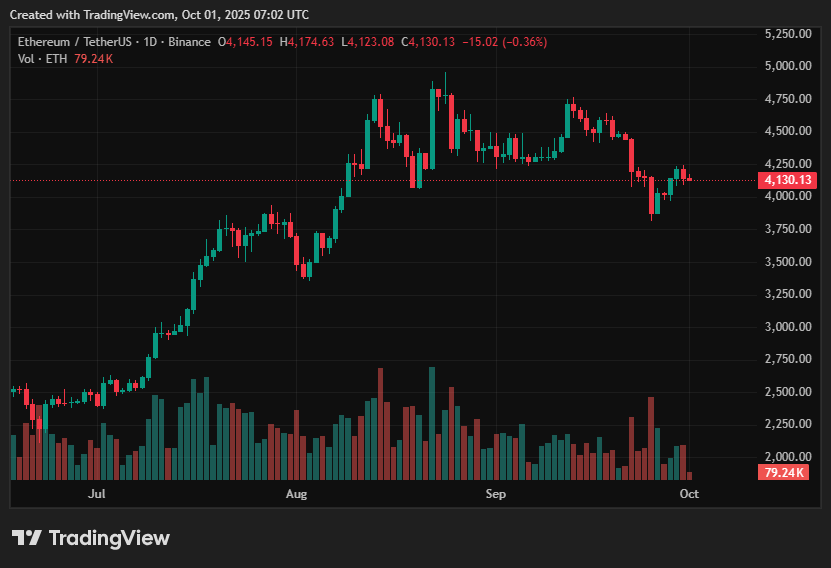

- Ethereum impress prediction analysts impress ETH is retaining between $4,000 and $4,400, with decrease volatility following September’s fluctuations.

- The major resistance zone is $4,600; a break may per chance well ship momentum to $4,800-$5,000.

- Institutional ETF inflows and staking assignment continue to force lengthy-term ask.

- Analysts predict that you may per chance well per chance take into accout positive factors above $5,200 if provide tightening from staking ETFs occurs.

- If ETH fails to protect $4,200 toughen, the price may per chance well fall under $4,000.

- The non everlasting explore ranges from honest to cautiously bullish, reckoning on ETH’s skill to retake resistance.

Ethereum impress prediction is in provocative focal level because the coin trades approach $4,140, retaining in model after a turbulent September. The $4,600 zone is shaping up as a extraordinarily crucial resistance level for bulls, while the $4,000–$4,200 vary stays a extraordinarily crucial cushion of toughen.

Traders are discussing whether Ethereum’s recent steadiness offers a foundation for one other upward thrust, or if the dearth of momentum may per chance well result in extra procedure back stress. Institutional ETF flows and constant staking assignment stay carefully watched as attainable catalysts.

Table of Contents

Ethereum impress prediction prognosis

Ethereum has entered a consolidation segment between $4,000 and $4,400, indicating a duration of decrease volatility than the rapid intraday adjustments observed excellent week.

Lighter volumes present a quick cease in market assignment as traders wait for stronger signals. Regardless of this, underlying community assignment stays stable, with DeFi protocols persevering with to stable predominant liquidity, bolstering Ethereum’s foundations.

Institutional flows fetch additionally played a stabilizing role. Express ETH ETFs fetch considered inflows on a plump selection of remarkable days, indicating a unhurried but constant invent-up in lengthy-term ask.

Whereas speculative impetus has slowed, elevated participation from funds and continuous staking assignment are helping Ethereum (ETH) avoid deeper retracements, keeping impress motion positive within its recent vary.

Upside outlook for Ethereum impress

A stable approach above $4,400-$4,500 would seemingly commence up Ethereum on a direction to elevated targets, on the beginning around $4,800-$5,000. This level has served as resistance in recent weeks, and regaining it can well result briefly covering in derivatives markets, accelerating upward momentum.

Traders leer ETF inflows as a catalyst that can also propel Ethereum into its subsequent bullish leg. From a broader Ethereum coin forecast, analysts impress that momentum may per chance well lengthen into Q4, with some calling for a push past $5,200.

The expectation is that if staking substances are integrated into ETF merchandise, accessible provide would shrink extra, doubtlessly drawing extra institutional allocations and fueling a long-term rally.

Method back risks for ETH impress

Essentially the most keen possibility is Ethereum’s inability to protect its $4,200 toughen zone. Derivatives heatmaps indicate thick liquidation clusters in this vary, implying that a surprising drop may per chance well intensify promoting stress toward $4,000. The kind of problem is per chance prompted by low liquidity and the unwinding of leveraged lengthy bets.

Macroeconomic prerequisites add one other layer of uncertainty. Political traits, shifting curiosity charge projections, or surprising ETF redemption waves may per chance well stall momentum and leave ETH inclined. Even with stable fundamentals, a possibility-off backdrop may per chance well quick cap upside strikes.

Ethereum impress prediction in accordance with recent ranges

Ethereum’s non everlasting direction is mainly dependent on whether it will protect a impress over $4,400-$4,500. A confirmed breach above this resistance dwelling would toughen a bullish forecast of $4,800-$5,000, with a likelihood of reaching $5,200 if institutional flows end supportive.

Traders assume this effort is an increasing selection of plausible if ETF inflows continue at their recent charge. Conversely, a decisive drop under $4,200 would shift sentiment bearish, opening the door to a trail under $4,000. The kind of transfer would seemingly discipline off liquidations and dampen approach-term self perception.

For now, the Ethereum outlook stays honest to cautiously bullish, with the steadiness of expectation resting on its skill to reclaim resistance.

Disclosure: This article does no longer signify funding advice. The philosophize and offers featured on this page are for educational applications completely.