- Ethereum tag plunged 7%, trading as tiny as $2,327 on Thursday after losing the $2,500 psychological toughen.

- Ethereum bulls file $ninety nine million LONG Liquidation losses, outpacing quick liquidations by 40%.

- With a loss of life corrupt now in play before Trump’s tariffs commencing on March 1, ETH tag dangers extra losses.

Ethereum tag tumbled 17% within the last 48 hours. With undergo merchants direct dominance amid Bybit hack resolution and looming U.S. tariffs, ETH faces extra downside dangers.

Ethereum tumbles 5% after losing serious $2,500 toughen

Ethereum came below intense selling stress this week, because the loss of its $2,500 psychological toughen introduced on a cascade of liquidations.

ETH slid as tiny as $2,327 on Thursday, wiping out latest good points and intensifying bearish sentiment.

This drop follows the resolution of the Bybit hack, wherein attackers—allegedly linked to North Korea’s Lazarus Community—stole over 400,000 ETH.

Before all the pieces, Ethereum held agency above $2,800 because the crypto community debated doable resolutions and their market implications.

Bybit spoke back rapid, absolutely reimbursing customer funds and returning over 100,000 ETH to partner exchanges admire Binance and Bitget, which had supplied emergency liquidity.

On the opposite hand, Ethereum developers firmly rejected a rollback resolution, leaving recovery efforts within the hands of staunch authorities.

Extra dampening investor sentiment, on-chain data printed that parts of the stolen ETH were laundered by plan of Solana-essentially essentially based memecoins.

This raised considerations that a corpulent recovery of the hacked resources would possibly perchance perchance very neatly be complex and drawn out, extra pressuring ETH’s tag.

Macroeconomic headwinds moreover contributed to Ethereum’s downturn. On Monday, U.S. President Donald Trump supplied original tariffs on Canadian and Mexican imports, fueling inflationary fears.

The combo of rising uncertainty surrounding the Bybit hack and a chance-off sentiment driven by U.S. commerce coverage supplied a twin catalyst for Ethereum’s sharp breakdown.

Ethereum Imprint Prognosis | ETHUSDT, Feb 27

After falling from $2,800 on Monday, ETH/USD rapid plummeted by one other 7% on Wednesday after it misplaced the $2,500 toughen, touching $2,225 on Binance.

Zooming out this brings Ethereum’s losses to 17% within the last 48 hours.

At press time on Friday, ETH had opened trading at $2,336, its lowest day after day opening tag in over 150 days—dating lend a hand to October 2024.

With bearish stress persisting, merchants are staring at carefully to explore whether ETH can reclaim misplaced ground or if extra downside awaits.

Short merchants perform larger hand as Ethereum liquidations corrupt $124 million

At press time, Ethereum appears to be like to earn stabilized around $2,300, but market uncertainty stays excessive.

The looming March 1 implementation of U.S. commerce tariffs would possibly perchance perchance advised extra chance-off habits among consumers.

Furthermore, considerations persist over the aptitude impression of the Bybit hack proceeds on market liquidity, because the stolen ETH continues to whisk into by plan of laundering channels.

In derivatives markets, quick merchants are capitalizing on Ethereum’s latest shuffle.

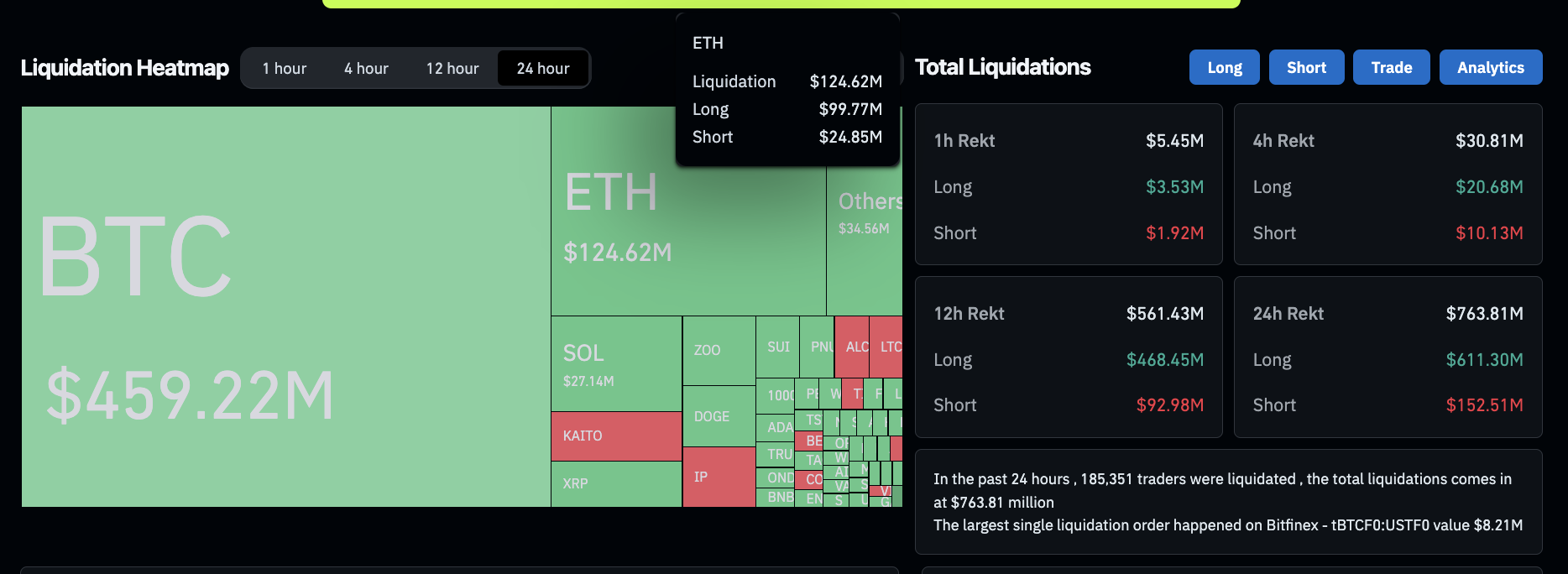

Consistent with Coinglass liquidation data, ETH liquidations surged to $124 million within the previous 24 hours.

Severely, long merchants bore the brunt of the losses, accounting for $ninety nine.77 million in liquidations, while quick positions seen honest correct $24.85 million liquidated.

Crypto market liquidations, Feb 27 2025 | Supply: Coinglass

This type that long liquidations outpaced quick liquidations by almost 75%, indicating that bearish merchants presently earn the larger hand.

The imbalance suggests that many leveraged long positions were caught off guard, main to forced sell-offs that exacerbated ETH’s tag decline.

With bearish sentiment gentle dominating the market, quick merchants would possibly perchance perchance seek for to lengthen their lend a hand within the upcoming days.

If ETH fails to reclaim the $2,500 stamp soon, bears would possibly perchance perchance proceed pressing their lend a hand, searching out for extra downside targets in pursuit of amplified earnings from leveraged quick positions.

Ethereum tag forecast: Bears would possibly perchance perchance target a retest of $2,100

Ethereum tag has extended its downward spiral, presently trading at $2,326 after shedding over 18% within the previous three days.

The chart indicators a bearish continuation, with the formation of a loss of life corrupt—where the 50-day straightforward difficult common (SMA) at $2,933 crosses below the 200-day SMA at $3,264—cementing the broader downtrend.

Traditionally, this crossover amplifies selling stress, aligning with the most contemporary spike in quantity to three.16 million ETH, this capacity that a capitulation segment is underway.

Ethereum tag forecast

The selloff won momentum after Ethereum misplaced toughen at the 100-day SMA, triggering a cascade of long liquidations.

This capacity that, ETH tag is now struggling arrive $2,315, a level that beforehand acted as a pivot in early January.

Failure to reclaim this zone would possibly perchance perchance utter ETH to a retest of the $2,100 psychological threshold.

The Money Waft Index (MFI) at 37.28 indicates that selling stress stays dominant but is now not but in oversold territory, leaving room for additonal downside.

A bullish argument emerges if Ethereum manages a decisive reclaim above $2,400, invalidating the loss of life corrupt’s impression within the quick term.

Given the historical tendency of Ethereum to unsuitable merchants out arrive serious toughen stages, a sharp bounce would possibly perchance perchance ensue if liquidity accumulates arrive $2,300.

On the opposite hand, with out a sustained push previous the 50-day SMA, any rebound dangers being a tiresome cat bounce within the broader bearish framework.