Bybit, in collaboration with Blocks Scholes, launched its newest weekly derivatives analytics document, revealing that Ethereum (ETH) has no longer too lengthy in the past surpassed Bitcoin (BTC) in key trading metrics.

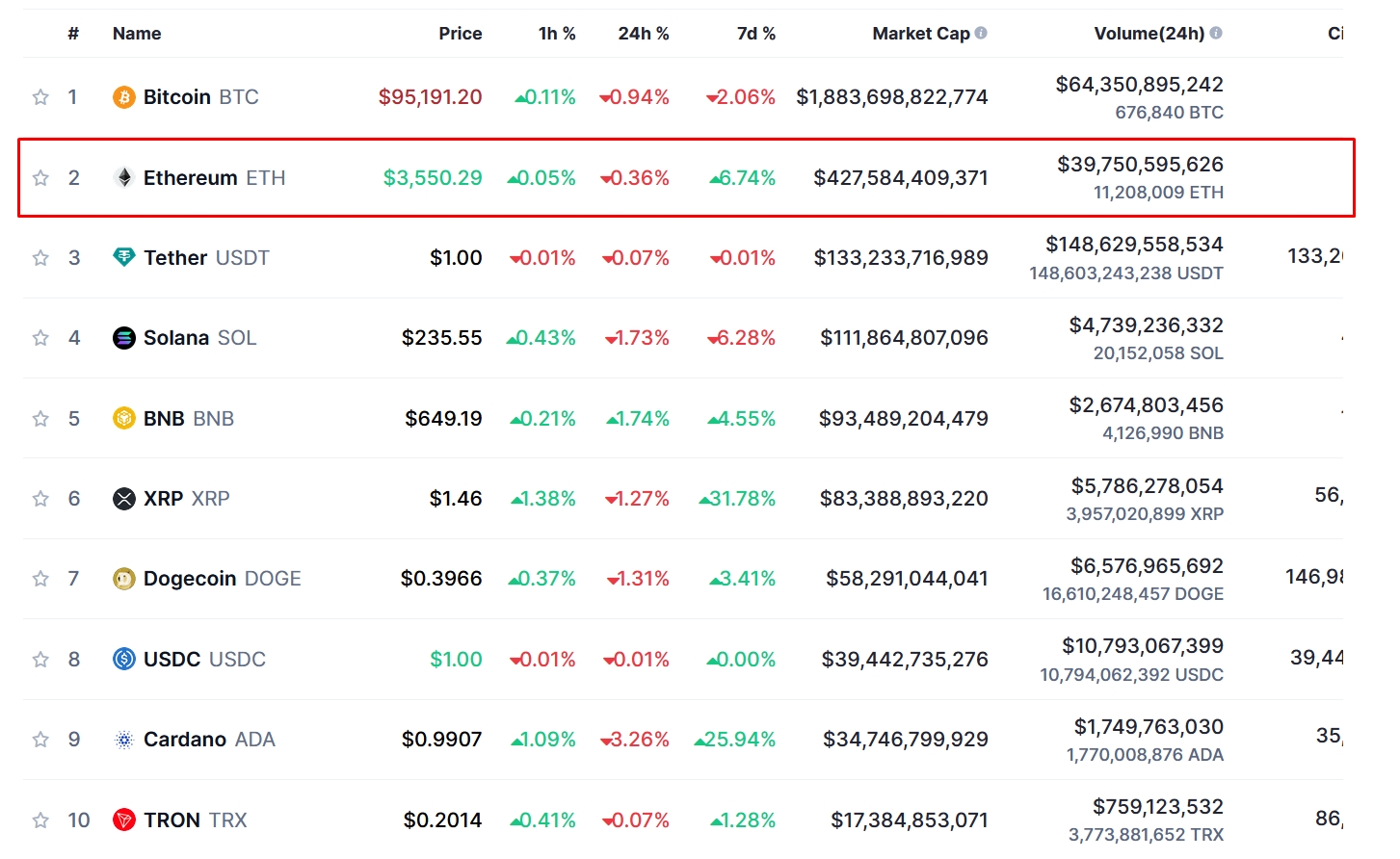

Per CoinMarketCap, Ethereum is amongst the cease gainers in the cryptocurrency market. This surge in ETH’s performance is attributed to information referring to US SEC Chair Gary Gensler’s upcoming departure on the discontinuance of the Biden administration’s term.

Shoppers are optimistic about a potentially extra crypto-friendly SEC Chair after Gensler’s exit on January 20, 2025.

Ethereum Surpasses Bitcoin in Buying and selling Quantity

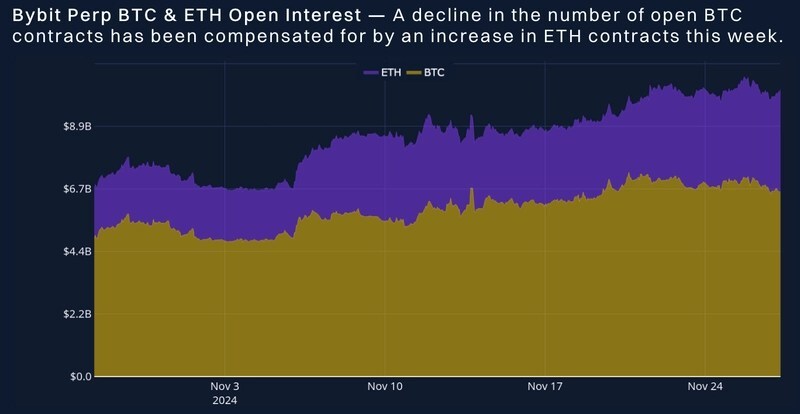

The document highlights that ETH has outperformed BTC in birth curiosity. Files presentations a decline in birth curiosity for BTC perpetual contracts, whereas ETH’s birth curiosity has been on the upward thrust.

All over the final six months, ETH has also captured a elevated portion of day-to-day trading volumes, no matter a slower market overall this week. This shift suggests rising curiosity in Ethereum as investors depend on much less regulatory scrutiny in the finish to future.

Earlier, The US SEC confirmed Gensler’s departure, as reported by Finance Magnates coinciding with Donald Trump’s inauguration. Gensler, identified for his strict crypto regulations, faced challenges in the end of his tenure, at the side of the GameStop saga. No matter criticism, the SEC credited him with reforms aimed in direction of improving market efficiency and transparency.

Securities and Alternate Chair Gary Gensler will leave on January 20, giving Trump the ability to set up a brand new chief (because the incoming admin talks up crypto) on day 1 pic.twitter.com/GJMetVJvRP

— brian cheung (@bcheungz) November 21, 2024

CoinMarketCap information presentations that Ethereum’s market cap stands at $428.06 billion, securing the volume two map, genuine on the motivate of Bitcoin.

BTC Ticket Decline Ends in Flattened Volatility

On the opposite hand, BTC has considered a decline in impress from its old excessive of $100K. This has led to a knocking down of the ATM volatility term structure, with non permanent alternatives dipping below 60%. This tumble in BTC’s volatility reflects a broader pattern seen for the explanation that US election. While birth curiosity in calls and places stays genuine, the inquire for non permanent alternatives has stagnated.

In phrases of alternatives, ETH presentations a runt bit extra bullish sentiment than BTC. No matter market recalibration following the post-election highs, name alternatives for ETH proceed to handbook in each and each trading volumes and birth curiosity.