Ethereum stays in a downward construction, with mark action exhibiting insufficient bullish momentum for a reversal.

Within the end to term, the cryptocurrency is liable to enter a consolidation part within a crucial range, with light bearish retracements seeming a ways extra likely.

Technical Diagnosis

By Shayan

The Day after day Chart

On the on each day foundation chart, Ethereum has been in a sustained downtrend since getting rejected at its yearly excessive of $4K. The associated fee has repeatedly fashioned lower lows and lower highs, growing a descending channel that shows the overall bearish market sentiment. This sample highlights the pessimism amongst market participants relating to ETH’s broader trajectory.

Now not too prolonged in the past, the value became rejected on the channel’s middle boundary round $2.7K, leading to 1 more bearish retracement.

For the time being, ETH is buying and selling within a key range, supported by the $2K level and capped by the channel’s middle boundary end to the $2.5K resistance. Unless the value breaks out of this range, further consolidation is anticipated.

The 4-Hour Chart

On the 4-hour chart, Ethereum encountered elevated selling rigidity round the resistance zone between the 0.5 ($2.6K) and zero.618 ($2.7K) Fibonacci ranges, resulting in a predominant tumble in direction of $2K. The present mark action signifies that bearish sentiment aloof dominates the market, with sellers likely aiming to push the value under its present yearly low on the $2K level.

ETH is now forming an ascending wedge sample and consolidating end to the lower boundary of this formation. A damage under it ought to also lead to an additional decline in direction of $2K, doubtlessly breaching this enhance.

Nonetheless, if buying for rigidity will enhance in the quick term, Ethereum would possibly possibly per chance stare a bullish rebound, with the value retracing in direction of the 0.5 Fibonacci level at $2.6K.

Onchain Diagnosis

By Shayan

The perpetual futures market plays a predominant operate in shaping the overall mark bolt of the broader crypto market.

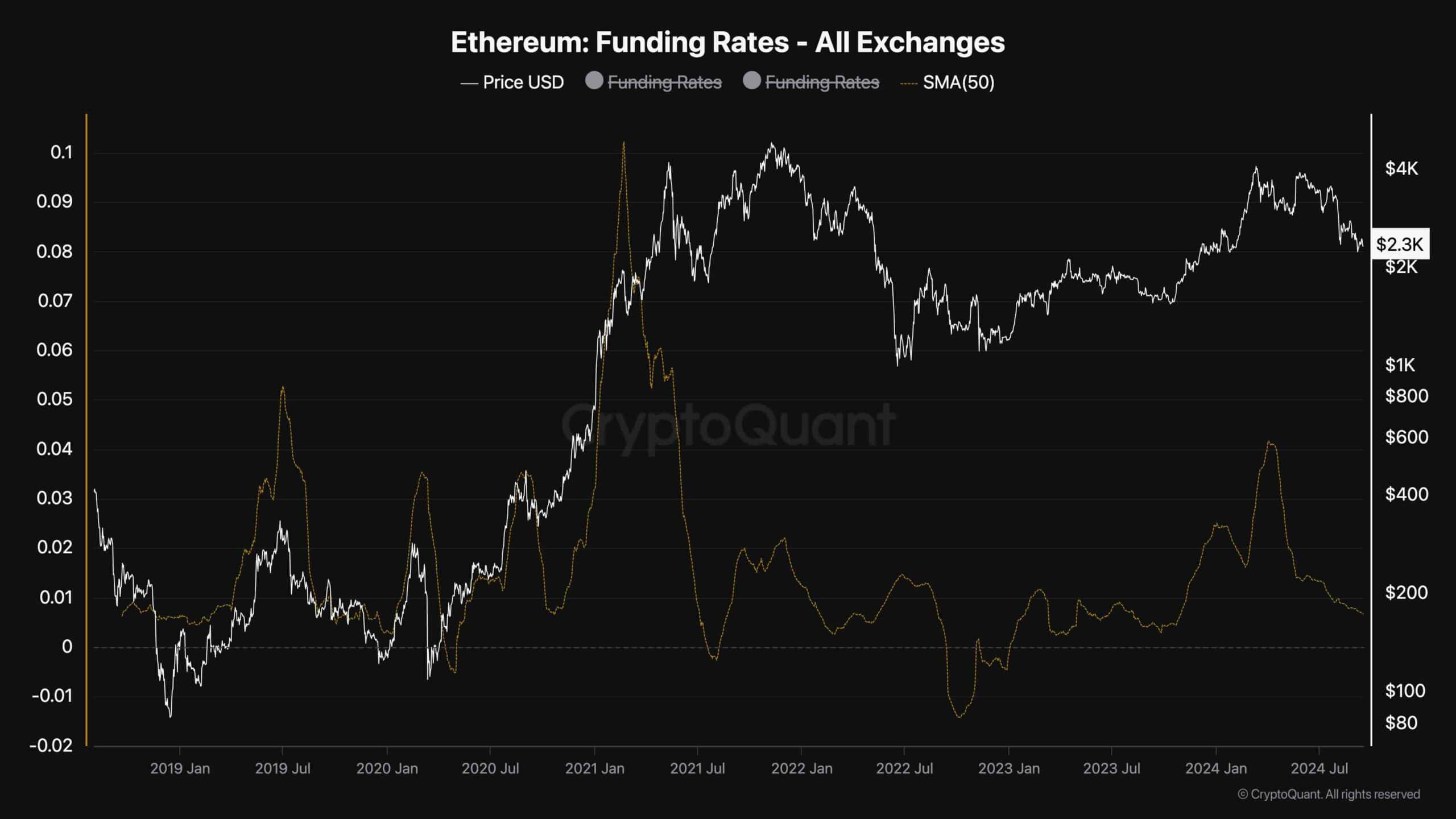

Attributable to this truth, by inspecting the sentiment of futures traders, participants can accomplish precious insights into skill mark traits. This chart reveals the 50-day shifting real looking of Ethereum’s funding charges, providing a broader look of whether investors or sellers are executing orders extra aggressively thru market orders in the futures market.

Now not too prolonged in the past, the 50-day shifting real looking of ETH funding charges has been repeatedly in a downtrend, reaching its lowest ranges in 2024.

This continual decline highlights the prevailing bearish sentiment, signaling a lack of buying passion from traders. For Ethereum to recuperate and reach better mark ranges, anticipate in the perpetual futures market must manufacture better. If the present construction of destructive funding charges continues, it is miles likely that Ethereum will skills further mark declines in the mid-term.

Nonetheless, it’s predominant to point that while destructive funding charges are in overall viewed as bearish, they’ll every so often be an early tag of market recovery. This is because they’ll lead to quick liquidation cascades, which would possibly predicament off mark reversals, nonetheless this is extremely dependent on whether there would possibly be sufficient space buying for rigidity to enhance a rebound. Without stronger anticipate from space investors, Ethereum’s mark would possibly possibly per chance dwell under rigidity.