Ethereum (ETH) is on the verge of a dramatic offer shock as leveraged short positions cruise to unprecedented levels, staking hits historic highs, and change liquidity plummets.

Will this be bullish for ETH, or will one other “Sunless Thursday” tournament be created?

ETH Provide Shock Gaining Momentum

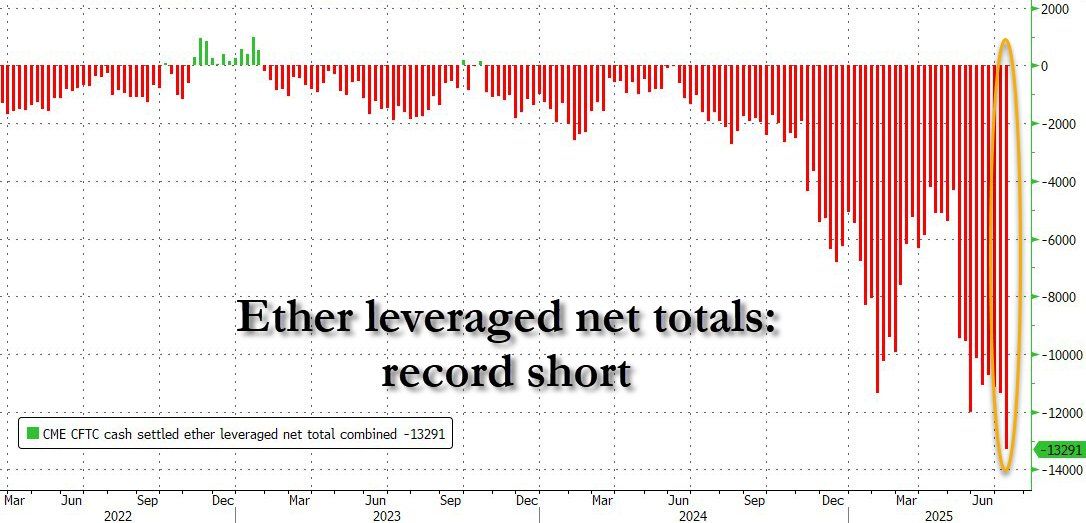

A chart posted by ZeroHedge on X highlights the Ethereum offer shock with leveraged short positions reaching a picture -13,291 in aggregate OTC and cash contracts. This marks the sharpest descend since early 2025, signaling aggressive hedge fund disclose.

Crypto educated Fejau notes on X that this isn’t pushed by bearish sentiment but by a basis alternate approach. Hedge funds exploit mark differences between ETH futures on CME and site markets, securing consistent earnings amid contango.

“Explanation for the colossal ETH shorts is basis alternate. Funds can capture an annualized basis of 9.5% by shorting the CME futures and procuring ETH site with a staking yield of three.5% (this why its mostly ETH not BTC) for a delta neutral 13%.” Fejau explained.

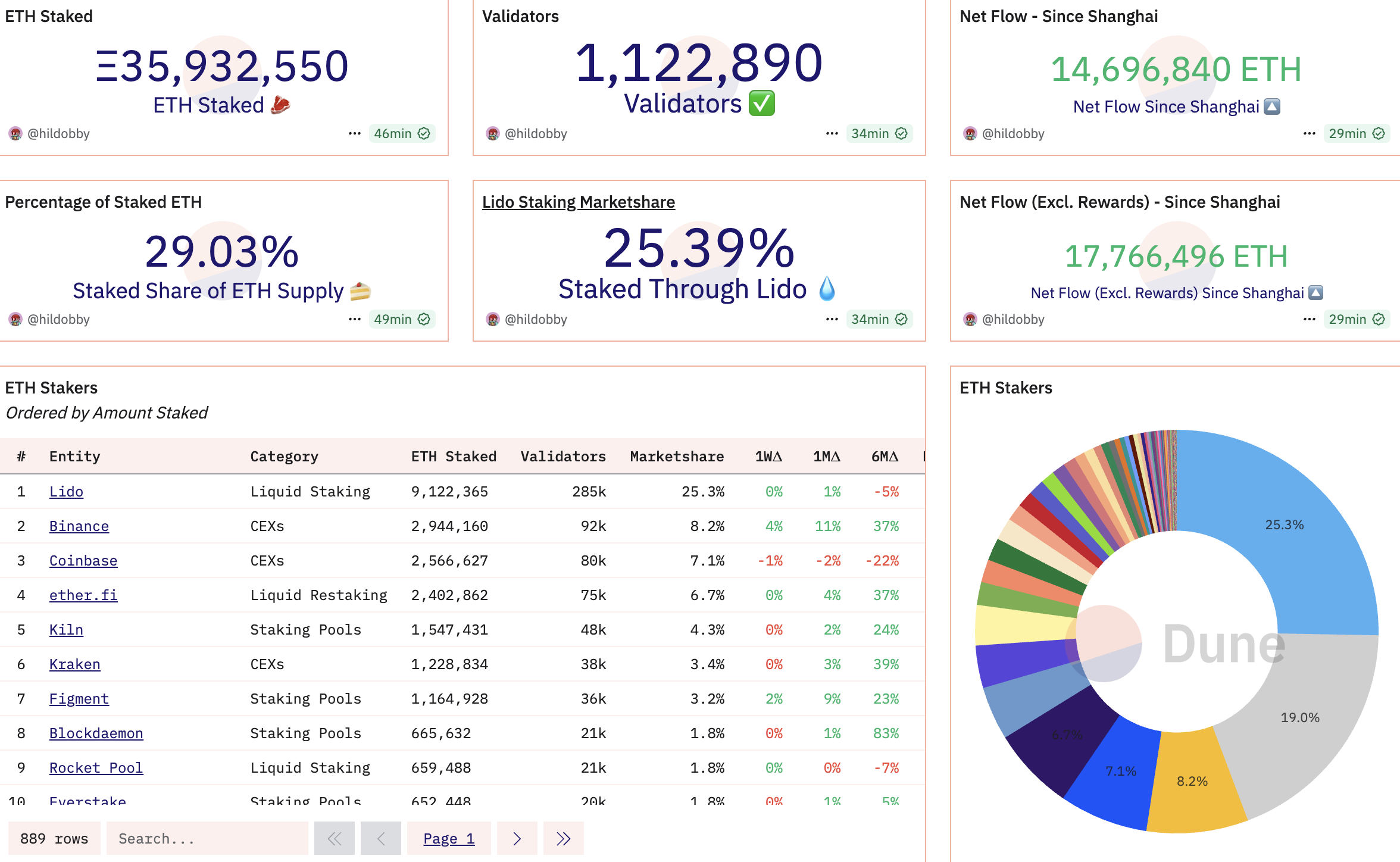

The ETH offer shock is additional intensified by staking surging to an all-time high. In maintaining with Dune Analytics, over 29.03% of the entire offer is locked, leaving roughly 121 million ETH circulating.

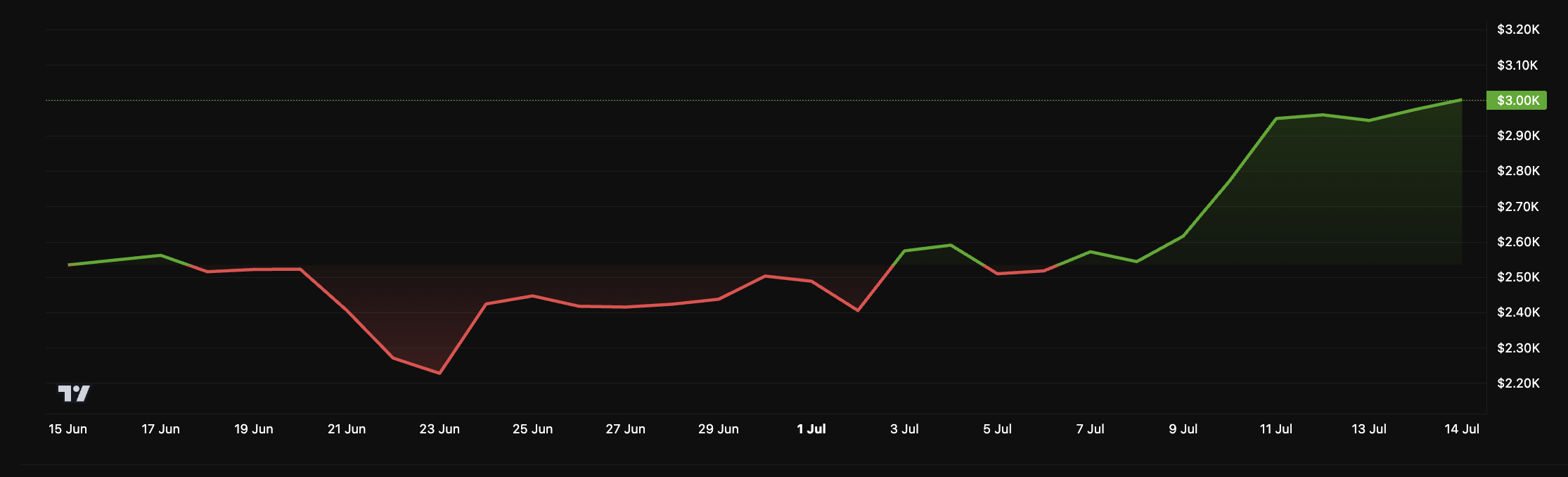

On-chain records additionally displays that ETH has been leaving exchanges lately, coinciding with the associated price of ETH returning to its most up-to-date $3,000 tag. This is partly as a consequence of the accumulation assignment of whales or trim corporations love SharpLink.

Decreased liquidity additionally contributes to the upward strain on costs when quiz exceeds offer. Last Friday, 140,120 ETH valued at approximately $393 million hold been withdrawn from crypto exchanges.

“More than 140,000 ETH, price roughly $393 million, flowed out of exchanges, marking a truly noteworthy single-day withdrawal in over a month,” Sentora infamous.

MerlijnTrader on X forecasts ETH hitting $10,000 in this cycle, propelled by a attainable short squeeze and staking dynamics. ETF staking approvals are anticipated by year-live, reinforcing the ETH offer shock yarn.

Yet, risks loom trim. The premise alternate, whereas lucrative, is inclined to sudden volatility, as seen in 2020’s “Sunless Thursday.” If the Ethereum offer shock fails to force a mark surge, funds would possibly per chance face losses, shaking market self assurance.

ETH has damaged abet above the $3,000 tag on the time of this writing. Nonetheless, essentially the most up-to-date mark is peaceable 38% below the all-time high it reached in November 2021.