Retail sentiment in direction of Ethereum (ETH) remains extinct, but analysts counsel that a vital breakout would possibly per chance per chance even very effectively be on the horizon. Despite Ethereum’s sluggish label action, loads of on-chain indicators and technical patterns ticket at an impending bullish reversal.

Ethereum Retail Sentiment At Low Amid Sluggish Mark Circulate

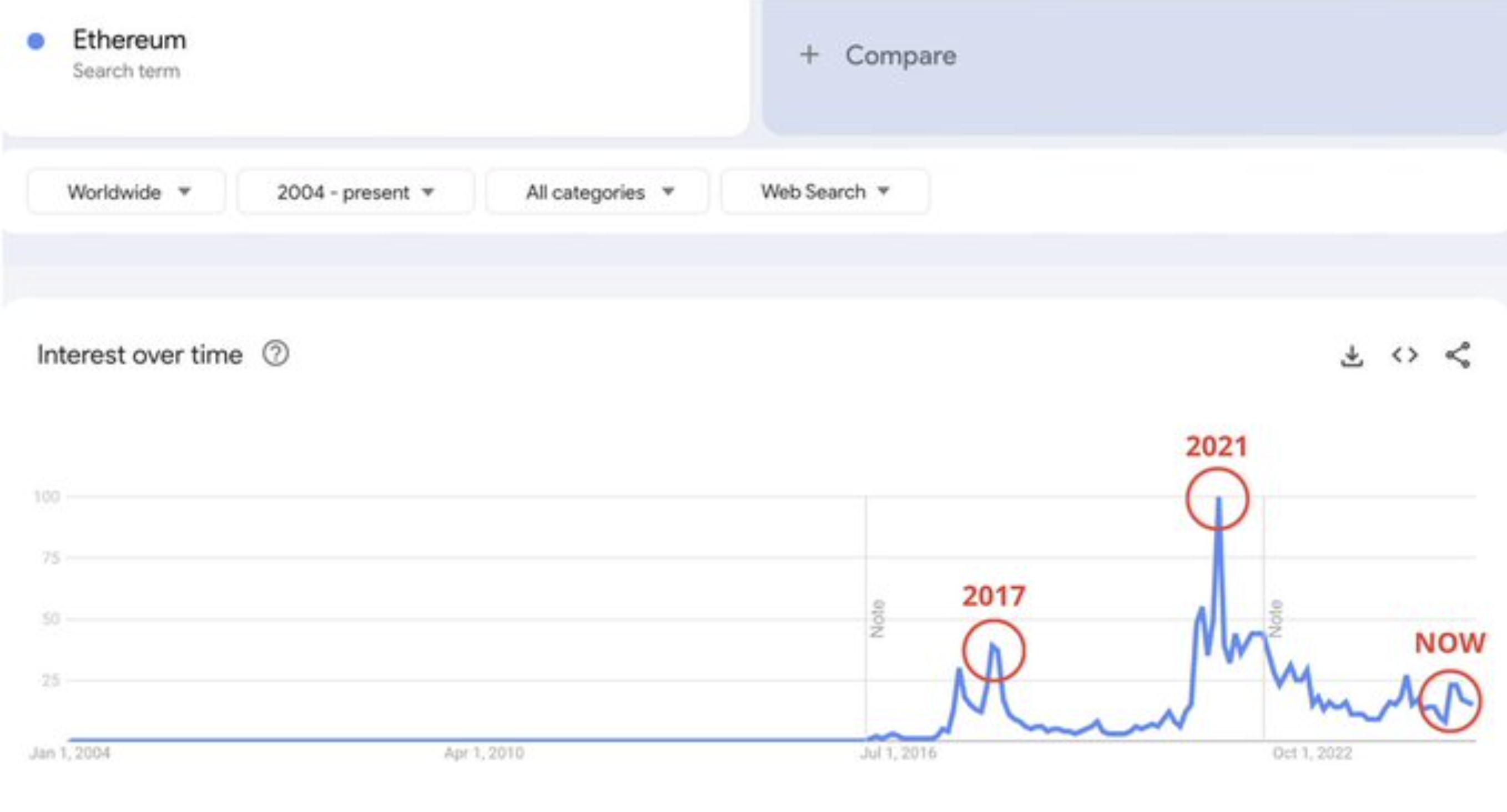

Essentially based fully on cryptocurrency analyst Mister Crypto, retail curiosity in ETH is “extraordinarily low,” as indicated by Google Traits info. In comparison with its 2017 and 2021 peaks, Ethereum’s most modern sentiment ranks vastly lower, suggesting that many retail investors are sitting on the sidelines.

Historically, low retail sentiment in most cases indicators a major looking out to to find opportunity for institutional investors taking a bump into to construct up sources sooner than the following label surge. While extinct sentiment displays a shortage of confidence among tiny investors, institutions tend to diagram shut goal appropriate thing about such prerequisites, positioning themselves forward of the following bullish cycle.

Despite the pessimism, crypto analyst Ted pointed out that the skill approval of an Ethereum trade-traded fund (ETF) staking and the upcoming Pectra change would possibly per chance wait on as key catalysts for a breakout. He means that these developments would possibly per chance help Ethereum accept momentum and push its label in direction of fresh highs.

Fellow analyst Crypto Patel echoed this sentiment, noting that ETH is for the time being consolidating inner an accumulation fluctuate. Essentially based fully on historical label cycles and on-chain info, Patel expects Ethereum to salvage away after April, with a prolonged-term goal of $10,000.

Additionally, analyst Titan of Crypto highlighted a bullish crossover on Ethereum’s weekly Stochastic RSI, a label that has traditionally marked market bottoms. He means that ETH would possibly per chance per chance even very effectively be nearing the stay of its bearish cycle, setting the stage for a stable rally.

Extra Effort For ETH?

Sharing a contrasting perspective, eminent crypto analyst Ali Martinez emphasised that there used to be “no exchange within the outlook for Ethereum.” The analyst hinted that ETH is aloof more likely to hit the lower-stay of its most modern label fluctuate at $1,300.

However, some on-chain indicators counsel Ethereum would possibly per chance already be undervalued. An diagnosis using the Market Cost to Realized Cost Z-ranking (MVRV-Z) indicates that ETH is trading at ranges traditionally linked with label rebounds. This metric, which compares Ethereum’s market price to its realized price, suggests that ETH would possibly per chance per chance even very effectively be primed for accumulation.

For Ethereum to verify a bullish reversal, it must demolish thru stable resistance at $2,300. A a success breakout would possibly per chance push ETH in direction of $3,000 within the short term. Failure to surpass this stage, on the assorted hand, would possibly per chance result in extended consolidation or one more label decline. At press time, ETH trades at $2,007, down 0.5% within the closing 24 hours.