Ethereum has over but again did no longer reclaim the severe $4K resistance level, leading to a indispensable decline in designate. Then but again, the cryptocurrency has now reached a foremost toughen zone, where a rebound adopted by consolidation is anticipated.

Technical Prognosis

By Shayan

The Day-to-day Chart

Ethereum’s $4K designate space has proven to be a severe resistance zone over the final year, continuously halting bullish advances on account of strong selling force.

Most honest currently, the value faced but every other rejection at this level, triggering a foremost sell-off. This decline modified into extra fueled by Federal Reserve Chairman Jerome Powell’s remarks, suggesting the central financial institution would possibly pause its contemporary protection of lowering key rates of interest.

Regardless of this setback, ETH has found toughen at the $3K level, a a must possess designate zone, leading to a rebound above the $3.5K threshold. Currently, the cryptocurrency is consolidating all the map via the $3.5K–$4K differ, with expectations of a likely bullish try to retest the $4K resistance following this consolidation part.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s rejection at the $4K resistance precipitated a fascinating decline, breaking below the ascending wedge sample—a certain indication of sellers’ dominance. This bearish momentum pushed the value decrease, leading to a pullback sooner than resuming its downtrend.

At contemporary, Ethereum is buying and selling within a foremost toughen zone, outlined by the 0.5 ($3.2K)–0.618 ($3K) Fibonacci retracement levels.

This is expected to give steadiness within the short to mid-time period, with the possibility of continued consolidation and minor retracements. If this toughen holds, customers would possibly additionally honest re-enter the market, atmosphere the stage for but every other try to anxiousness the $4K resistance.

Onchain Prognosis

By Shayan

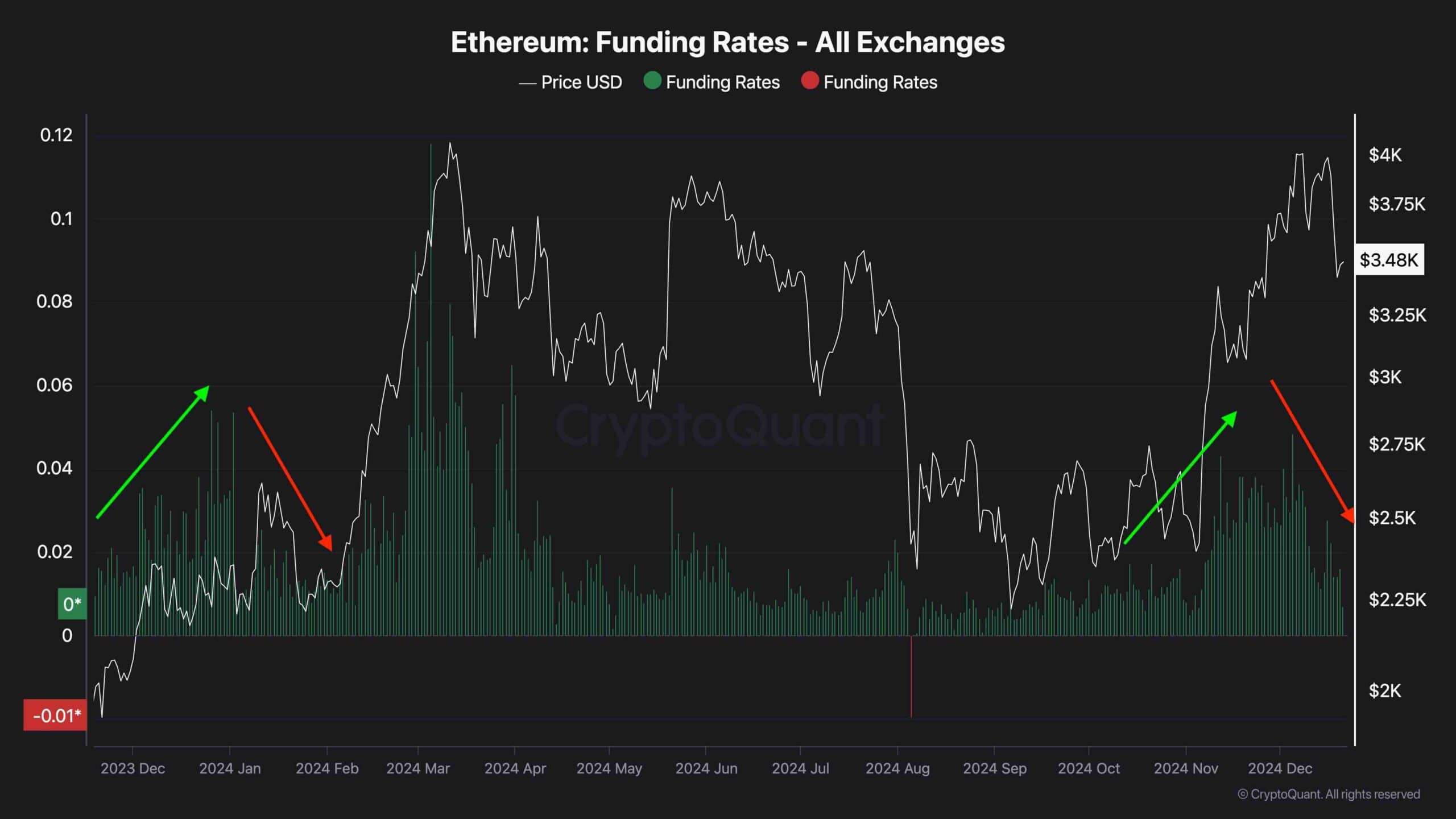

Ethereum’s failure to reclaim the $4K threshold precipitated valuable liquidations within the futures market, adopted by a flash wreck that appears to possess severely cooled the broader sentiment.

The chart illustrates the funding rates metric, a authentic indicator of futures market sentiment. Whereas Ethereum’s combination funding rates saw a fascinating spike closing week, the rejection at $4K resulted in colossal liquidations, bringing funding rates serve to levels conducive to a bullish pattern.

This cooling sort would possibly pave the model for a more sustainable rally within the arrival weeks. A same sample modified into noticed in January 2024 when a fascinating decline in funding rates calmed the futures market, atmosphere the stage for Ethereum’s next foremost impulsive rally. This ancient precedent means that the contemporary market reset would possibly ticket the beginning of but every other bullish part.