Ethereum (ETH) has recorded sturdy gains over the last two weeks, rising from $2,111 on June 12 to $2,515 on June 25, reigniting hopes for a sustained bullish rally that may perchance well push the digital asset previous the crucial $3,000 level.

Ethereum Rally Marked By Shift In Dynamics

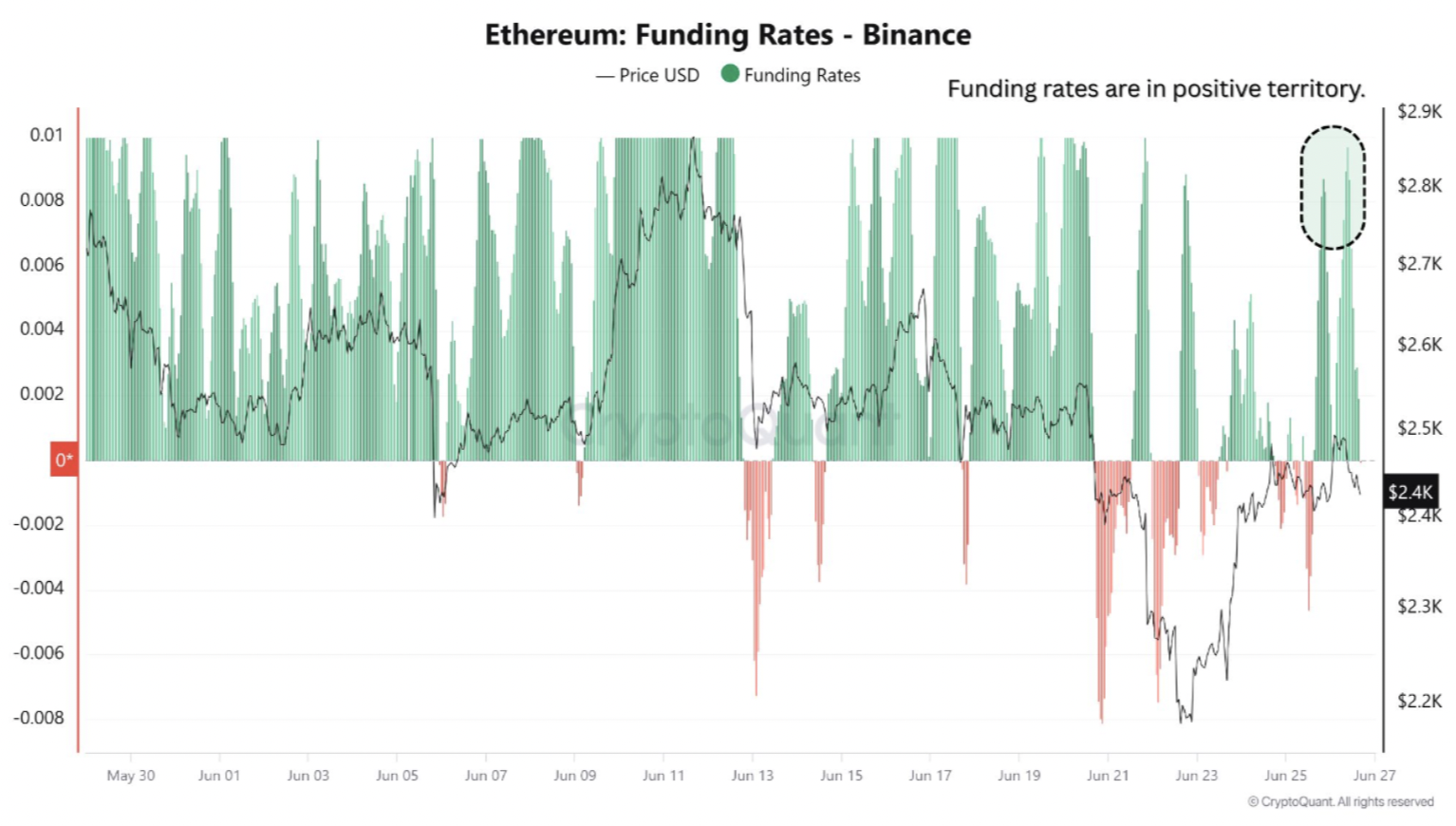

Essentially based on a recent CryptoQuant Quicktake post by contributor Amr Taha, Ethereum’s most up-to-date rally has been accompanied by a indispensable shift in market dynamics – collectively with a flip to obvious funding rates, a probably brief squeeze, and an elevate in ETH inflows to Binance crypto change.

Newest data from Binance reveals a serious shift in ETH funding rates from negative to obvious. Obvious funding rates most regularly show that traders are opening or maintaining leveraged lengthy positions, reflecting expectations of extra upside.

Alternatively, rising funding rates may perchance well well additionally elevate the chance of a non everlasting label pullback if lengthy positions change into overextended. Knowledge from CoinGlass reveals that 68.15% of liquidations over the last 24 hours were lengthy positions – highlighting this chance.

Taha also emphasised the role of a brief squeeze in Ethereum’s recent label surge and the amplify in funding rates. As ETH’s label climbed, it retested the outdated brief-squeeze zone around $2,500. He explained:

In that earlier tournament, brief positions were forcibly closed by initiating aggressive market aquire orders to quilt their publicity, triggering a cascading invent identified as a brief squeeze. This dynamic occurs when traders who had bet against ETH (shorts) are compelled to discontinuance their positions by aggressively searching to search out assist the asset to limit losses.

In the period in-between, ETH inflows to Binance catch also spiked. On-chain change data means that 177,000 ETH became deposited into Binance over a three-day length – an strangely excessive volume.

This form of surge most regularly indicators elevated selling tension or substantial-scale repositioning by vital holders. Great transfers of ETH to exchanges most regularly precede either probably sell-offs or liquidity provisioning.

In conclusion, Taha well-known that while a non everlasting correction may perchance well well be likely, ETH’s breakout above $2,500 underscores the aggressive speculative train using its recent label action. Traders are suggested to closely track funding rates and change flows for indicators of an impending retracement.

ETH Bulls Take The Price

Newest technical prognosis suggests ETH may perchance well well be gearing up for a breakout above the $2,800 resistance level. The asset also recently shaped a golden defective on the day after day chart, fuelling hypothesis that a brand novel all-time excessive (ATH) may perchance well well be within scrutinize.

That stated, ETH just will not be completely in the certain. Technical analyst Crypto Wave recently predicted that the cryptocurrency may perchance well well revisit decrease phases in the $1,700 to $1,950 vary. At press time, ETH trades at $2,429, down 0.4% over the last 24 hours.