The Ethereum (ETH) mark outlook has been on merchants’ radars for a whereas. Amid this sentiment, the cryptocurrency has rallied above $4,000 and, at one level, lowered under $3,200.

Nonetheless, within the closing 24 hours, Ethereum’s mark has increased by 10%, with spruce transactions climbing to phases no longer considered in practically one week.

Ethereum Sees Distinguished Institutional Interest

Ethereum’s 10% surge has pushed the altcoin to $3,422. On-chain data exhibits that increasing institutional passion is a key ingredient influencing Ethereum’s mark outlook.

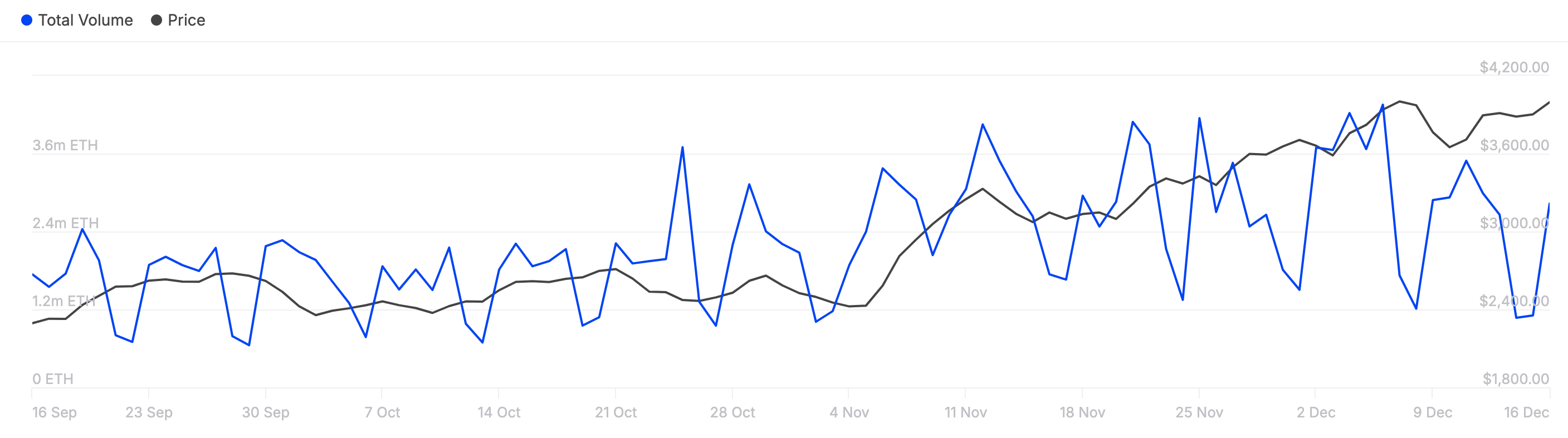

IntoTheBlock reports that Ethereum’s spruce transactions bask in climbed to 2.83 million ETH. This boost suggests heightened trading activity amongst whales and key stakeholders.

On the loads of hand, a decline on this metric indicates dwindling passion. At the time of writing, these transactions are value roughly $11 billion. Historically, when this metric rises alongside the value, it is a bullish stamp. As such, the ETH mark might per chance maybe maybe upward push above $4,500 within the short time frame.

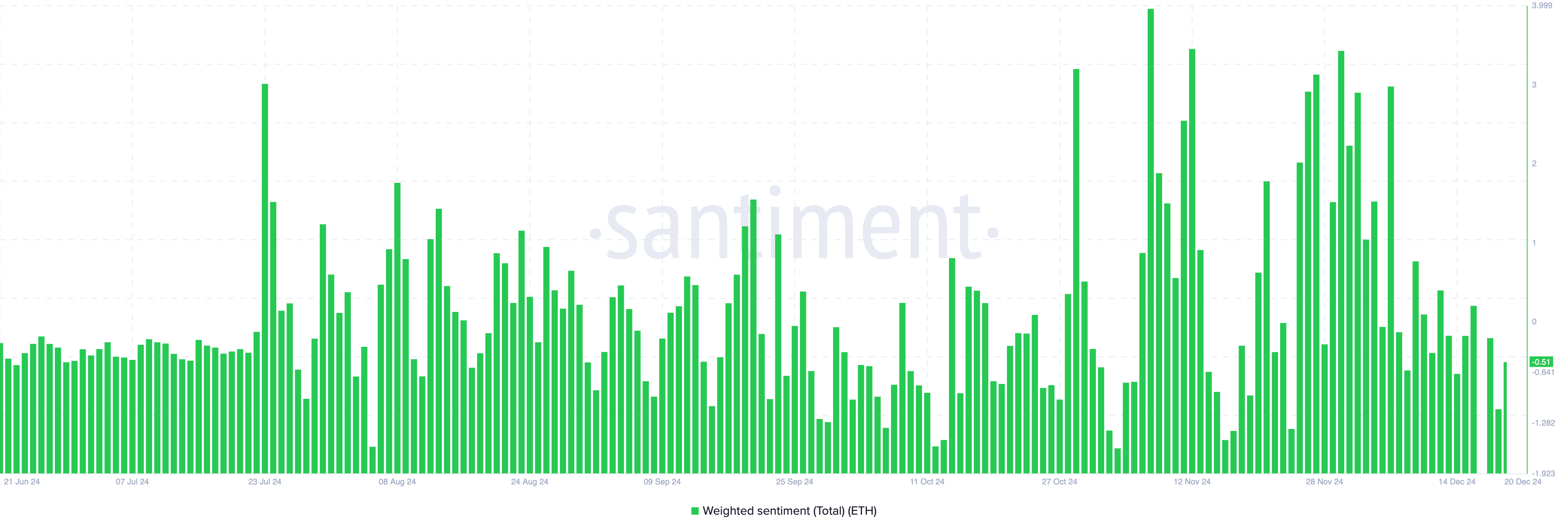

The Weighted Sentiment indicator suggests Ethereum’s mark might per chance maybe maybe score rising. This metric measures overall market perception of a cryptocurrency, with sure readings reflecting bullish sentiment and adverse readings indicating bearish sentiment.

Santiment data reveals Ethereum’s Weighted Sentiment is nearing the sure zone. If it stays on this territory, ETH’s mark might per chance maybe maybe continue to prolong.

ETH Stamp Prediction: Breakout Previous $4,000 Composed On the Playing cards

In step with the three-day ETH/USD chart, the Accumulation/Distribution (A/D) line has persevered to climb. A rising A/D line indicates that merchants are procuring, which might per chance maybe maybe power the value better. When the indicator’s learning drops, it indicates that merchants are distributing, which is a bearish stamp.

Because it is the customary for ETH, it means that the cryptocurrency’s mark might per chance maybe maybe damage the $3,982 resistance. If validated, the value might per chance maybe maybe hit $4,110. Nonetheless, if the broader market stipulations became extraordinarily bullish, Ethereum’s mark might per chance maybe maybe rally above $4,500.

But if the cryptocurrency fails to interrupt above the resistance, the value might per chance maybe maybe no longer skills such an upswing. As an various, the value might per chance maybe maybe decline to $3,178.