Recordsdata displays the Ethereum Inaugurate Hobby has been shopping and selling at rather low ranges no longer too lengthy within the past. Right here’s what this would perchance perchance well mean for the asset’s heed.

Ethereum Inaugurate Hobby Has Been Transferring Sideways Since Its Plunge

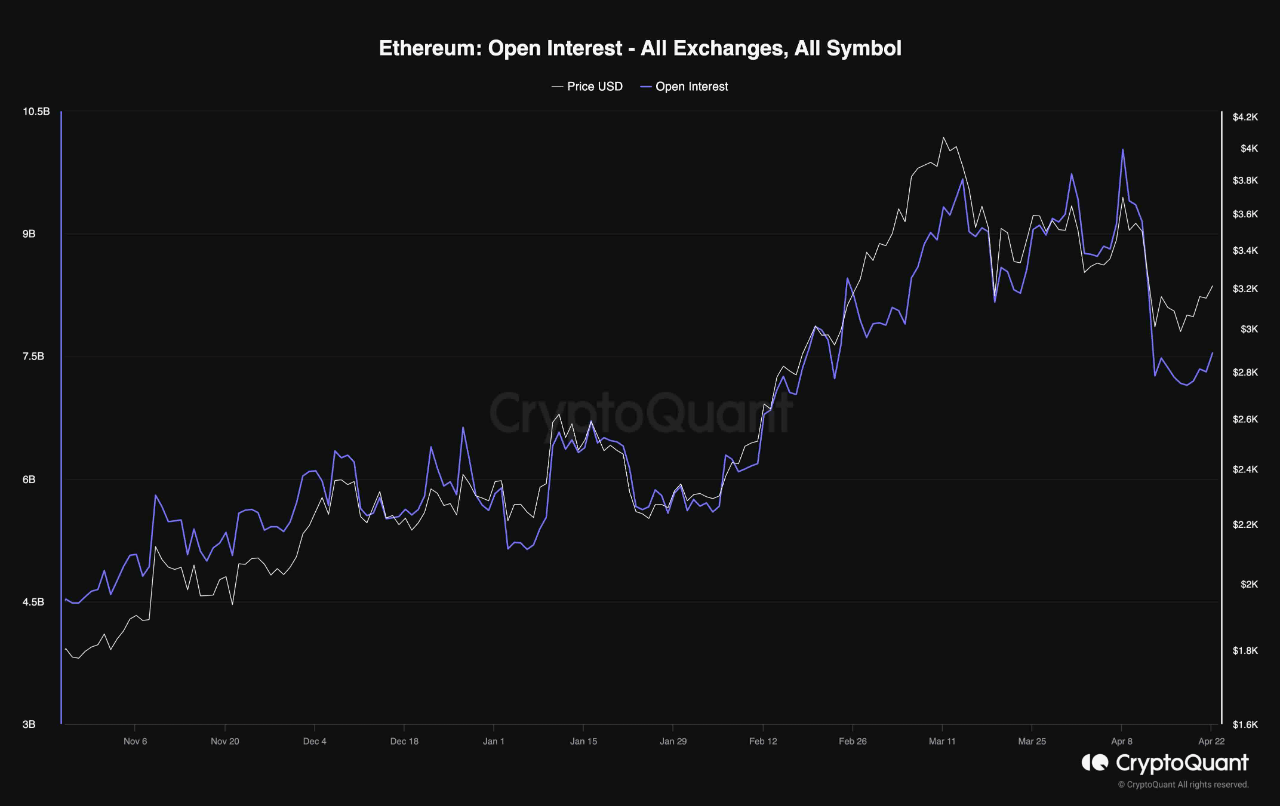

As defined by an analyst in a CryptoQuant Quicktake submit, the ETH Inaugurate Hobby has followed a identical trajectory as the value of the cryptocurrency no longer too lengthy within the past. The “Inaugurate Hobby” right here refers to the total quite just a few of derivative-related contracts originate for Ethereum on all exchanges.

When the value of this metric goes up, it approach that customers are at the moment opening up original positions on these platforms. In most cases, this more or much less pattern ends in an influence bigger available within the market’s total leverage, so the asset heed might perchance perchance perhaps became more volatile.

On the assorted hand, a decline within the indicator implies the customers are either closing up their positions of their personal volition or getting forcibly liquidated by their platform. This kind of drawdown might perchance perchance perhaps also accompany violent heed saunter, but as soon as the drop is over, the market might perchance perchance perhaps became more real on account of the reduced leverage.

Now, right here is a chart that displays the pattern within the Ethereum Inaugurate Hobby over the closing few months:

The value of the metric appears to appreciate witnessed a difficult drop no longer too lengthy within the past | Offer: CryptoQuant

As displayed within the above graph, the Ethereum Inaugurate Hobby registered a difficult drop earlier alongside the asset’s heed. The drop within the metric used to be naturally introduced about by the lengthy contract holders being washed out within the value drawdown.

As the value has mostly consolidated sideways for the reason that decline, so has the value of the Inaugurate Hobby. The quant notes,

This alignment suggests a cooling down of exercise within the futures market. Consequently, the market appears poised for the resurgence of either lengthy or short positions, potentially initiating a original and decisive market saunter in either route.

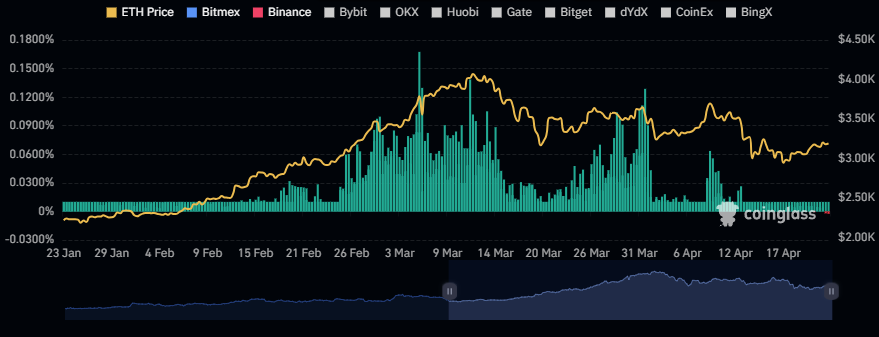

One more indicator related to the derivative market that would be relevant for Ethereum’s future heed saunter is the funding rate. This metric tracks the periodic prices that derivative contract holders are at the moment paying every varied.

Certain funding rates suggest that the lengthy holders are paying the shorts a top rate to address onto their positions; therefore, that bullish sentiment is dominant. Equally, unfavorable values suggest that a bearish sentiment is shared by the bulk of the derivative merchants.

The chart under displays that the Ethereum funding rate has no longer too lengthy within the past grew to became red.

The guidelines for the ETH funding rates over the closing few months | Offer: CoinGlass

Historically, the market has been more liable to poke in opposition to the opinion of the bulk, so the incontrovertible truth that the funding rate has flipped unfavorable would be a unbiased set apart for the probabilities of any seemingly uptrends to beginning out up.

ETH Ticket

Ethereum has step by step increased over the closing few days, as its heed has now reached $3,200.