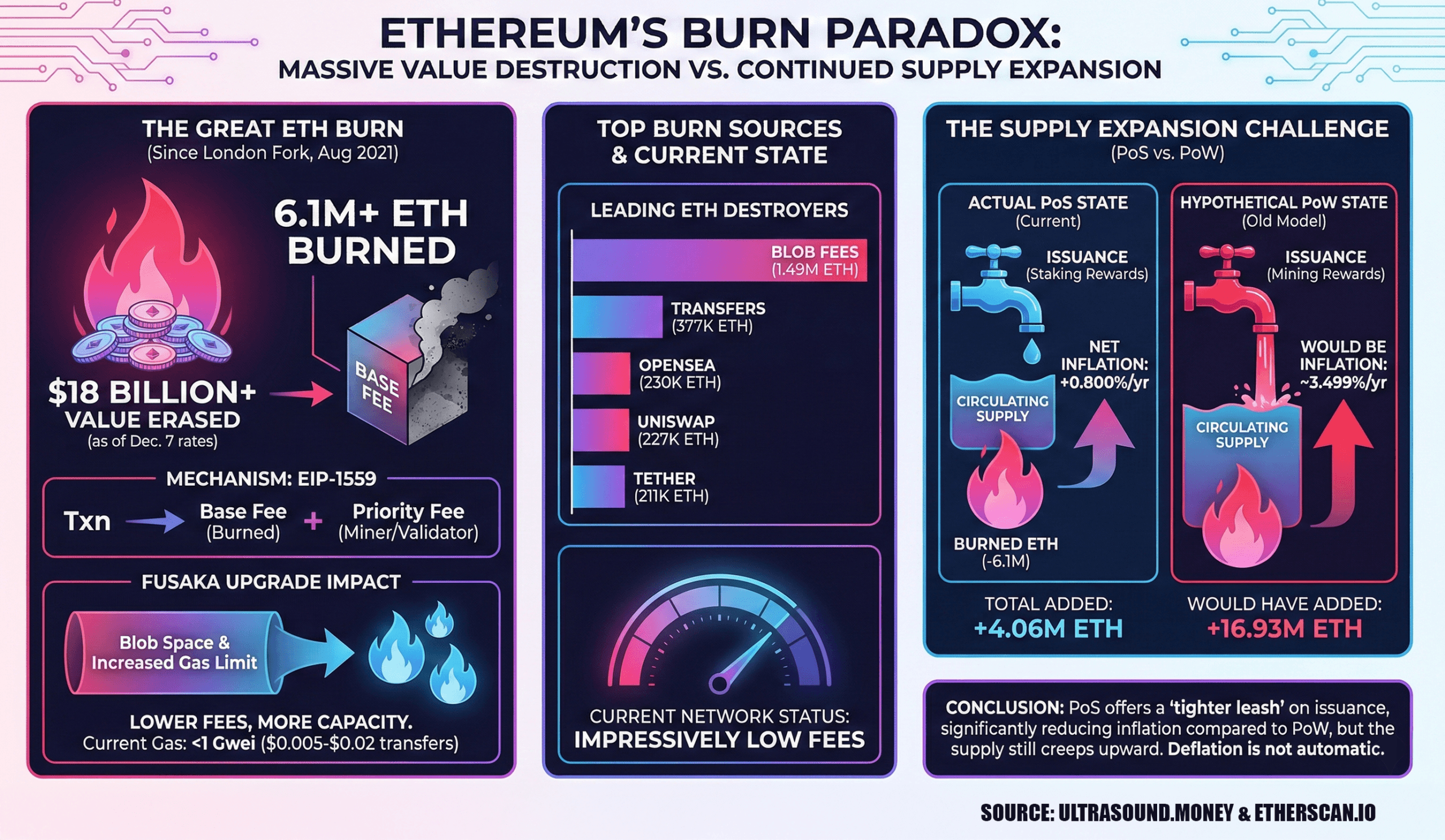

In accordance to metrics, the tally of ETH burned from fees has sailed past the 6 million sign, meaning that as of Dec. 7’s replace rates, bigger than $18 billion in worth has successfully gone up in smoke for the reason that London demanding fork on Aug. 5, 2021.

ETH Bonfire Surpasses 6M ETH Since 2021’s London Toughen

Correct only in the near past, Ethereum rolled out its Fusaka upgrade, which dramatically expanded the community’s details and gas skill (mediate better block gas limits and much bigger blob house), permitting every block to haul more call details and rollup blobs.

The Fusaka upgrade reshaped layer two (L2) fees and, by extension, supplied a helping hand to onchain (L1) gas prices to boot. Onchain fees on Ethereum are impressively low — dipping below a single gwei, in step with etherscan.io’s gas tracker.

At 11 a.m. Eastern time on Dec. 7, a low-precedence charge hovered shut to 0.305 gwei, while a excessive-precedence charge clocked in spherical 0.326 gwei. That locations transfer prices somewhere between $0.005 and $0.02 on Sunday, while clean contract moves esteem swaps, NFT sales, or bridging walk wherever from $0.14 to $0.50 per circulation.

When the London demanding fork arrived in August 2021, it introduced EIP-1559 with it—a plump makeover of Ethereum’s transaction charge mechanics that supplied a dynamic incorrect charge, robotically burned and gone for exact with every block.

The fork landed 4 years, 4 months, and 2 days ago (bounce yr quirks incorporated), and since then, 6.1 million ETH valued at $18 billion has been erased from circulation. Metrics from ultrasound.money sign that blob fees fetch taken the crown because the ideal ETH burner, wiping out 1,492,094 ETH on their fetch.

Mature ether transfers be conscious with 377,388 ETH torched, while the non-fungible token (NFT) market Opensea is accountable for 230,051.12 ETH reduced to digital ashes. The decentralized replace (DEX) Uniswap v2 isn’t a ways in the support of, with 227,337.27 ETH burned, and tether ( USDT) usage clocks in with 211,342.55 ETH eradicated. Closing out the discontinue 5, Uniswap v1 has erased an additional 153,585.62 ETH since 2021.

Learn more: No Santa Rally? Bitcoin Derivatives Markets Trace at a Frigid December

Despite the 6.1 million ETH burned, stats over the past four years serene repeat the community running inflationary at 0.800% per yr. Since the London demanding fork, roughly 4,065,657 ETH were added to the provision. Underneath the proof-of-stake (PoS) mannequin, issuance has eased in comparison with what it might perchance perchance be below proof-of-work (PoW). If Ethereum were serene working on PoW machine, simulated details reveals the annual inflation charge would sit down at 3.499%, and a hefty 16,931,820 ETH would were added to circulation.

Whereas PoS is keeping issuance on a tighter leash, Ethereum’s provide serene creeps slowly upward, reminding all americans that deflationary dreams aren’t computerized. Despite this, the community has approach a lengthy map for the reason that London demanding fork, reducing attainable inflation dramatically in comparison with its venerable PoW days.

FAQ ❓

- What prompted Ethereum’s large burn totals?

Ethereum’s burn job stems from EIP-1559, which destroys the dynamic incorrect charge in every block. - How worthy ETH has been burned for the reason that London demanding fork?

Higher than 6 million ETH valued at roughly $18 billion were eradicated from circulation. - Did the Fusaka upgrade affect Ethereum fees?

Yes, Fusaka expanded block skill, mainly helping L2 transaction prices. - Is Ethereum deflationary in spite of all the pieces this burning?

No, the community remains moderately of inflationary despite the a lot of amount of ETH destroyed.