Ethereum has been going through well-known resistance on the $2.8K stage, which marks the lower boundary of a multi-month wedge pattern.

The pricetag plod means that it could in reality per chance per chance be finishing a pullback, doubtlessly utilizing the pricetag down in direction of the $2.1K threshold.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum has been grappling with the multi-month wedge’s lower boundary at $2.8K for loads of weeks, suggesting a that you should per chance per chance also imagine pullback completion.

After retracing in direction of this key resistance stage, the pricetag has entered a interval of minute consolidation, reflecting insufficient market put a query to. The low-volatility plod conclude to this resistance means that the pullback will probably be nearing its cessation.

Given the well-known present force around the $2.8K price, a rejection could per chance per chance result in a decline in direction of the serious $2.1K assist effect.

Additionally, the 100-day spirited reasonable is forthcoming a crossover below the 200-day spirited reasonable at $3.2K, doubtlessly forming a “loss of life execrable.” This pattern on the total indicators a bearish market outlook, extra supporting the expectation of rejection at $2.8K and a subsequent price fall.

The 4-Hour Chart

On the 4-hour chart, Ethereum has entered a crucial fluctuate between the 0.5 ($2.6K) and zero.618 ($2.7K) Fibonacci ranges after consolidating conclude to the $2.8K resistance.

The pricetag is going through strong selling force, struggling to ruin through this serious resistance with minute bullish momentum.

For the time being, ETH is sorting out the lower boundary of the wedge pattern. If selling force intensifies and the pricetag breaks below this boundary, it could in reality per chance per chance verify the continuation of the bearish vogue, focusing on the $2.1K assist stage.

Shut monitoring of the pricetag plod in the impending days will probably be well-known, because the skill for a deeper correction stays high.

Onchain Evaluation

By Shayan

Inspecting futures market metrics for Ethereum provides priceless insights that complement veteran price diagnosis.

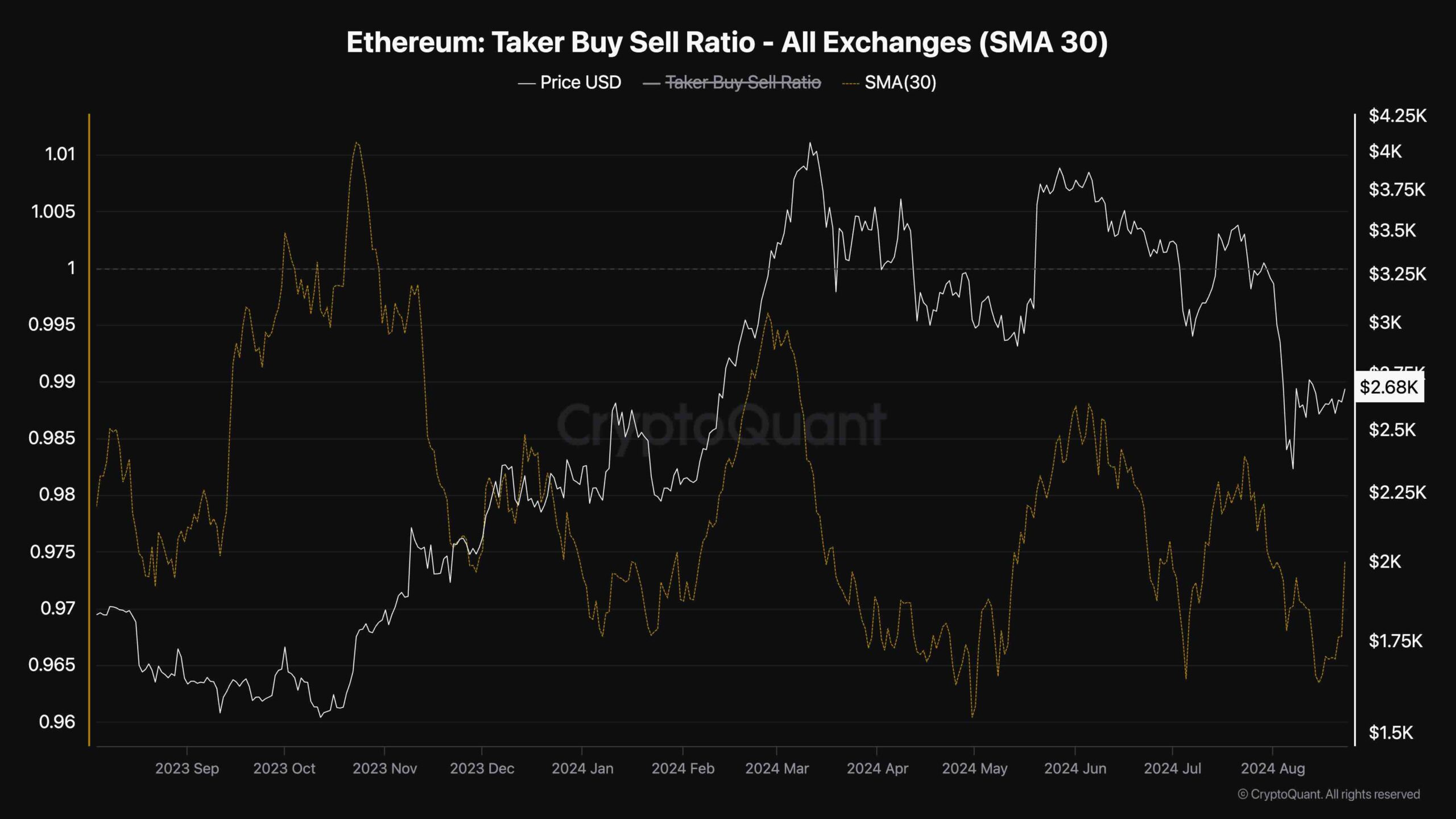

This chart highlights the Taker Aquire Sell Ratio, one in all a in point of fact great futures market indicators. It measures the aggregate aggressiveness of traders versus sellers in executing orders.

No longer too lengthy ago, the Taker Aquire Sell Ratio plummeted to its lowest stage in months, signaling wide selling force in the market. However, the metric has since begun to accept higher, exhibiting a minute uptick.

This implies that traders are attempting to push Ethereum’s price above the serious $2.8K resistance stage. If this upward vogue in the ratio continues, basically the latest retracement fragment could per chance per chance also extend in the speedy term.