Ethereum co-founder Vitalik Buterin pointed to Sam Bankman-Fried’s collapsed crypto trade FTX as the antithesis of what the blockchain community stands for: It’s decentralized, “can’t be execrable,” and is a community, he believes.

The crypto billionaire took to the foremost stage of Ethereum’s Devconnect Argentina convention on Monday, donning a pair of Willy Wonka-impressed shades to boot to a wrinkled Moo Deng shirt, and ripped into the extinct FTX CEO.

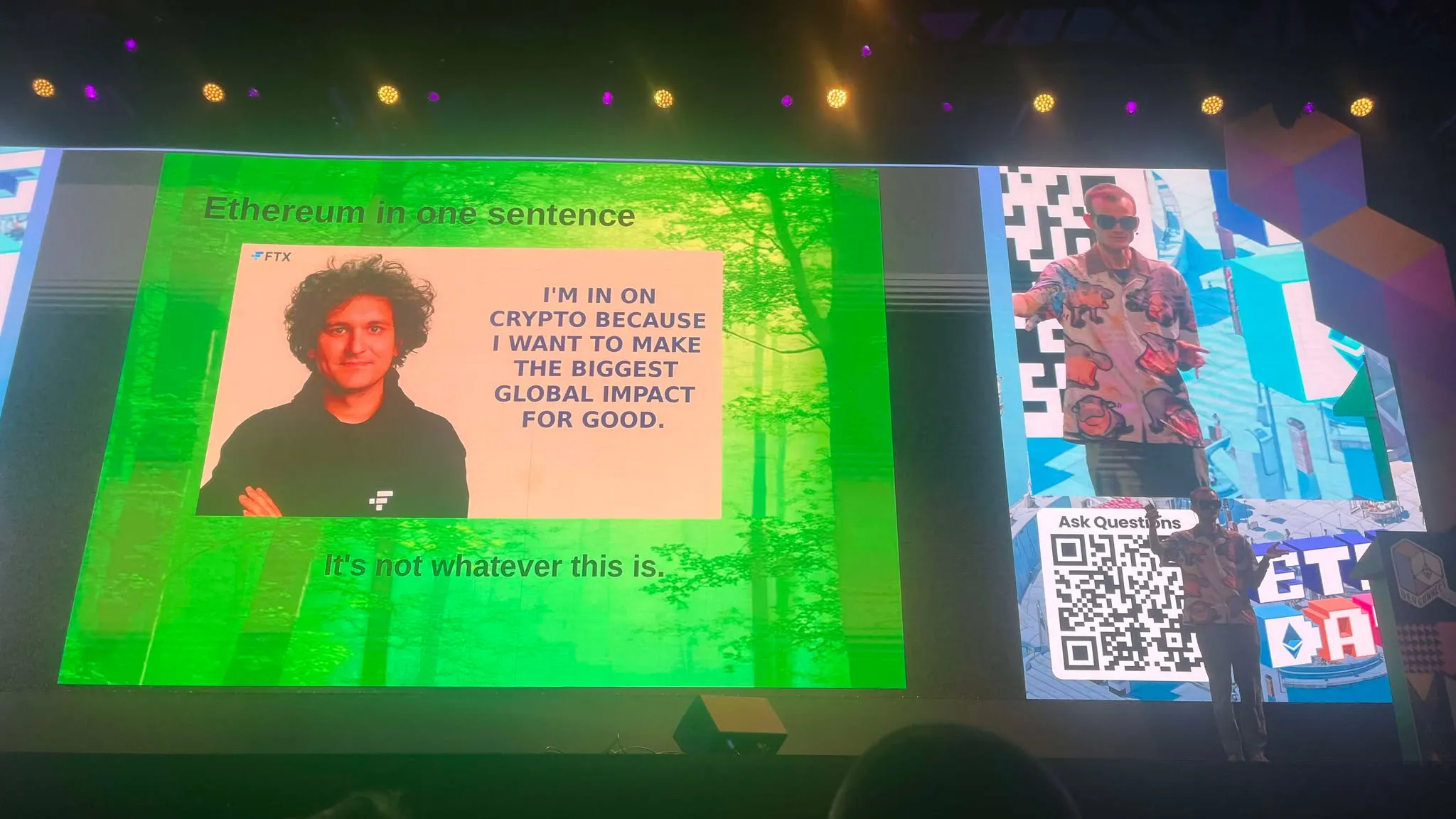

After some transient pleasantries, Buterin flicked onto the first tear of his presentation with Bankman-Fried’s face and a outdated quote from the imprisoned crypto effectively off person, asserting, “I’m in on crypto due to the I are making an are attempting to believe the top most likely global affect for excellent-trying.”

“FTX… I think or no longer it is a supreme example of what you develop if you happen to rob Ethereum’s recommendations and then actually rotate them 180 degrees,” Buterin defined. “So, Ethereum in a single sentence: It’s no longer whatever here’s,” he said, gesturing to an image of Bankman-Fried on the display cloak cloak.

The Ethereum co-founder went deeper into his comparability. Most clearly, FTX became a centralized trade, while Ethereum is being constructed with decentralization as a core knowing. Buterin defined that this centralized nature became core to FTX’s failure, because it required the public to blindly believe the trade with out perception into its inside of workings.

As for Ethereum, pattern is conducted by process of incremental upgrades that are proposed, scrutinized, and developed by the community—all out in the beginning.

Decentralized exchanges bear surged in recognition this 300 and sixty five days, partly for this perform. Hyperliquid, as an instance, became created in the wake of the FTX cave in as the founder, Jeff Yan, believed the industry had a tangible perform to no longer believe centralized exchanges. Distrust in centralized exchanges has top most likely persevered with data leaks, hacks, and mismanagement, prompting users to gaze in assorted locations to trade crypto.

Buterin believes that FTX opted for a “Don’t be execrable” motto, an ethos adopted by Google in its early days. All once more, this kind requires the firm to be relied on no longer to develop one thing sinister.

“The point of decentralized abilities, the purpose of blockchains, is that you develop no longer must believe them,” Buterin said, claiming that Ethereum merely “can’t be execrable” due to the decentralization.

FTX became a significant centralized trade that secretly gave billions of bucks of client funds to Bankman-Fried’s procuring and selling firm, Alameda Study, to shore up big procuring and selling losses.

In consequence, the FTX and Alameda Study founder became sentenced to 25 years in detention heart on seven counts of fraud, money laundering, and conspiracy. While collectors were repaid billions of bucks’ price of investments, the cave in stays a gloomy label on the crypto industry—one which ended in wider contagion right by strategy of platforms, and colossal losses.

In the slay, a significant inequity to Buterin is that FTX became a firm, while Ethereum is a “community.”

Every cycle we unlock a novel Vitalik

& we admire all of them pic.twitter.com/gjIl1c06Kd

— Uttam 🇦🇷 (@uttam_singhk) November 16, 2025

“The inequity between a firm and a community is that a firm is a hub-and-spoke structure; there’s a thing on the guts that does stuff and collects money,” he defined. “A community is a truly orderly kind of those that are all doing issues for every other.”

To Buterin, Ethereum is a decentralized community of crypto fans that’s slowly nurturing a credibly neutral abilities. FTX, alternatively, became a centralized firm being instant by a couple of highly effective figures that asked the public to believe it no longer to develop execrable, nonetheless indirectly did.

Ethereum became on the upward thrust earlier this 300 and sixty five days, breaking a four-300 and sixty five days-used designate file in August and topping out real petrified of the $5,000 label. But or no longer it is been a rough couple months since then, with ETH since shedding by 39% and falling beneath the $3,000 label Monday for the first time since July.