After procuring and selling on the same enhance stage over previous couple of years, Ethereum mark broke down, below $2K for the first time since gradual 2023.

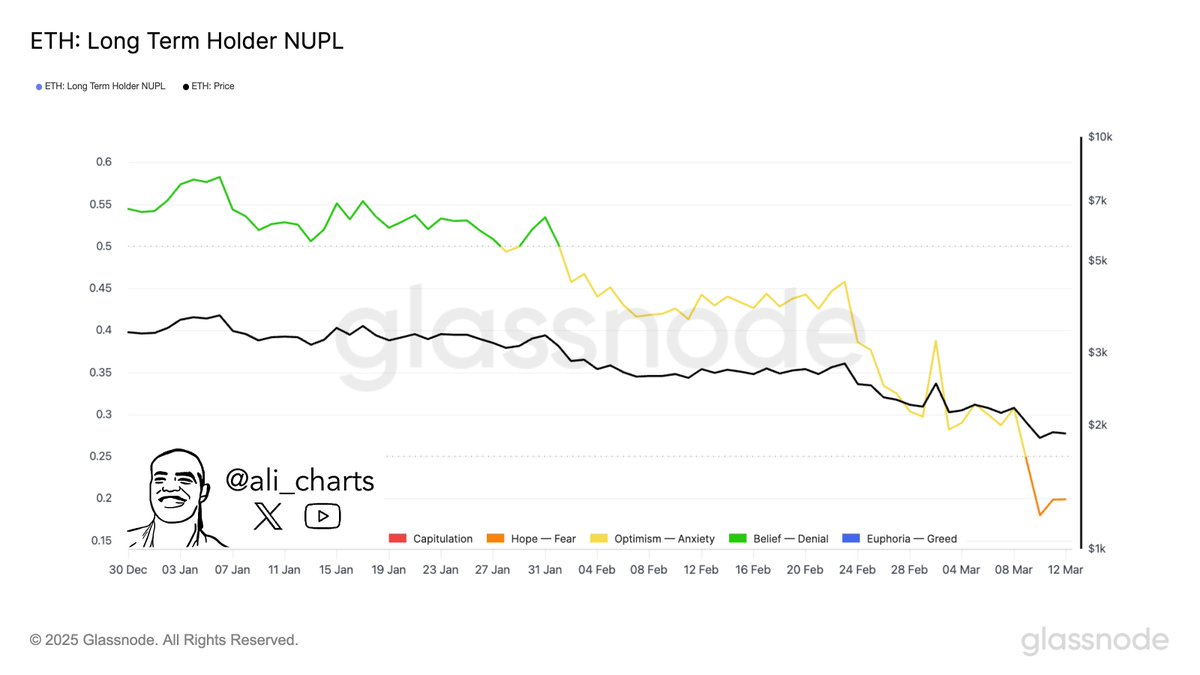

Diagnosis of Ethereum’s long-term holders showed an unlimited deal of downside as the fresh In finding Unrealized Revenue/Loss (NUPL) stage stood at 0.38, indicating a shift from hope to terror.

Beforehand, NUPL ranges of the same size had indicated essential corrections, such as in May even honest 2022 when NUPL dropped below 0.35 and ended in ETH dropping.

If the phobia escalates and ETH could well proceed falling below fresh ranges of enhance headed in direction of next predominant helps, that will offer be long-term procuring opportunities.

But if the mood is extra healthy and NUPL returns to 0.forty five, ETH can retest ranges above $2,500, with imaginable retest of ranges above $3,000 in a continuation pattern.

The NUPL readings confirmed the market indecision, mark being at a key stage.

One other tumble will verify capitulation, but staying right here could well lead to a new rally.

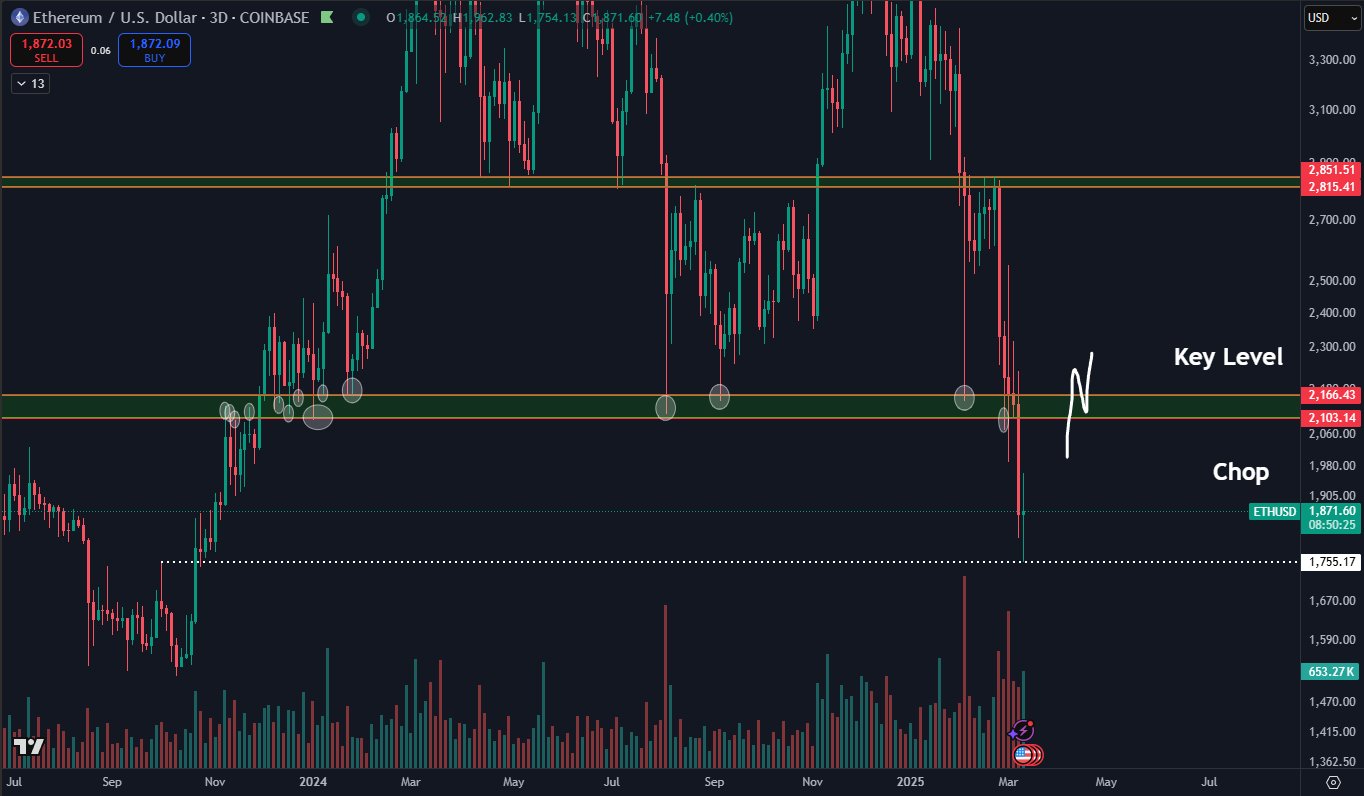

Ethereum Mark Breaking Prolonged-term Make stronger Stage

Ethereum’s mark breakdown dented investor self assurance as facets of ancient enhance didn’t retain.

Nonetheless, ETH became once supported at round $1,950, the October 2023 retest of breakout, which is unruffled in space.

The $2K-$2.1K vary is the predominant vary for a reversal on the upper timeframes.

If ETH is able to reclaim this vary, momentum could well unruffled take it up to $2,400-$2,500, rendering transient bearish concerns moot.

Failing to retain above $2K, alternatively, can leave ETH initiate to further weak spot, with $1,750 the following essential take a look at.

A damage down below $1,750 would extra emphatically set aside aside in circulation a serious correction, one who can even attain the $1,500-$1,600 ranges not seen since early 2023.

The space of $1,750-$2,100 is an ungainly battleground vary the effect mark action is indeterminate.

Reloading $2K+ signals bullish momentum, but slipping below $1,750 could well living off rapidly liquidations, which provides to thrill in momentum.

Within the meantime, Ethereum mark finds itself in the clutches of reclaiming $2K. Turnaround already looms gargantuan if that’s the case.

In every other case, below-$1,750 ETH also a convincing likelihood threat, constructing a delight in pattern decrease.

Historical ETH’s Performances for Q1

This comes as ETH is determined to enact its worst Q1 ever, reflecting dire investor fears.

ETH has traditionally had perfect Q1 performances, such as 2021 with +120% and 2020 had +21%, while 2022 offered a modest loss.

Q1 2024 has been very completely different, with ETH struggling to procure back to key ranges.

Now, ETH has skilled a double-digit decline, an aberration of the prior years’ bull runs.

January, February, and March three-month rolling performance showed ongoing weak spot, with failed breakouts and lengthening promoting rigidity.

ETH ending Q1 in the red would be the first in ancient previous with such a involving beginning effect.

This means bearish sentiment for Q2 unless ETH reverses greater above $2,100.

In every other case, the stage is determined for the checking out of $1,750, confirming a long-term bearish pattern.

Nonetheless, if ETH repeats ancient Q2 reversals treasure 2020 with a +55% soar in April, then there could be unruffled room for a recovery.

The following few weeks will decide if ETH bounces back or if below $1,750 is a sure bet.