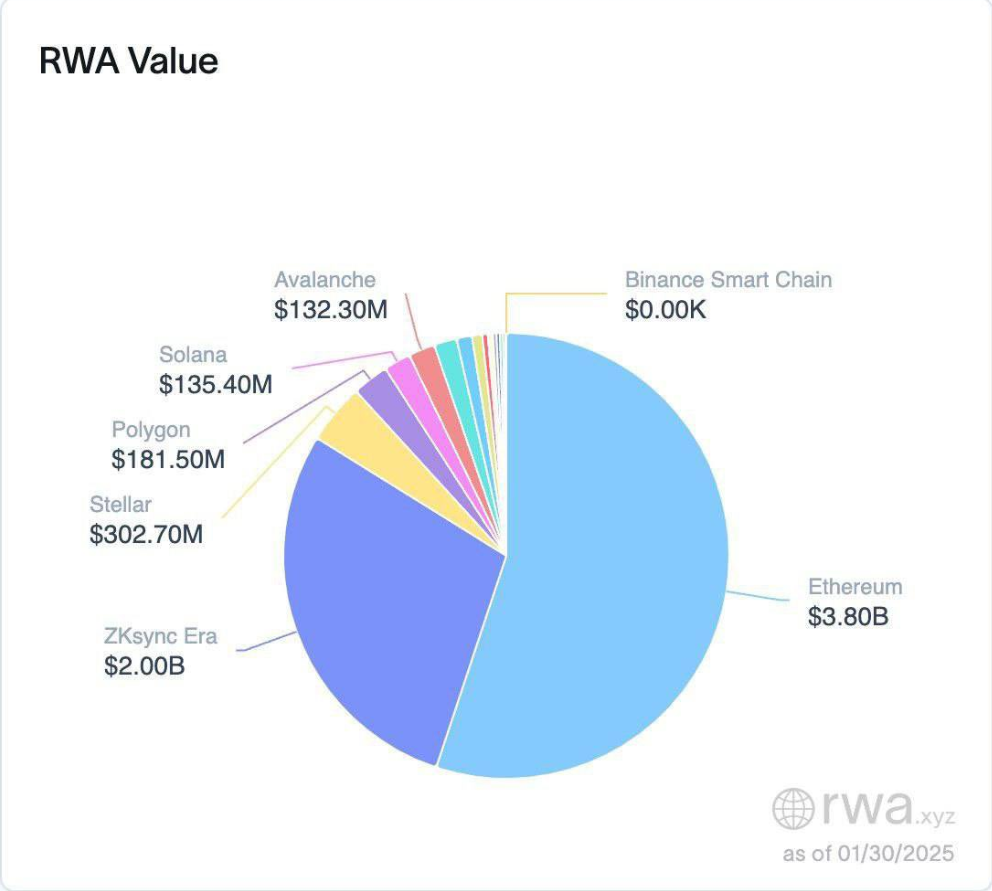

Ethereum continues to dominate the blockchain home, with 86% of all valid-world sources (RWAs) on-chain being held on Ethereum and Ethereum Layer 2 solutions.

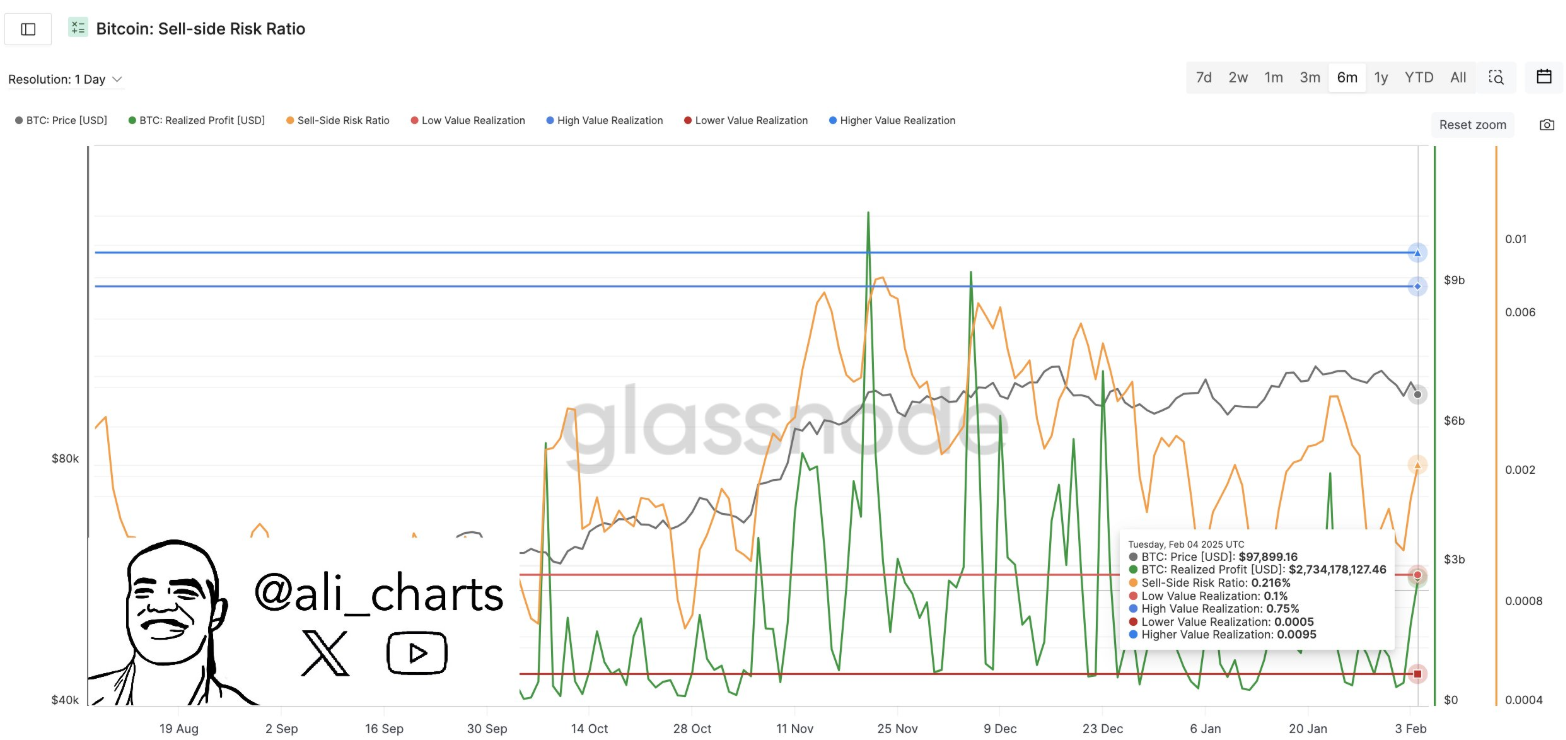

Despite Ethereum’s dominance, Bitcoin and Ethereum are each and each seeing a fixed drift of capital into stablecoins, suggesting cautious market sentiment.

The dearth of unheard of altcoin circulate additional signals that the crypto market is in a consolidation part.

Ethereum Dominates the Loyal-World Asset Market

Loyal-world sources dispensed to the Ethereum mainnet and Layer 2 solutions operate at $3.80 billion whereas dominating rather a lot of the on-chain market.

Ethereum maintains a substantial lead over blockchain platforms Solana and Polygon because it holds $3.80 billion in sources whereas Solana holds $135.4 million and Polygon holds $181.5 million.

Ethereum’s Layer 2 solutions increased its transaction throughput whereas reducing charges, which makes Ethereum the developer’s and investor’s top selection.

Facing its stable decentralized structure, builders decide Ethereum above totally different blockchain selections thanks to its solid progress ecosystem capabilities.

By Optimism and Arbitrum, Ethereum Layer 2 solutions push the boundaries of Ethereum potential by enabling deflationary transactions at reduced costs to increase DeFi progress.

Furthermore, Ethereum retains solidifying its blockchain revolution shriek thru rising RWAs allotment metrics.

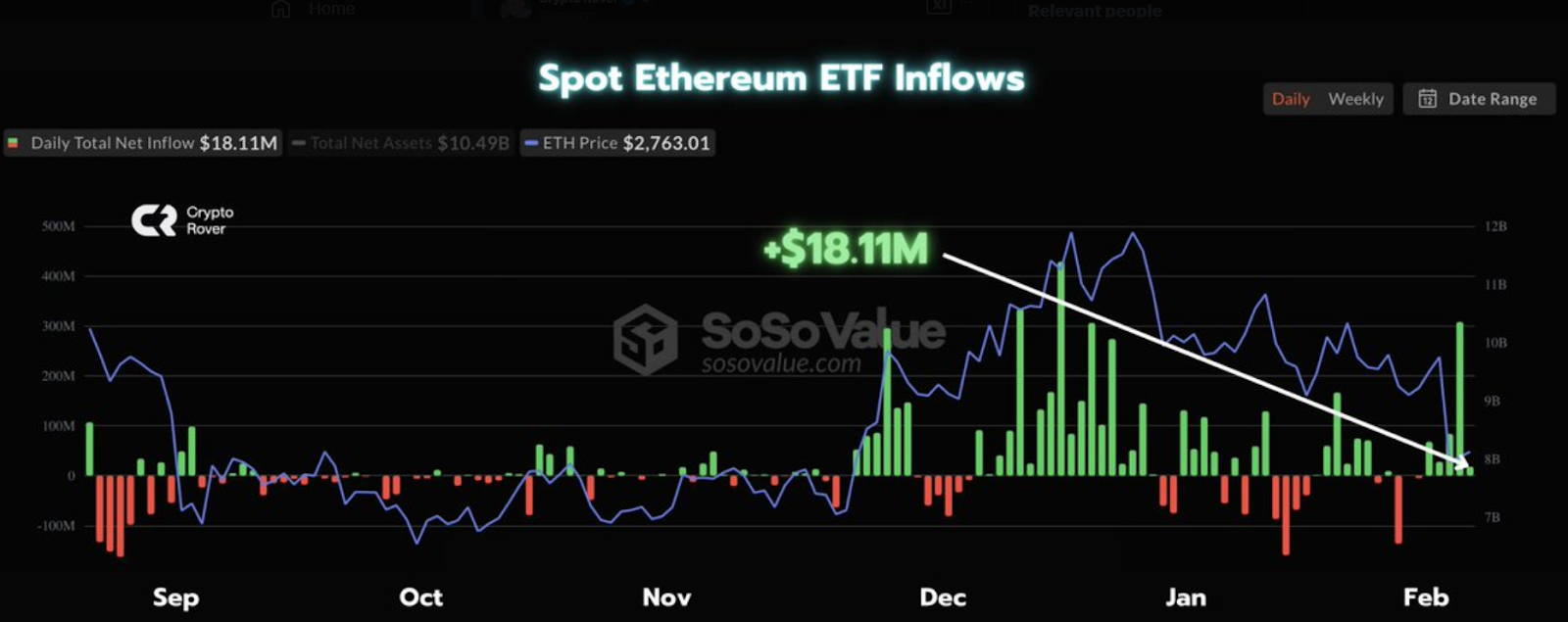

Fresh investments within the Effect Ethereum ETF totaled $18.11 million as Ethereum continues its repute progress.

Records from SoSoValue confirms that investor trust is rising because Ethereum requires approximately $2,763 per unit.

The pretty influx amplify printed thru the inexperienced bar reveals merchants returning to Ethereum investment opportunities.

Ethereum Price Diagnosis: Key Strengthen at $2,500 and Most likely Rebound Targets

Ali Chart analysis of the Ethereum designate indicates $2,500 functions as an very important increase level, that can even fair attach a normal shift in market route.

Ethereum stays shut to its fresh trading vary at $2,500 and would probably rebound upwards if it sustains costs above that resistance stage.

Future market movements will resolve if Ethereum costs can rise between $4,000 and $6,000.

The failure of Ethereum to retain $2,500 increase will space off a downward designate circulate in direction of $1,700 sooner than it’ll verify a brand original pattern.

Bullish sentiment concerning the token requires the $2,500 designate stage to remain intact.

Fresh designate circulate indicates Ethereum follows an on a typical basis upward pattern starting from mid-2023, which ceaselessly exams and exceeds the $2,500 aim.

The cryptocurrency stands to trip additional designate progress in drawing near months per the energy of its increase, which reveals indications of reaching its better channel boundaries.

Bitcoin and Ethereum Inquire of Persisted Capital Outflows into Stablecoins

Furthermore, Bitcoin and Ethereum proceed to face capital outflows to stablecoins.

Fund transfers into stablecoins present a longtime pattern because market avid gamers prefer stablecoin balance as a result of fresh market uncertainty.

Stablecoins have received rising capital since merchants serve a shriek of expecting definitive market indicators.

The Altseason Indicator reveals no signal of an altseason rally, since altcoins remain below Bitcoin and Ethereum market designate.

The marketplace demonstrates an overall conservative near because merchants quiz of decisive signals similar to regulatory breakthroughs or Ethereum and Bitcoin benchmark adjustments to drive market adjustments.

Fresh market circumstances level to anxiousness as merchants either quiz of Bitcoin’s momentum to surge every other time or require a triggering match to initiate altseason.