Ethereum’s label has dropped one other 13% over the final week. At some level of Monday’s early Asian hours, the leading altcoin plunged to $1,997—its lowest level since December 2023.

With a increasing bearish bias, the cryptocurrency may per chance per chance soon breeze under the severe $2,000 give a tackle shut to level once extra.

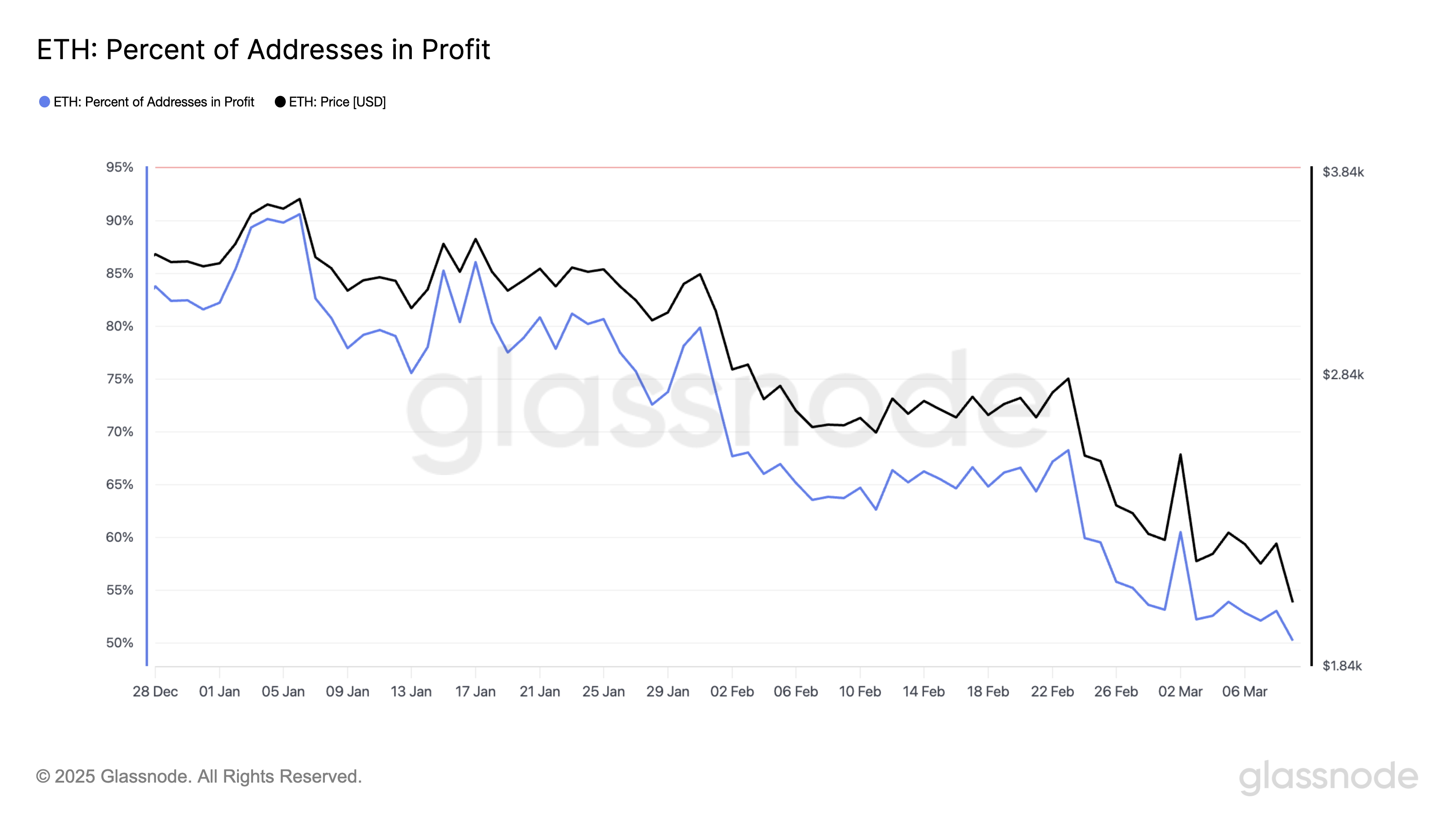

ETH Selloffs Surge as 50% of Holders Lunge Into Losses

An review of the ETH/USD one-chart presentations that the altcoin trades vastly under its Ichimoku Cloud and has executed so since January 25.

At press time, the Main Spans A (inexperienced) and B (crimson) create dynamic resistance above the altcoin’s label at $2,346 and $2,742, respectively.

The Ichimoku Cloud tracks the momentum of an asset’s market traits and identifies potential give a tackle shut to/resistance ranges. When the worth trades above this cloud, the market is in an uptrend.

Conversely, when an asset’s label falls under the cloud, the market is in a downtrend. In this anguish, the cloud acts as a dynamic resistance zone above ETH’s label. It reinforces the likelihood of persisted downward circulation if the coin’s label remains under it.

Extra, ETH’s falling costs like plunged many holders into losses. Per Glassnode, the proportion of ETH wallet addresses whose funds like a median aquire label lower than the coin’s most up-to-the-minute label has dropped to a 365 days-to-date low of fifty%.

This implies that simplest 50% of all addresses keeping ETH are in profit. For context, it used to be 82% in the starting up of the 365 days. The sort can irritate the selloffs among ETH merchants, as many are in actual fact making an strive to offload their holdings to gash again losses.

If selling intensifies, it’ll further power ETH’s costs down, reinforcing bearish momentum and potentially triggering extra stop-loss sell-offs.

Ethereum’s Next Pass: $1,924 Breakdown or a Rally Past $2,500?

ETH’s $2,000 give a tackle shut to may per chance per chance not protect if selling strain persists. This may per chance per chance potentially delivery the door to further losses in the upcoming days. Readings from its Fibonacci Retracement utility indicate that the coin’s label may per chance per chance topple to $1,924 if build a question to weakens further.

However, a definite shift in market sentiment would invalidate this bearish projection. If ETH witnesses a resurgence in fresh build a question to, it may per chance per chance most likely power its label to $2,224. Must calm the coin flip this resistance into a give a tackle shut to ground, it may per chance per chance most likely propel ETH’s label in direction of the extremely coveted $2,500 space