Ethereum rate has entered a phase of consolidation, hovering between $3,300 and $3,400 after losing from its fresh high of $4,085. Whereas this steadiness could well reassure some investors, others reside cautious referring to the functionality for further declines. With crypto costs losing momentum and Bitcoin going thru challenges, could well Ethereum rate dip to original lows?

Ethereum Impress Diagnosis: Most up-to-date Trends and Market Job

Ethereum rate currently sits at $3,330, exhibiting blended efficiency over various time frames:

- 1-Year Efficiency: +44%

- 1-Month Efficiency: -8.5%

- 7-Day Efficiency: -4.5%

Basically the most popular traded volume for Ethereum has dropped by 31% within the past 24 hours, which is conventional for this time of one year when market exercise slows down ensuing from seasonal tendencies. This declining volume reflects waning ardour among merchants, which could well pave the vogue for further corrections.

ETH/USD 4-hours chart – TradingView

Why Is Ethereum Shedding Momentum?

The crypto market as a total has been struggling to protect its fresh highs, with costs all over predominant sources love Bitcoin and Ethereum seeing declines. Analysts attribute this to several components:

Seasonal Slowdown

Market exercise tends to dip within the origin of the one year, main to decreased buying and selling volumes and worth stagnation.

Bitcoin’s Affect

Bitcoin’s lack of skill to abet a cost above $90,000 has had a ripple designate on the broader market, including Ethereum. If Bitcoin rate drops further, Ethereum is likely to follow swimsuit.

Profit-Taking

After Ethereum’s impressive gains in 2024, many investors are locking in earnings, contributing to the fresh rate decline.

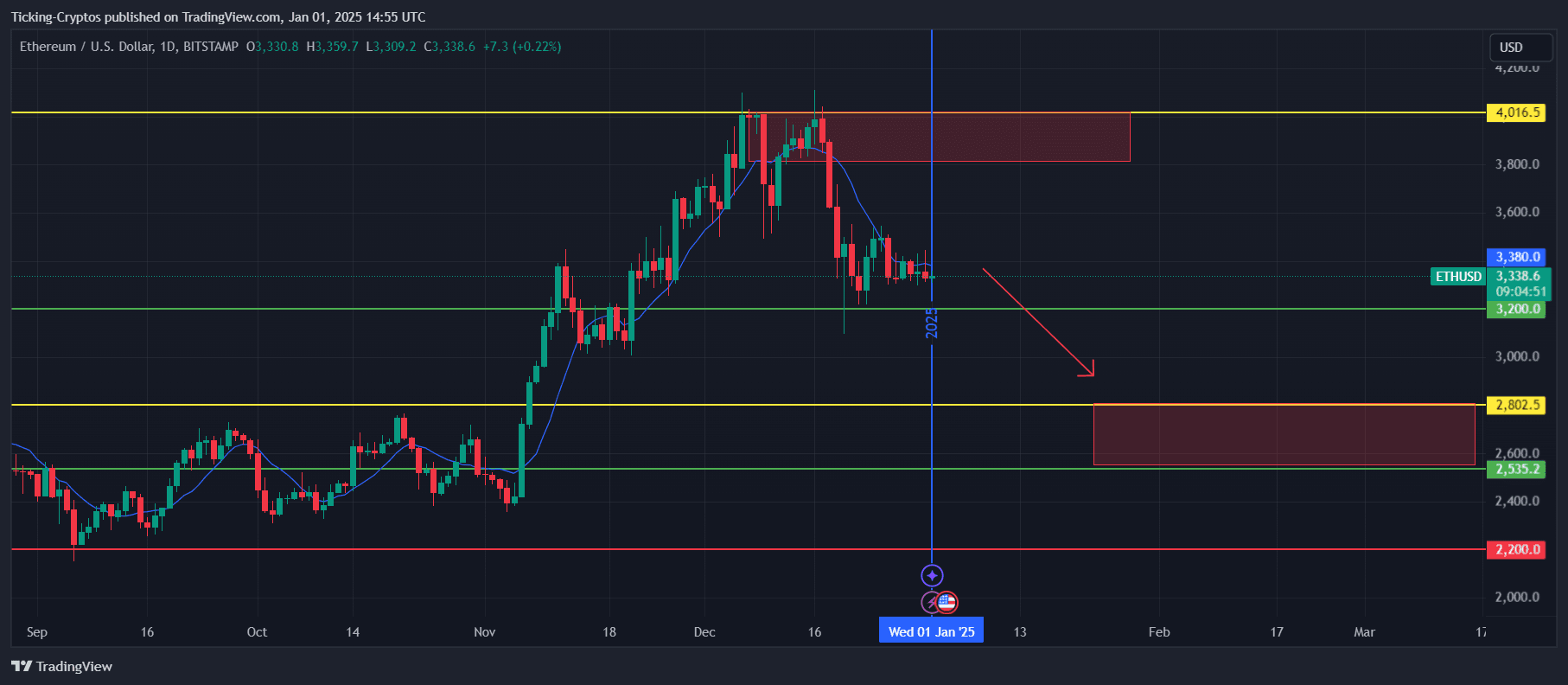

Ethereum Impress Prediction 2025: Key Pork up Zones to Behold

Analysts are carefully monitoring Ethereum rate because it approaches serious toughen ranges.

Short-Term Outlook

Ethereum rate could well drop to $3,000 if Bitcoin’s rate fails to protect its most popular ranges.

Medium-Term Outlook

Key correction zones for Ethereum are anticipated to be between $2,500 and $2,800. These ranges symbolize essential toughen and could well present a hunting for various for long-term investors.

ETH/USD 1-day chart – TradingView

In spite of essentially the most popular bearish outlook, Ethereum’s long-term likely stays stable, particularly given its ongoing model and in vogue adoption.

What’s Next for Ethereum Impress?

The Ethereum rate is at a crossroads, consolidating spherical $3,330 while going thru likely downward stress. With the crypto market losing momentum and Bitcoin struggling to protect its highs, Ethereum could well search for further corrections within the arriving weeks.

For investors, keeping an trace on the $3,000 and $2,500 ranges is significant. Whereas transient volatility could well proceed, Ethereum’s stable fundamentals counsel that any dip could well negate a strategic hunting for various.