Ethereum sign remained below stress on Sunday as sentiment in the crypto industry worsened. ETH token became once procuring and selling at $3,187, down by over 36% from its all-time high, which means that it’s miles in a deep agree with market. The coin will doubtless be about to drop further as a unhealthy pattern nears.

Ethereum sign is able to compose a unhealthy pattern

Reproduction hyperlink to piece

The day after day timeframe chart reveals that the Ethereum sign has remained below stress previously few months, transferring from the all-time high of $4,950 to the fresh $3,185.

ETH has persevered to compose a series of decrease lows and decrease highs, a signal that any try and rebound is funding sturdy resistance.

The Relative Energy Index (RSI) has moved from the overbought stage of 87 in July to the fresh 35. This rupture came about as the RSI fashioned a double-high pattern m

Meanwhile, the Realistic Directional Index (ADX) has jumped to 37, a signal that the continuing downtrend is gaining momentum previously few days.

The coin has also misplaced key pork up ranges like $4,100, its highest stage in December last year. It also moved underneath the basic pork up stage at $4,000, while the 50-day and 200-day Exponential Consuming Averages (EMA) are about to contaminated every various, forming a death contaminated pattern, one of the riskiest indicators in technical diagnosis.

Therefore, the maybe Ethereum sign forecast is bearish, with the following key pork up stage to explore being at $2,877, the highest stage in June this year. On the flip facet, a pass above the resistance at $3,500 will invalidate the bearish outlook.

ETH sign has a amount of bearish catalysts

Reproduction hyperlink to piece

The doubtless Ethereum sign rupture has some basic bearish catalysts that will push it decrease in the shut to time duration.

First, facts compiled by SoSoValue reveals that American traders have persevered to dump their ETH ETFs. These funds shed over $728 million sources last week, larger than the $507 million they misplaced in the earlier week.

Dwelling Ethereum ETFs have shed over $1.24 billion this month, erasing the gains made previously two consecutive weeks. The cumulative influx has moved from virtually $15 billion in the year to $13.1 billion this day. They now have $20 billion in sources.

Second, the Ethereum sign might possibly perchance proceed crashing on myth of of deteriorating community process that is doubtless prompted by the waning participation available in the market.

Data reveals that the choice of transactions in the community dropped by 25% in the last 30 days to forty five.7 million, while active addresses fell a bit to eight.19 million. Network charges plunged by 44% to 26.9 million.

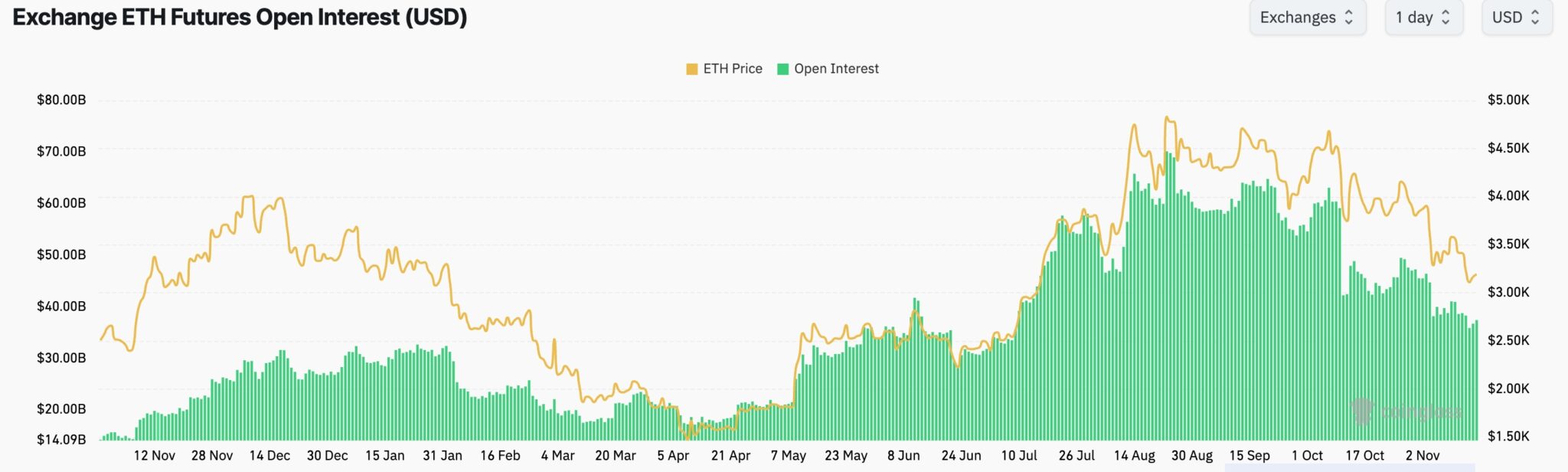

Third, Ethereum’s futures initiate curiosity has plunged to $37.4 billion by virtually $70 billion in August. One trigger of that is the good liquidation event that came about on October 11. Ethereum’s funding rate has remained in a consolidation previously few weeks.

Therefore, the token will doubtless proceed falling in the shut to time duration as its broken-down fundamentals and technicals align.