Ethereum tag has crashed by over 52% from its absolute top stage in December, and technicals and on-chain metrics deliver extra downside in the conclude to term.

Ethereum (ETH) peaked at $4,105 in December and changed into once trading at $1,970 on March 20. This 52% smash makes it one in all the worst-performing blue-chip money available in the market.

Ether has crashed as considerations about its future live. Correct this week, Customary Chartered analysts downgraded their estimate by 60% from $10,000 to $4,000, citing the rising opponents from layer-1 and layer-2 networks that non-public affected its income enhance.

Layer-2 networks on Ethereum, adore Coinbase’s Deplorable, Arbitrum, and Optimism, private drawn extra users to their ecosystems ensuing from of their decrease prices. As an illustration, DeFi Llama’s recordsdata shows that DEX Ethereum protocols handled over $9.8 billion in quantity in the last seven days.

Arbitrum handled $2.87 billion, whereas Deplorable had $2.8 billion. In the previous, this quantity would private been handled on Ethereum’s mainnet community.

Ethereum also will be seeing intensified opponents from layer-1 networks adore Solana (SOL) and BNB Chain. BNB Neat Chain’s DEX protocols handled DEX quantity rate over $13 billion in the last seven days.

Ethereum also will be no longer anticipated to be a main beneficiary of emerging applied sciences adore Accurate World Asset tokenization ensuing from of its bigger prices and slower bound. As a replace, developers could well furthermore decide to exercise other scalable and more cost effective networks adore Mantra (OM) and BNB Chain.

Ethereum has aged on-chain metrics

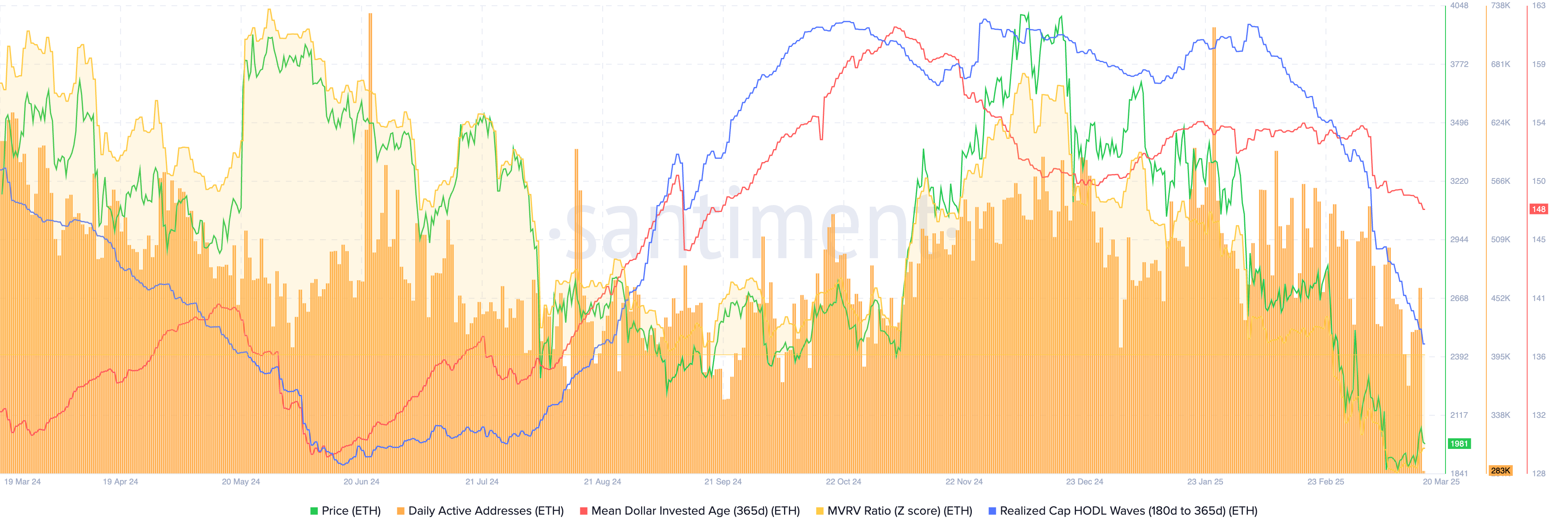

More recordsdata shows that the preference of active addresses on Ethereum has declined in the previous few months. The chart under from Santiment shows that Ethereum had 461,000 active addresses on Wednesday, down from 717,000 earlier this year.

One more essential recordsdata point is Ethereum’s realized cap HODL wave, which is proven in blue. It has crashed to the lowest point since August last year, a signal that long-term holders private began to sell.

The 365-day imply dollar invested age or MDIA, which calculates the duration that every coin has stayed in an address and the general money old to buy it, has dropped to its September lows.

Ethereum tag technical evaluation

The every day chart shows that the ETH tag has been in a grand downward pattern over the previous few months. This drop began after it fashioned a triple-top sample at $4,000, with the neckline at $2,120.

Ether then fashioned a death sinful sample because the 50-day and 200-day bright averages crossed every other. This sinful on the general ends in extra downside momentum. Also, standard oscillators adore the Relative Energy Index and Share Model Oscillator private dropped.

As a result of this truth, the coin will probably continue falling as sellers target the psychological point at $1,500, which is set 25% under the sizzling stage.