The funding firm BlackRock bought $54 million price of Ethereum (ETH), per Crypto Rover. The transaction serves as a well-known institutional approval from the realm’s greatest asset manager, producing short-time-frame market shifts and strengthening ETH’s attract institutional investors.

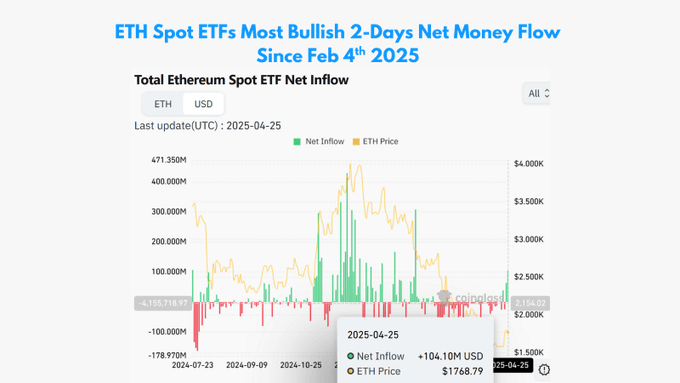

A surge in space Ethereum ETF inflows coincides with the changing United States regulatory reforms. Analysts ogle this shift as an optimistic trace, as space Ethereum ETF inflows proceed to rise and buying and selling volumes surge to match a definite week of ETF inflows no longer considered since February. Market contributors show screen Ethereum’s skill to protect its extreme $1,800 help residence and assign a expansive-scale market recovery.

Ethereum Buying and selling Process and Market Metrics Toughen

Ethereum (ETH) trades at $1,807.19 at press time, exhibiting a each day market increase of 1.38%. This asset’s market capitalization reaches $218.16 billion, while its 24-hour buying and selling quantity amounts to $17.08 billion and marks a huge 29.95% increase. This surge in activity incessantly indicates a spike in volatility forward, a warning for bulls and bears.

Linked: Ethereum Whale Borrows 4,000 ETH on Aave to Provoke Unusual Short Residence

Ethereum’s short-time-frame outlook depends on its skill to protect above $1,800. If this help holds, a extra take a look at toward $1,830—and maybe $1,850—would changed into more seemingly. On the opposite hand, if there is a decisive damage under $1,790, ETH would possibly maybe be uncovered to extra downside menace toward $1,760 and even $1,720.

BlackRock’s Strategic Timing Amid Political Shifts

The acquisition by BlackRock indicates rising hobby from institutional investors in purchasing Ethereum-essentially based funding merchandise. Knowledge from SoSoValue presentations US space Ethereum ETFs recorded assemble inflows of $157.1 million in the old week and $104.1 million on Friday, marking the principle definite flows since February.

The ETHA product from BlackRock recorded $54.43 million inflows while surpassing the efficiency of FETH from Fidelity and ETHE from Grayscale. As effectively as, President Trump’s softened rhetoric when it comes to China tariffs and the appointment of Paul Atkins, a crypto-friendly figure, as SEC Chair maintain vastly improved sentiment among institutional investors.

Linked: Ethereum Whales Stack 449K ETH in a Day, nevertheless $1,895 Resistance Holds Firm

The unusual Chairman of the SEC, Atkins, takes a supportive means toward digital sources, planning to map “affordable and centered” regulatory pointers. The political shift toward crypto-friendly rules creates excessive expectations for the SEC’s approval of space ETFs and their staking capabilities.

Disclaimer: The information offered listed here is for informational and academic capabilities easiest. The article does no longer inform monetary advice or advice of any form. Coin Edition is no longer to blame for any losses incurred since the utilization of insist, merchandise, or companies talked about. Readers are educated to exercise caution sooner than taking any action connected to the company.