Ethereum has skilled a major downtrend since the start of the 365 days, causing the altcoin to fall underneath the $1,500 diploma.

Whereas this latest decline might perchance appear pertaining to to some, many investors scrutinize this as a possibility. The low mark is tempting novel entrants and fueling optimism for a ability restoration.

Ethereum Traders Procure Opportunity

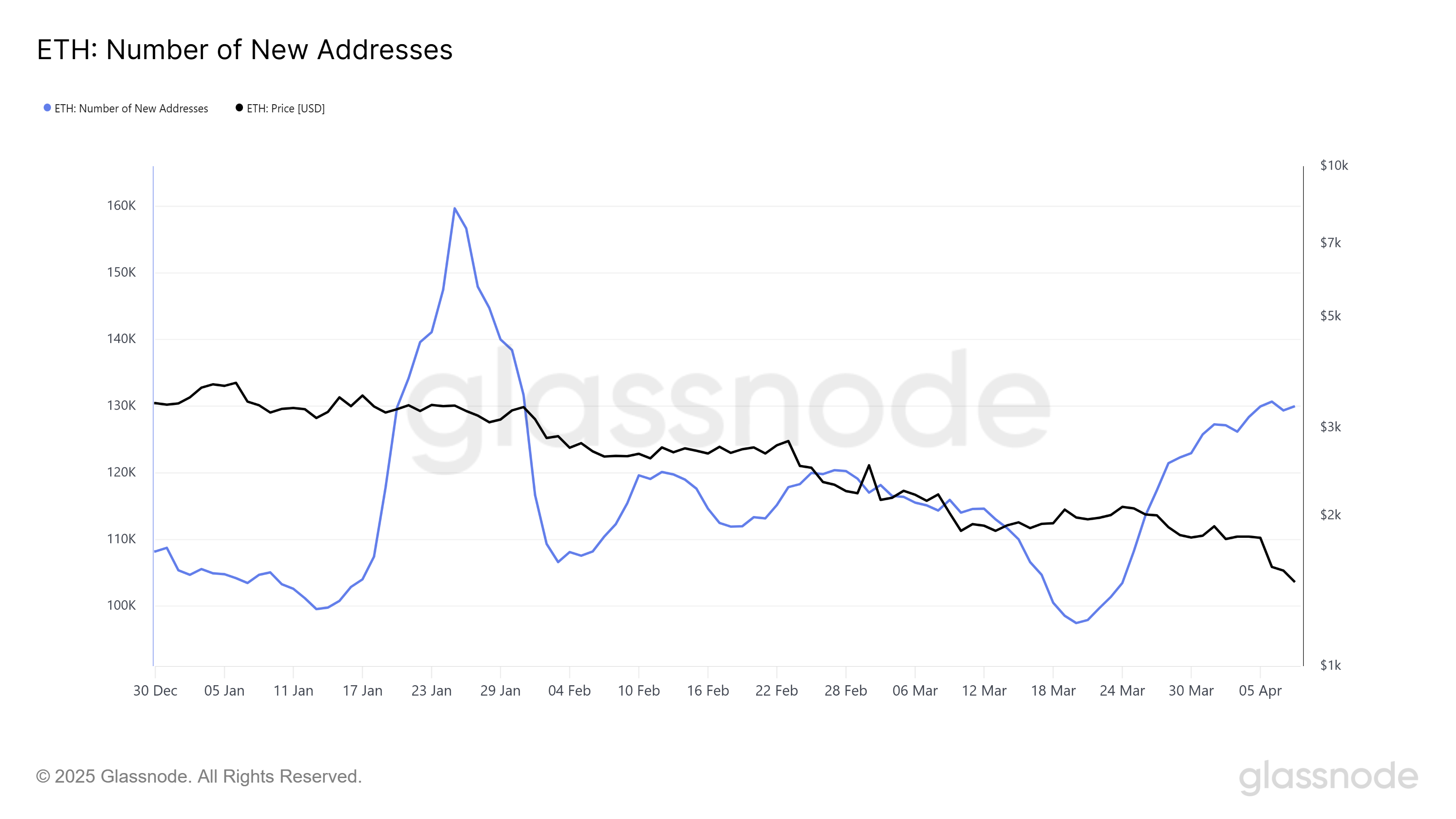

Ethereum’s mark dip underneath $1,500 has resulted in a surge of latest addresses, reaching a two-month excessive. This uptick in novel investors suggests growing self assurance in Ethereum’s future, especially at these lower mark stages. The most modern mark decline has made Ethereum more accessible, that will almost definitely be encouraging fresh investment.

The develop in novel addresses also indicates that investors are positioning themselves for a ability rebound. With costs at this time lower than earlier in the 365 days, some stumble on this as a making an attempt to seek out more than a few.

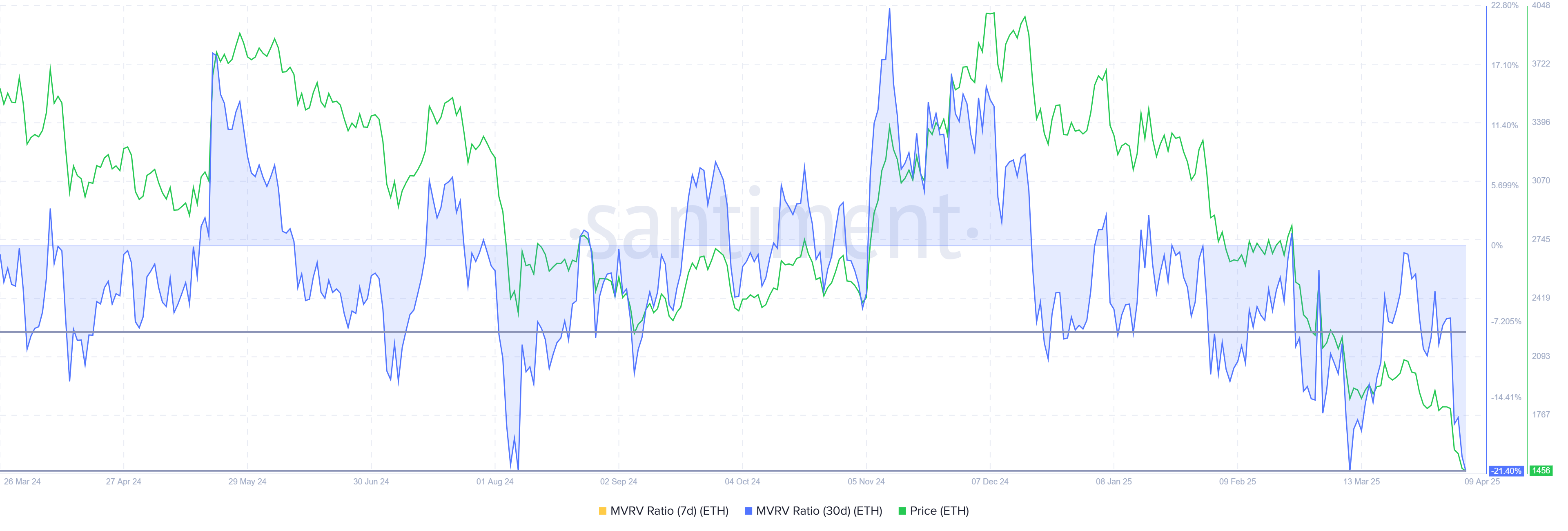

The MVRV Ratio, which measures the market value relative to the realized value, is at this time in the “more than a few zone,” starting from -8% to -21%. This differ indicators that Ethereum is undervalued, as costs enjoy dipped to stages the save investors usually step in. Traditionally, such stipulations enjoy ended in reversals in mark trends.

This low MVRV ratio reinforces the theory that Ethereum is in a high accumulation allotment. When the MVRV Ratio is in this zone, it indicates that investors who bear at some level of this period are likely to seek out definite returns in the slay.

ETH Tag Objectives To Recuperate

Ethereum’s mark has dropped by with regards to 19% over the final forty eight hours, reaching a yearly low of $1,375. As of writing, the altcoin is trading at $1,467. It has lost the major fortify of $1,533, which pushed it underneath $1,500. Despite the losses, Ethereum is probably going to recover, given its resilient historical efficiency and renewed investor pastime.

If Ethereum manages to reclaim the $1,533 fortify diploma, it would pave the arrangement for a restoration against $1,745. A destroy above $1,745 would verify the reversal, ending the 4-month-long downtrend.

On the assorted hand, if the bearish vogue continues, Ethereum might perchance fall extra, testing fortify stages underneath $1,429. Have to peaceable it destroy by $1,375, the bearish thesis would be validated, and the altcoin might perchance skills a prolonged period of decline.