Ethereum is experiencing a tiring restoration as its save climbs above $3,100. This marks a 2.3% amplify over the final day. However, the asset stays in a command of overall decline, down 3.3% over the week.

While this modest rebound provides some reduction, Ethereum is gathered grappling with the results of an overall bearish pattern. The continuing save circulation has caused some analysts to revisit Ethereum’s underlying on-chain metrics to label what would possibly perhaps well lie forward for the cryptocurrency.

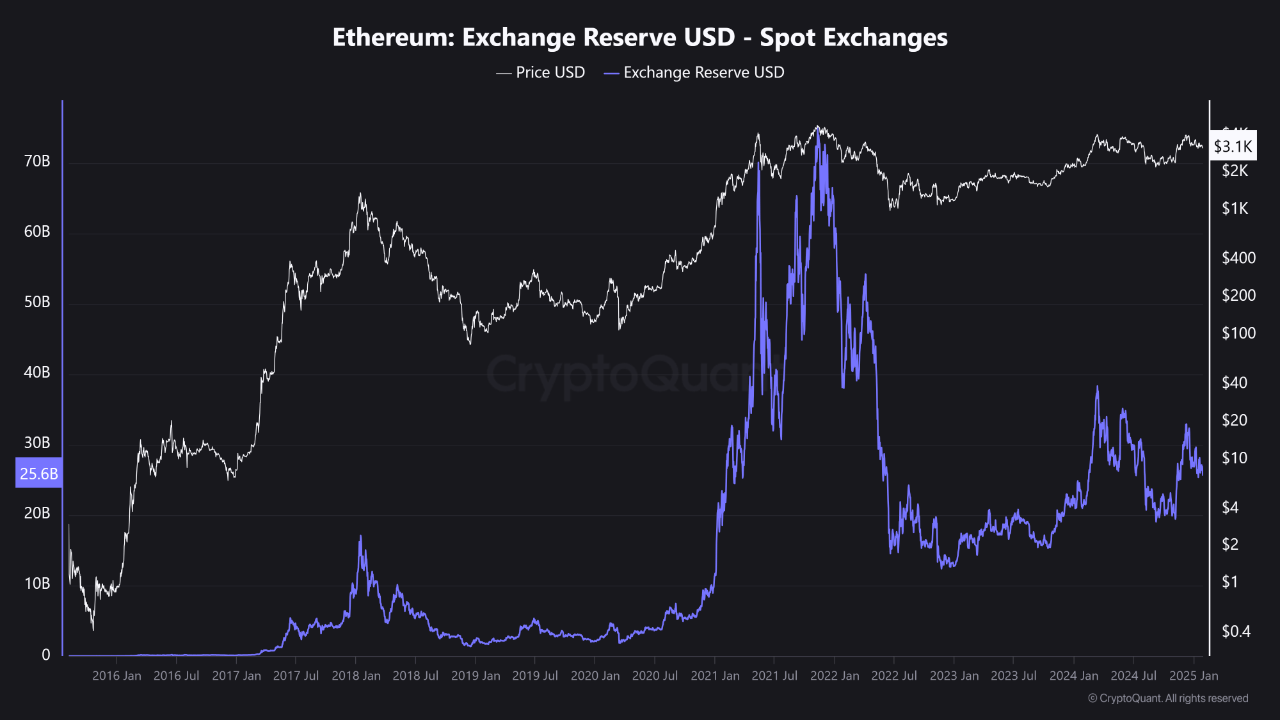

One key apartment of focal point is Ethereum’s space trade reserves. In step with a most modern diagnosis by Cryptoavails, a contributor to the CryptoQuant QuickTake platform, the total reserves of Ethereum held on space exchanges had been progressively declining. This long-time-frame pattern aspects to a shift in how market participants are managing their holdings.

Ethereum Situation Change Reserves Pattern

In step with Cryptoavails, Ethereum reserves on space exchanges contain gone by plan of vital adjustments through the years. Right by plan of the 2017-2018 bull market, reserves reached their height, driven by a surge in investor hobby.

The 2020-2021 length saw another abundant amplify, fueled by the rise of the DeFi ecosystem and Ethereum-based entirely projects. However, starting up in leisurely 2021, reserves began a involving decline as ravishing withdrawals from exchanges was more frequent.

By 2023, reserve ranges hit a low point, and by 2024, these diminished ranges persevered, signaling a attainable present scarcity. This reduction in reserves regularly means that holders are withdrawing Ethereum from exchanges for long-time-frame storage, in pickle of leaving it in the market for instant purchasing and selling.

In consequence, the diminished present on exchanges can create upward strain on costs. Cryptoavails infamous that from 2022 onward, as reserves lowered, Ethereum’s save began to stabilize at increased ranges. This sample means that low reserve ranges would possibly perhaps well enhance extra save increases, potentially triggering a brand contemporary upward pattern.

Technical Prognosis Of ETH

From a technical standpoint, Ethereum has proven patterns that analysts account for as bullish. Several prominent figures in the crypto neighborhood contain shared their insights.

One infamous analyst identified as Crypto Ceaser recently highlighted a jump in Ethereum’s save as a vital opportunity, expressing a explore that the cryptocurrency is undervalued and will more than likely be poised to reach contemporary all-time highs.

$ETH – #Ethereum bounced as anticipated. This used to be a sizable opportunity. Ship it.

Individually Ethereum is heavily undervalued. I feel we can explore contemporary ATH’s quickly. pic.twitter.com/ljMa1lEpJO

— Crypto Caesar (@CryptoCaesarTA) January 28, 2025

However, no longer all analyses paint a uniformly optimistic image. Anup Dhungana, another crypto analyst, pointed out a divergence between Bitcoin and Ethereum’s market behavior.

While Bitcoin has maintained an on a regular basis uptrend, Ethereum’s performance towards Bitcoin has been less sturdy, with the ETH/BTC pair forming lower lows. This divergence reflects diminished investor hobby in Ethereum relative to other property.

In step with Dhungana, the subsequent technical enhance diploma for ETH/BTC would possibly perhaps well lie between 0.028 and zero.026. A rebound from this diploma would possibly perhaps well potentially revive broader hobby in Ethereum and altcoins, paving the manner for another section of enhance.

Featured image created with DALL-E, Chart from TradingView