Ethereum’s trace has been in a appreciable downtrend, recently reaching the crucial $1.5K enhance space. Whereas this stage is anticipated to sustain, a breakdown might maybe well maybe position off another cascade towards $1K.

Technical Prognosis

By Shayan

The On a regular foundation Chart

ETH’s stable bearish momentum has temporarily paused at the mandatory $1.5K enhance zone, aligning with a first-rate swing low from November 2024. This space serves as a key psychological enhance stage, seemingly filled with query, making it a attainable pivot point for the fee.

These days, Ethereum experienced an uptick in searching for force, leading to a brief rebound. Nevertheless, with selling force peaceable dominant, another downward transfer to take a look at the $1.5K threshold remains seemingly in the mid-term, rising the risk of heightened volatility. If this enhance fails, a sharp decline towards the $1.1K space would be essentially the most attainable field.

The 4-Hour Chart

Ethereum continues to trend within a successfully-defined bearish trace channel, forming lower highs and lower lows, reinforcing sellers’ management over the market. The fee recently bounced from the channel’s lower boundary, showing a brief bullish reaction.

Given essentially the most up-to-the-minute market structure, Ethereum is at risk of consolidate within this channel, with rising volatility in the mid-term. If a bullish retracement happens, the $1.8K resistance stage would be essentially the most crucial goal in the instant term. Nevertheless, failure to carry out momentum might maybe well maybe lead to extra contrivance back circulation.

Onchain Prognosis

By Shayan

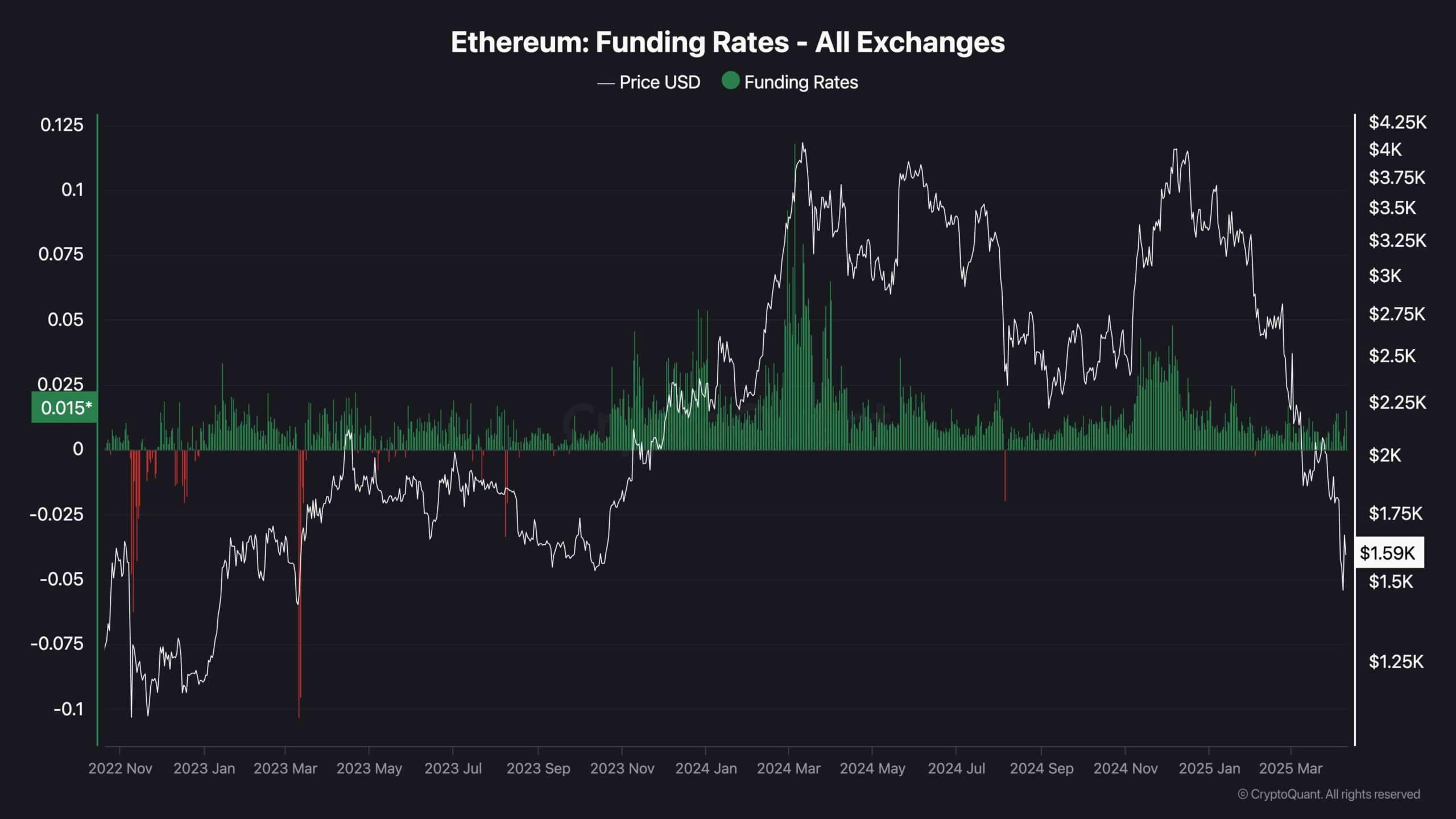

Analyzing the futures market sentiment has constantly supplied priceless insights into trace traits, with funding charges being one amongst essentially the most mandatory metrics. This indicator displays whether patrons or sellers dominate the futures market, offering a explicit look of market positioning.

As confirmed in the chart, funding charges bear been declining precise during the final few weeks, signaling that sellers bear been aggressively opening leveraged instant positions. Nevertheless, a dinky shift has occurred recently, an uptick in searching for process cease to the crucial $1.5K enhance stage has resulted in a rebound in both trace and funding charges.

If this trend persists, Ethereum might maybe well maybe put a stable reversal, focusing on increased trace ranges. Conversely, if selling force regains dominance, the $1.5K enhance might maybe well maybe also break, triggering a deeper decline towards lower ranges. Therefore, the impending weeks will seemingly be pivotal in figuring out Ethereum’s subsequent major transfer.