Ethereum (ETH) is nearing the $2,000 psychological pork up stage, elevating concerns a pair of doubtless breakdown as ETFs proceed to register outflows.

As Bitcoin witnesses a handy book a rough pullback below $83,000, Ethereum is shut to sorting out its $2,000 psychological build. With a pullback of almost 12% within the past 24 hours, the Ethereum market cap is all of the style down to $252 billion.

Because the declining constructing in Ethereum features momentum, is the $2,000 pork up stage breakdown inevitable? Let’s discover.

Ethereum Designate Assessments $2,000 Make stronger

Within the 4-hour build chart, Ethereum showcases a steep correction with two consecutive completion-fluctuate breakdowns. After the breakdown of the $3,000 psychological pork up, Ethereum chanced on crucial pork up near the $2,500 build.

However, the market atomize in unhurried February resulted in a 2nd-fluctuate breakdown with a pullback against $2,100. The announcement of the U.S. Crypto Reserve ended in a handy book a rough V-shaped reversal to retest the broken $2,500 stage.

However, the bullish failure to protect the constructing momentum led Ethereum to rob a bearish exit swiftly. The downfall in Ethereum has accounted for nearly a 15% pullback. Currently, ETH is trading at a market build of $2,093.

The declining constructing has resulted in a pullback within the Chaikin Money Waft Index from 0.32 to near the zero stage. This hints at a well-known reduce value in shopping for stress.

However, the each day RSI line hints at a doubtless bullish divergence. This suggests a doubtless consolidation near the $2,000 psychological build.

Ethereum ETF Outflows Continue

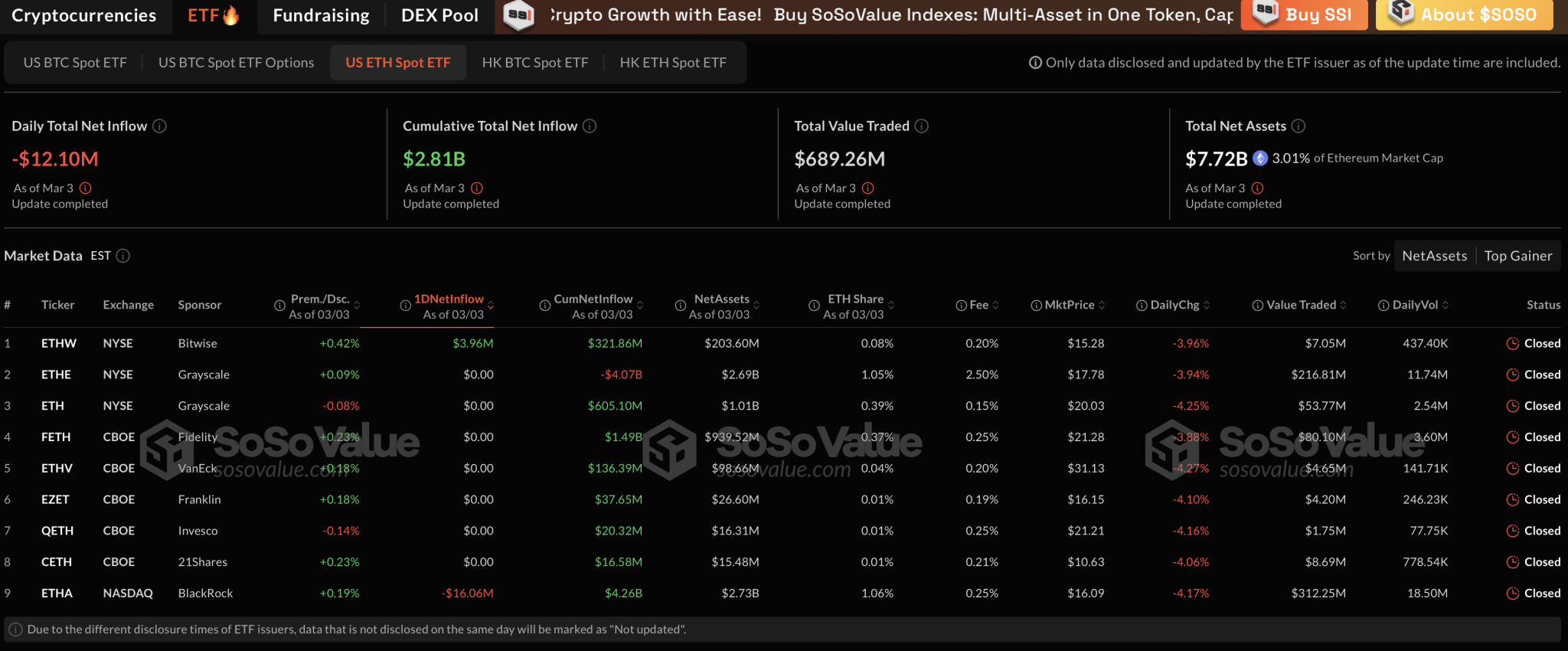

As Ethereum warns of a doubtless breakdown of the $2,000 crucial pork up, U.S. Ethereum Space ETFs chronicle one other day of outflow.

On March 3, the get outflow stood at $12.10 million. This marked the Eighth consecutive outflow day since February 20.

Most Ethereum ETFs maintained a get-zero outflow on Monday, whereas BlackRock offloaded $16.06 million value of Ethereum into the market. On the varied hand, Bitwise registered an influx of $3.96 million.

Will ETH Designate Damage Under $2,000?

Given the Ethereum build constructing, the downtrend follows a pattern of consolidation ranges followed by breakdowns. As a end result, Ethereum may presumably also ride consolidation near the $2,000 psychological pork up stage.

However, broader market situations—such because the aptitude for tariff wars from america—may presumably also trigger a well-known atomize in each and every global and crypto markets. On this case, Ethereum may presumably also damage below $2,000 and take a look at the crucial $1,800 pork up stage.

On the bullish aspect, if Ethereum manages to consolidate, it may probably probably perhaps also in the end take a look at the overhead resistance near $2,400 or $2,530.