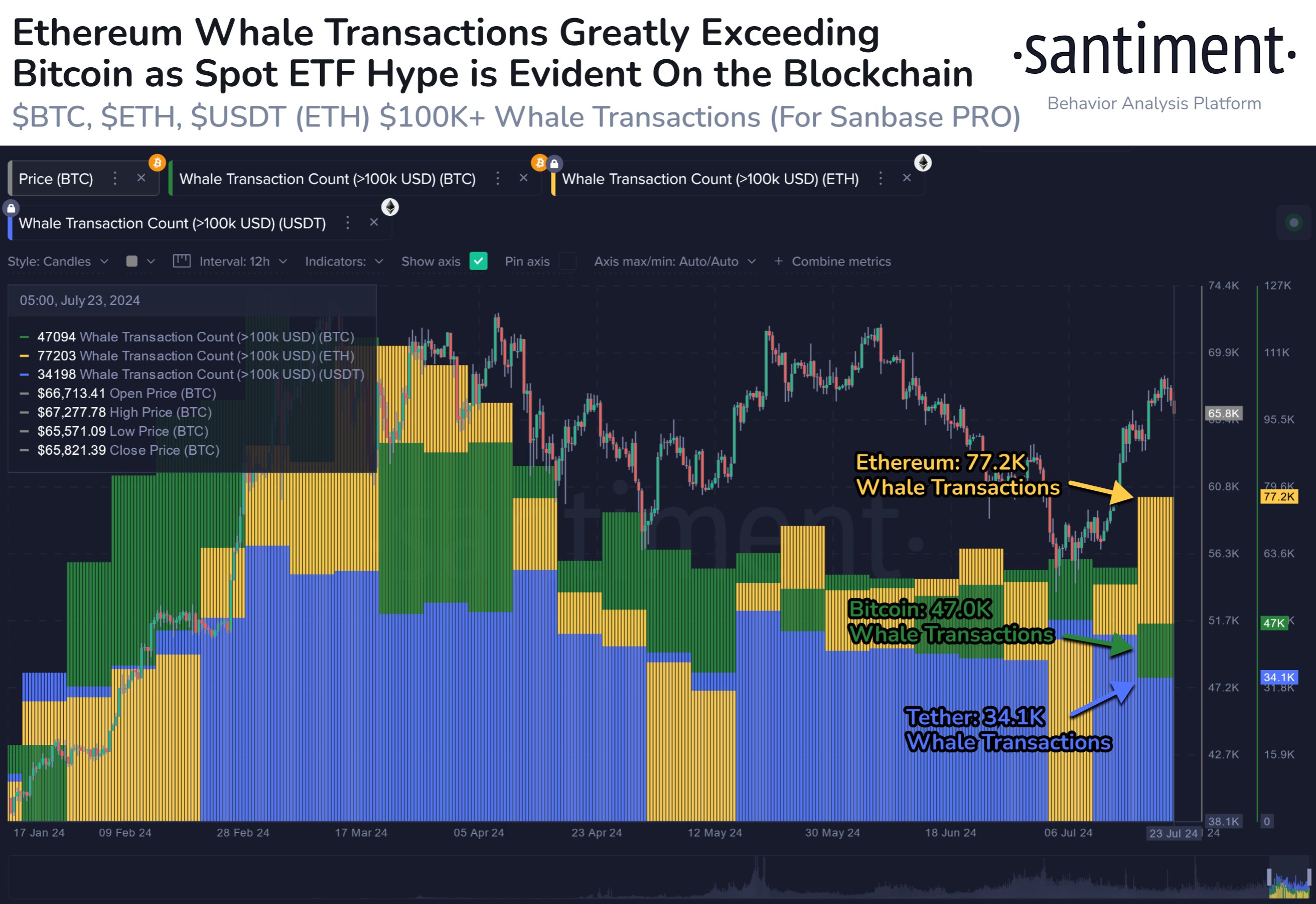

In a put up on X, Santiment info unearths an uptick in whale whisper sooner than the scheme Ethereum ETF in the United States. The analytics platform stated a pair of high-price ETH transfers bear outpaced these ordinarily seen on Bitcoin and USDT since July 17.

The irregular magnify on this roughly switch may perhaps presumably perhaps well deliver increasing self perception in Ethereum and ETH’s lengthy-term prospects. This has even been accelerated with one other crypto spinoff product, providing an alternative choice to Bitcoin.

the ETHBTC price chart, it is a ways evident that ETH bulls bear the upper hand. After the tumble in late June, the coin continues outperforming Bitcoin, sharply rising on July 23. Evident in the each day chart, there is a double-bar bullish formation signaling the presence of ETH traders enthusiastic in funneling capital and extending good points.

ETH is finding toughen at the 50% Fibonacci retracement level of the Might maybe perhaps moreover 2024 commerce range, confirming the uptrend. Even so, for Might maybe perhaps moreover traders to rob cost, bulls must definite 0.057 BTC, setting the contaminated for extra good points toward 0.08 BTC recorded in 2022.

Over $1 Billion Worth Of Self-discipline ETF Shares Traded

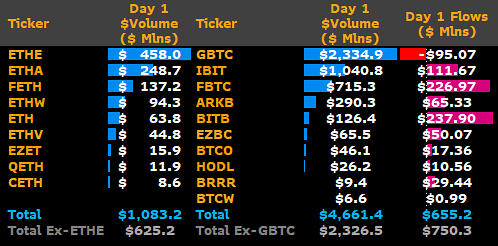

Inflows into scheme ETFs will gas the bull scuttle. As seen in Bitcoin, price performance will largely depend upon ardour from institutional players. Barely 24 hours after the product launched in the United States, diverse issuers offered $1.1 billion of ETH.

Inflows will possible upward thrust when ETH costs atomize above the immediate resistance level, ideally closing week’s high and $3,700. As costs stall for now, the originate of this product, a Bitwise analyst stated, cements Ethereum’s role as a foundational abilities in web3.

As seen from the rapid boost of the digital economic system, Ethereum, the Bitwise analyst added, will gaze the intellectual contracts platform catalyze pattern.