Ethereum has skilled a excellent surge in impress, up 60% over the previous month, reaching $2,543. This rally is basically pushed by major accumulation by investors, totaling 1.34 million ETH worth over $3.42 billion.

Despite the growth, some serious investors are foundation to exit, aiming to bag their earnings earlier than doubtless dangers come up.

Ethereum Investors Gobble Up Supply

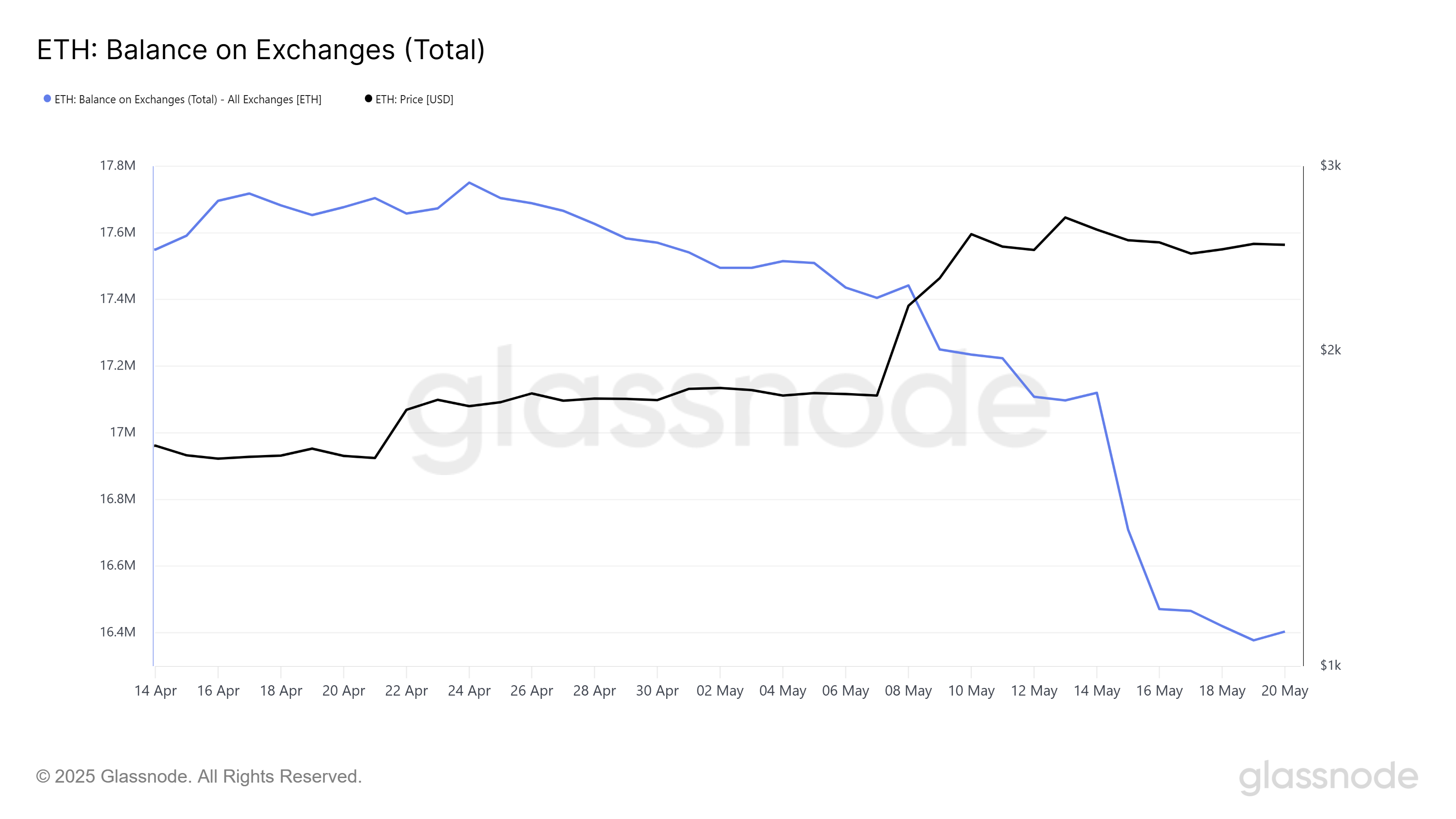

Ethereum’s steadiness on exchanges has dropped by 1.34 million ETH in the previous month (April 21 to May well 21), marking a prime shift in market prerequisites. This provide reduction is valued at over $3.42 billion and is basically attributable to the Pectra toughen, which has boosted investor self assurance in Ethereum’s long-term sigh.

The tumble in alternate provide shows a increasing belief that Ethereum might presumably additionally proceed its upward trajectory. This sprint to obtain Ethereum has created a FOMO (apprehension of lacking out) attain, contributing to the worth rise.

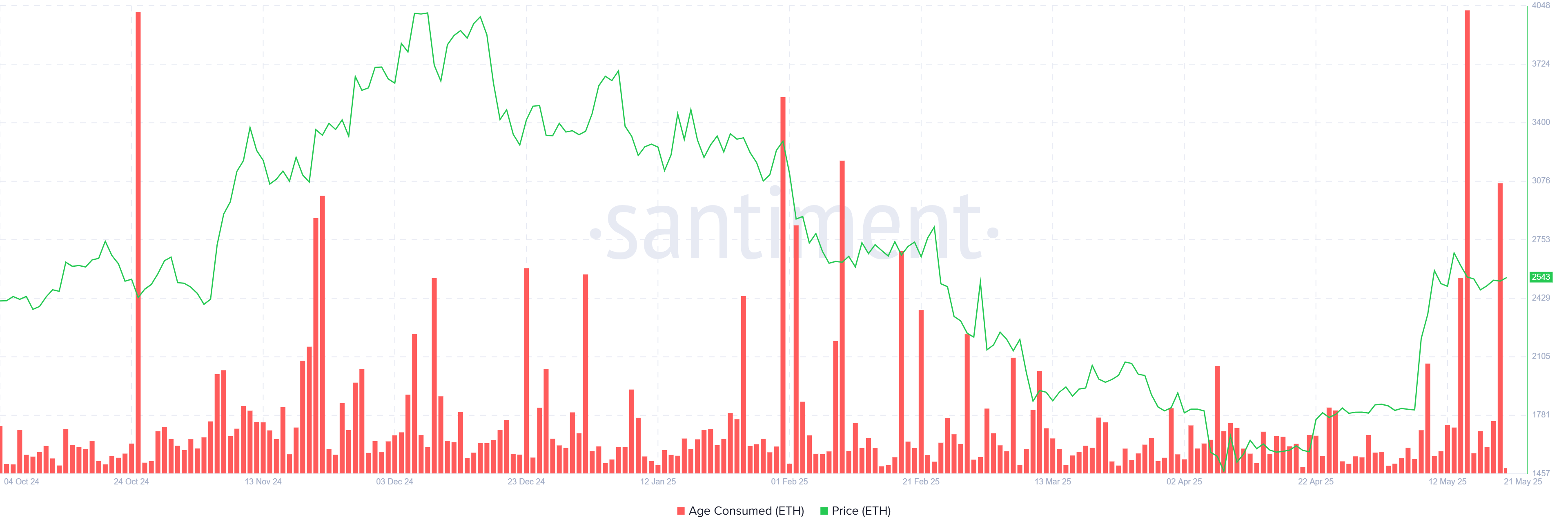

Nonetheless, the macro momentum surrounding Ethereum is mixed, with long-term holders (LTHs) exhibiting habits that suggests warning. The Age Consumed metric has spiked twice this week, indicating that major parts of ETH are being offered by LTHs to lock in earnings.

Here is the largest wave of promoting in the previous seven months, which implies that these holders have faith Ethereum might presumably additionally beget reached its market high. The sell-off by LTHs is drawing consideration to doubtless dangers that might presumably well additionally beget an affect on Ethereum’s future performance. If this pattern of profit-taking continues, it might presumably well additionally hinder the cryptocurrency’s sigh prospects.

ETH Brand Rallies

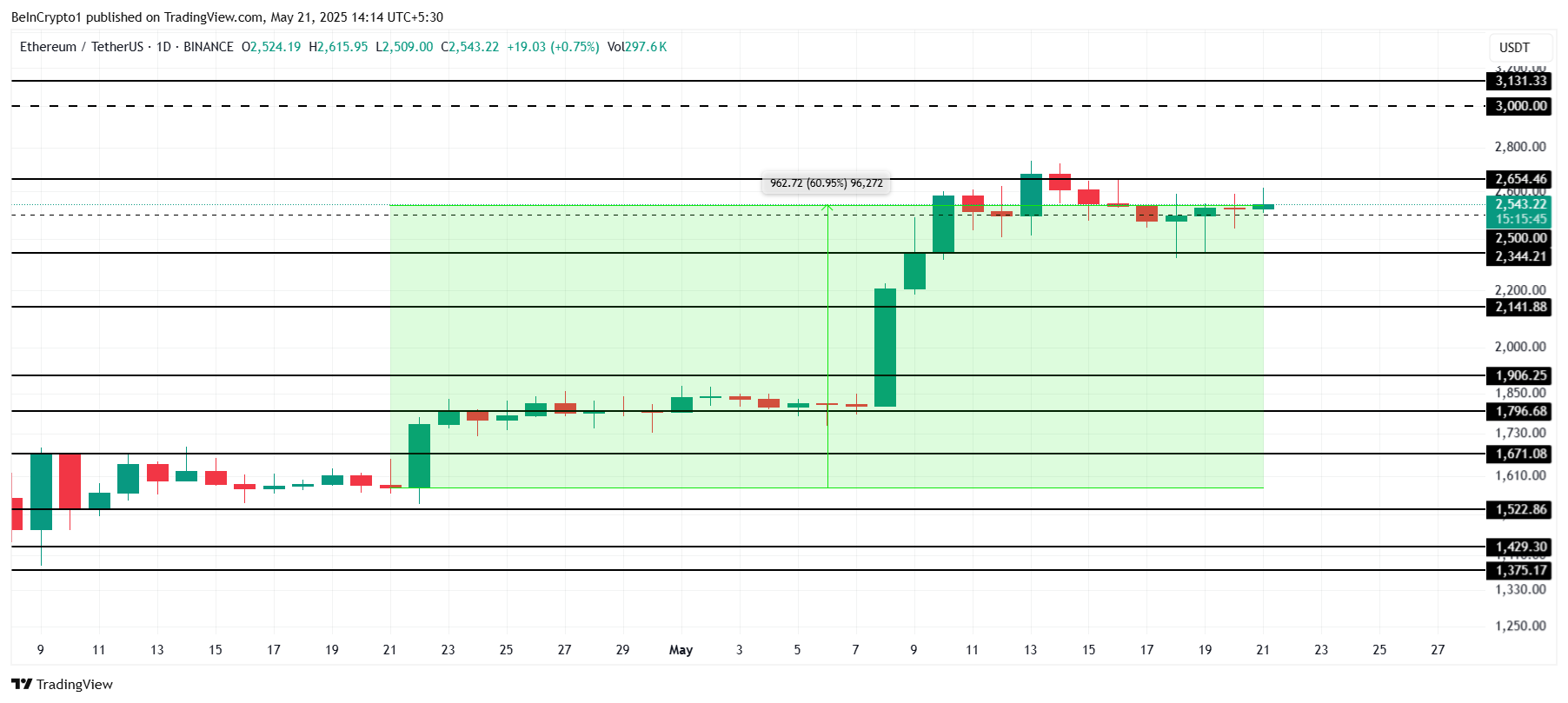

Ethereum impress is for the time being trading at $2,543, marking a 60% rally over the previous month. Nonetheless, the worth faces resistance at the $2,654 mark. Breaching this resistance is critical for Ethereum to proceed its rise.

The impress will seemingly surge previous this stage if Bitcoin forms a brand serene all-time excessive (ATH), as Ethereum has a solid correlation with Bitcoin. This pass might presumably additionally push Ethereum closer to $3,000, further solidifying its bullish outlook. If the broader market stays sure, Ethereum’s impress might presumably additionally eye persevered upward momentum.

Nonetheless, the market comes with its dangers. If the selling stress from LTHs intensifies and the buildup share halts, Ethereum’s impress might presumably additionally fight to defend its upward trajectory. Losing enhance at $2,344 would seemingly result in a decline in opposition to $2,141, invalidating the most up-to-date bullish thesis and extending a bearish outlook for the cryptocurrency.