Ethereum is grappling with a decisive enhance fluctuate between the 100-day MA ($3.2K) and the 200-day MA ($3K), a main location serving because the merchants’ last line of protection.

The tip result at this stage is anticipated to shape Ethereum’s mid-term trajectory.

Technical Diagnosis

By Shayan

The Daily Chart

ETH currently encountered heightened volatility as it approached the various $3.2K-$3K mark fluctuate, reflecting an intense wrestle between merchants and sellers. The price action highlights sellers’ attempts to push the asset below these key inspiring averages, signaling a possible bearish breakdown.

At show, Ethereum is finding transient enhance within this fluctuate, with the price confined between the $3.2K stage and the bullish flag’s upper boundary. A decisive breakout in both route is susceptible to search out out the next most main pattern for Ethereum.

The 4-Hour Chart

On the 4-hour chart, Ethereum consolidated approach the 0.5 ($3.2K) and 0.618 ($3K) Fibonacci retracement ranges forward of temporarily breaking below this main enhance zone. Nevertheless, tough shopping passion rapid drove the asset befriend above the $3.2K designate.

This location remains pivotal as it represents the last most main enhance zone for merchants. A sustained preserve above the $3.2K stage could perhaps most certainly reignite bullish momentum, focusing on a recovery toward increased resistance strains.

Conversely, a breakdown below this fluctuate could perhaps most certainly region off liquidations, doubtlessly utilizing the price toward the $2.5K enhance zone. For now, Ethereum is consolidating approach this main location, with a wrestle between merchants and sellers dictating the market’s next transfer.

Onchain Diagnosis

By Shayan

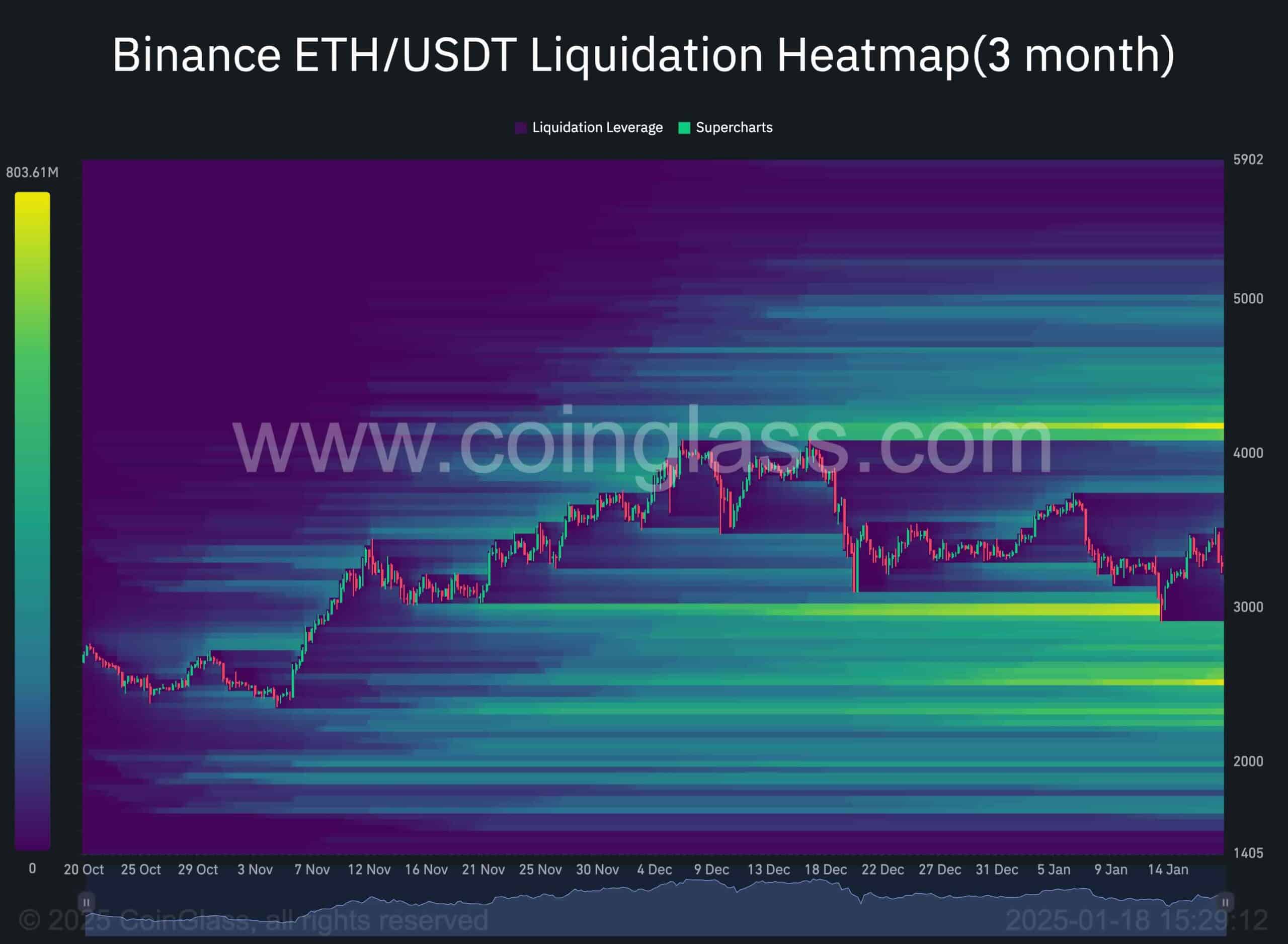

The Binance liquidation heatmap gives insights into key ranges where notable liquidation events are seemingly. Constant with the clustering of liquidation ranges for prolonged and quick positions, these ranges on the total act as magnets, utilizing mark action toward them as market participants purpose to capture liquidity.

All the device by essentially the most smartly-liked shake-off, Ethereum grabbed liquidity on the $3K designate, resulting in a challenging mark recovery. A notable cluster of wrecked ranges collected exists appropriate below the main $3K enhance, representing prolonged-thunder liquidations. This makes the $3K dwelling extremely lovely to bears and institutional sellers, rising the chance of a bearish breakout toward these ranges within the mid-term.

Nevertheless, a serious liquidity pool also rests on the $4K threshold, marking a possible last purpose for merchants. Nevertheless, it’s seemingly that the price could perhaps perhaps merely grab liquidity below $3K first, creating a shakeout phase forward of resuming a bullish trajectory toward $4K. While Ethereum’s most smartly-liked mark action reflects consolidation, the $3K stage remains pivotal. A bearish breakout to capture liquidity below $3K is plausible within the quick-to-mid term.