Ethereum has considered a gripping rejection from its local highs, slipping assist correct into a vital strengthen zone. With netflows showing continual outflows and momentum cooling, the market is now testing whether bulls can defend key levels or if deeper retracements are forward.

Technical Prognosis

By Shayan

The Day-to-day Chart

On the day to day chart, ETH did no longer retain above $4,400, breaking below the runt ascending channel fashioned no longer too long in the past. This breakdown has shifted momentum, with designate now hovering spherical $4,200. The RSI will be sitting spherical 40, reflecting an absence of bullish strength but no longer yet an gross oversold condition.

The predominant main strengthen is chanced on come $4,000, adopted by the $3,800 apartment, which lines up with the 100-day shifting moderate and the lower boundary of the elevated channel. If investors defend this level, ETH might per chance originate a elevated low structure, retaining the broader uptrend intact.

For now, ETH’s mid-interval of time vogue remains bullish so long as $3,700 holds, but the momentum shift suggests more downside probing sooner than strength returns.

The 4-Hour Chart

The 4H chart paints a clearer describe of contemporary weak point. ETH broke down from its $4,400–$4,800 consolidation vary and like a flash dropped against $4,100. Momentum is now carefully tilted to the downside, with RSI come 30, showing immediate-interval of time oversold prerequisites. While this can spark a relief bounce, the breakdown has shifted the local vogue bearish till $4,400 is reclaimed.

The following sturdy liquidity cluster sits spherical $3,800, which aligns with both horizontal ask and the ascending trendline. This zone is seemingly where investors will try and step in aggressively. If ETH can retain and rebound from this apartment, the first upside target would be $4,200, adopted by a retest of the key $4,400 level. On the different hand, failing to retain above $3,800 might per chance plug promoting force, dragging the market into an total bearish segment.

Onchain Prognosis

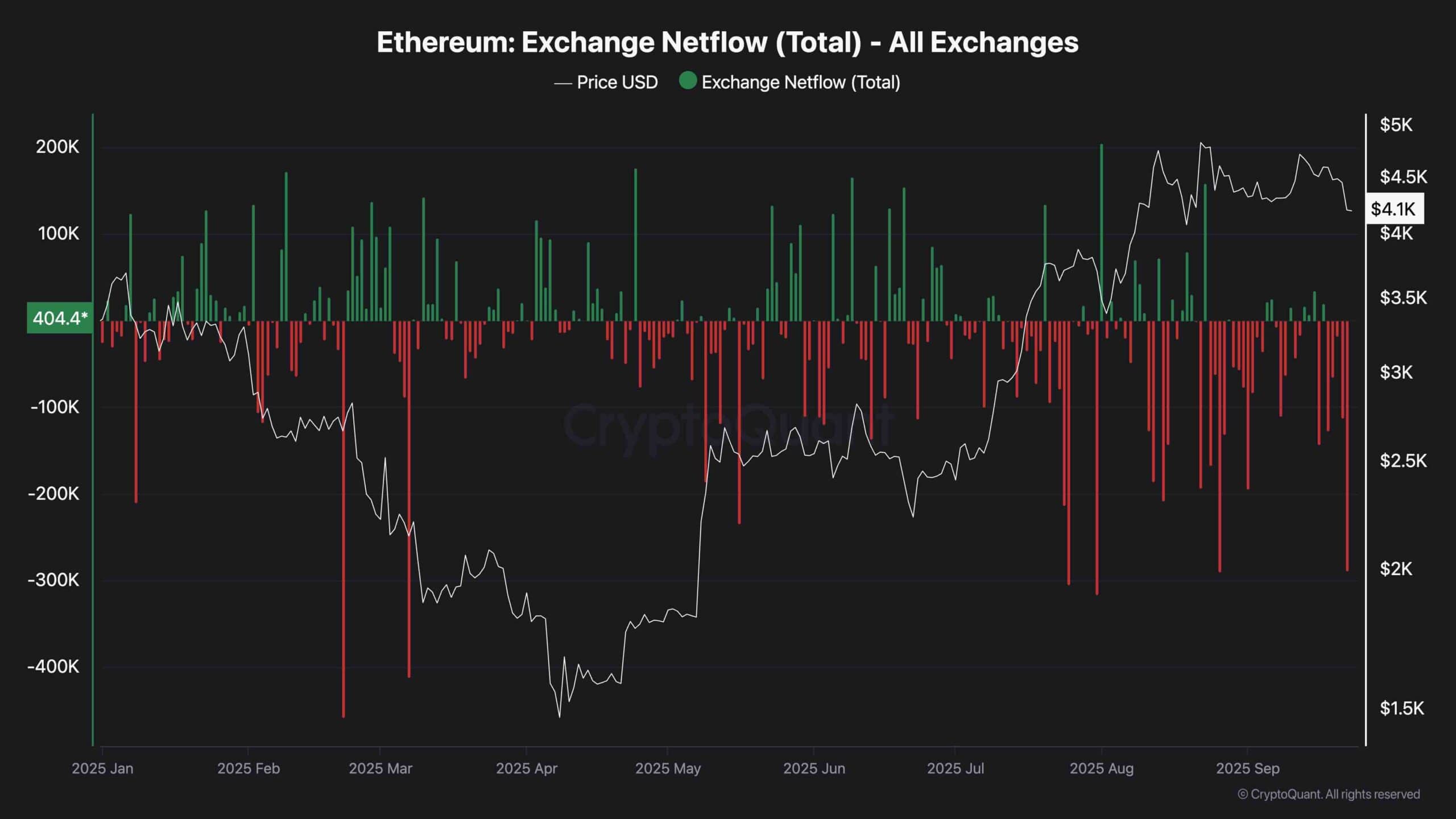

Replace Netflows

Replace netflows proceed to disclose big unfavorable spikes, indicating constant ETH outflows from exchanges. This implies investors are shifting coins into self-custody or staking, which reduces sell-aspect provide and is in general bullish over the medium to long interval of time.

On the opposite hand, in the immediate interval of time, the market is more influenced by technical weak point and profit-taking at contemporary highs. If accumulation continues all over this dip, it might per chance maybe hassle the stage for a tough restoration later, but for now, market sentiment leans against testing lower strengthen levels sooner than a new bullish leg begins.