Ethereum’s worth has encountered intensified procuring activity, using a major surge against a pivotal resistance zone, significantly the old predominant yearly high at $3.6K.

A leap forward above this essential level could presumably reputation the stage for Ethereum to build a brand recent all-time high (ATH) within the attain duration of time.

Technical Prognosis

By Shayan

The On day by day basis Chart

An intensive examination of the day by day chart underscores Ethereum’s robust bullish momentum, as the worth undergoes a noteworthy and impulsive upward trail, reaching the excessive resistance house represented by the prior predominant yearly high of $3.6K.

Despite the ambitious barrier at $3.6K, Ethereum’s total outlook remains extremely bullish, with market contributors largely anticipating a winning breach of this level within the coming weeks.

One of these leap forward would seemingly signal the expansion of the uptrend against Ethereum’s ATH, positioning the worth for a brand recent high within the medium duration of time. Alternatively, until this kind of breakout occurs, the $3.6K worth differ is more seemingly to support as a containment zone for Ethereum’s actions.

The 4-Hour Chart

Examining the 4-hour chart further confirms Ethereum’s robust upward trajectory, propelling it to its very top level since April 2022. This surge, accompanied by a series of increased highs and increased lows, displays major procuring curiosity geared against pushing Ethereum against the significant resistance level of its ATH at $4.8K.

Alternatively, Ethereum presently finds itself in shut proximity to a noteworthy resistance zone outlined by the excessive $3.6K threshold. Given the ability of this worth differ and the immediate ascent of essentially the latest bullish rally, periodic correction phases are expected within the overarching pattern to enable for market consolidation. Key abet phases to video display at some point of such corrections embody $3K, $2.8K, and $2.5K.

While immediate to mid-duration of time corrections could presumably introduce volatility, the total sentiment remains constructive, with Ethereum poised for further upside doable.

On-chain Prognosis

By Shayan

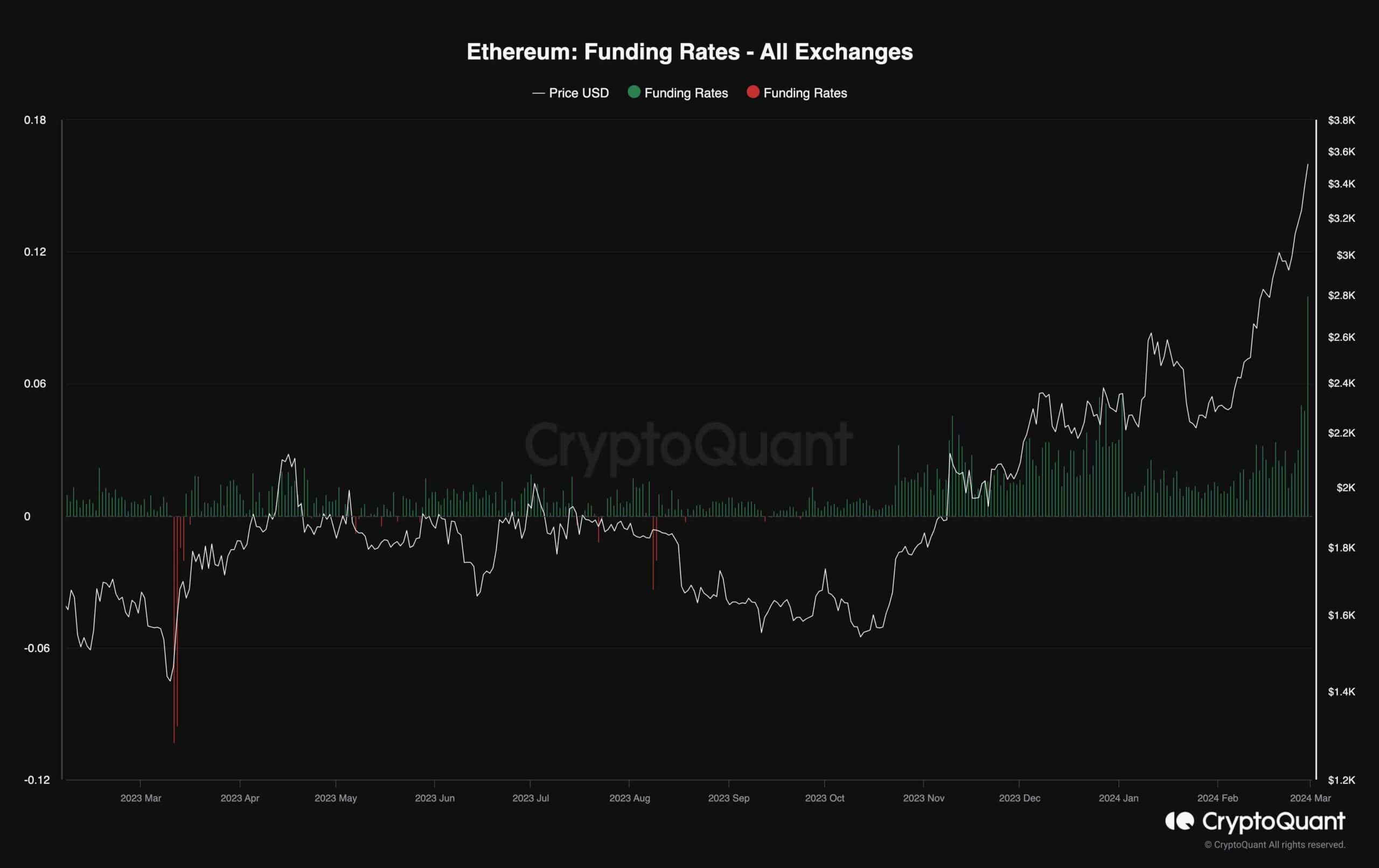

Ethereum has surged significantly, underscoring investor self belief and a surge in procuring activity. A key metric reflecting market dynamics is Ethereum’s funding charges, which gauge the aggressiveness of trades completed by patrons and sellers within the futures market. Definite charges cloak a bullish outlook, whereas detrimental charges counsel bearish sentiment among merchants.

Lately, Ethereum’s funding charges absorb surged in tandem with its worth uptrend, signaling a sustained bullish trajectory. Alternatively, while rising funding charges most steadily align with bullish market sentiment, excessively high values can indicate challenges. Elevated charges elevate the threat of prolonged liquidation cascades, doubtlessly triggering surprising worth retracements. Subsequently, it’s very essential to intently video display funding charges amid Ethereum’s bullish momentum to gauge market stability and reside up for doable worth actions.