Ethereum continues to interchange sideways, with minute to no impress motion reflecting an absence of decisive keep a question to or offer. Neither merchants nor sellers are in support watch over, leaving the market stagnant internal effectively-defined ranges and anticipating a catalyst to interrupt the equilibrium.

ETH Technical Prognosis

By Shayan

The Each day Chart

On the day-to-day timeframe, ETH remains confined internal its ascending channel, although momentum has stalled in the greater half of the structure. After failing to lengthen elevated towards the $5K resistance zone, the asset has settled into a narrow consolidation at some level of the $4.2K mid-vary support.

This zone has acted as a maintaining ground, but the absence of fresh seeking to search out stress underscores an absence of bullish conviction. At the identical time, sellers absorb did not mount important downside stress, leaving the market in a ready segment. A decisive switch is doubtless to emerge greatest when fresh reveal spin along with the scamper shifts the steadiness of vitality.

The 4-Hour Chart

The 4-hour chart makes the indecision plot more obvious. ETH is compressed internal a descending wedge, procuring and selling between $4.2K and $4.4K. This tight consolidation reflects the muted hiss of the market, the set each and each offer and keep a question to look exhausted in the rapid time frame.

A breakout from this wedge will dictate the following leg of impress motion. A push above resistance might per chance per chance power momentum towards $4.6K–$4.8K, whereas a breakdown dangers a retest of deeper liquidity pockets round $4K and under. Till the sort of breakout occurs, Ethereum remains trapped, with people anticipating a catalyst to inject fresh orders into the market.

Sentiment Prognosis

By Shayan

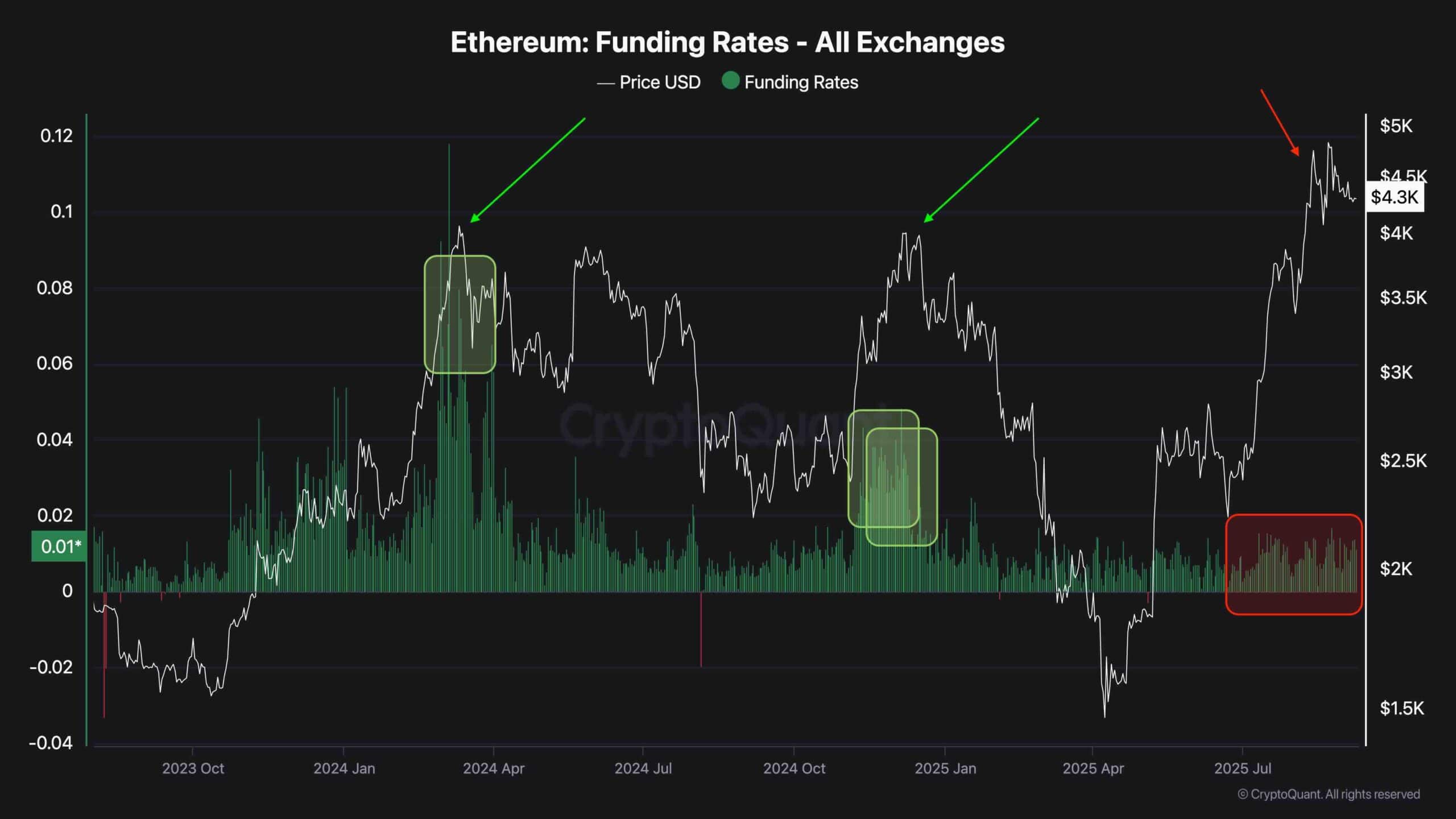

Funding charges at some level of exchanges provide a extraordinarily fundamental context when comparing Ethereum’s last three foremost highs. For the length of the first height in early 2024, funding charges spiked above 0.08, reflecting vulgar long positioning and speculative keep a question to. The asset rapidly topped out as overheated leverage unwound.

At the 2nd height in slack 2024, ETH revisited identical impress stages, but funding charges were very a lot decrease. This signalled diminished speculative participation, showing a less overheated market but peaceable lacking solid, sustained momentum.

Now, on the most modern height in 2025, Ethereum reached a elevated high strategy $4.9K, whereas funding charges remained pretty muted at moderate stages. This divergence highlights a shift: ETH is advancing without the aggressive long positioning that fueled earlier rallies.

The takeaway is twofold. On one hand, the market appears to be like more residing-driven and structurally more fit, as impress isn’t being pushed by vulgar leverage. On the replacement hand, the absence of aggressive keep a question to additionally limits breakout momentum, leaving ETH in a slower-transferring ambiance the set fresh reveal spin along with the scamper will be crucial for continuation.

Briefly, Ethereum’s elevated highs in opposition to declining funding charges counsel a market that is steadier and no more inclined to surprising liquidation cascades, but equally one which requires stronger conviction from merchants to preserve the following leg elevated.