Ethereum’s sign has been on a huge decline no longer too long within the past and has yet to reverse. If issues remain the identical, much decrease costs could presumably be anticipated.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Day to day Chart

On the daily chart, the price has been making decrease highs and lows since getting rejected by the $4,000 resistance degree twice in December.

At demonstrate, ETH is trading below the 200-day intriguing sensible, situated all the arrangement in which by the $3,000 label, and is making an are trying to destroy befriend above $2,700. If the market is able to compose so, a bullish reversal will turn out to be doable. In case of failure, a fall toward the $2,350 purple meat up zone could presumably be forthcoming.

The 4-Hour Chart

the 4-hour chart, the price has been consolidating all the arrangement in which by the last couple of weeks. Whereas the market is making an are trying out the $2,700 degree on the 2d, the RSI is on the verge of losing below 50%.

This signal would show a bearish shift in momentum and could also result in one more push decrease toward the $2,000 zone within the upcoming weeks.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Funding Charges

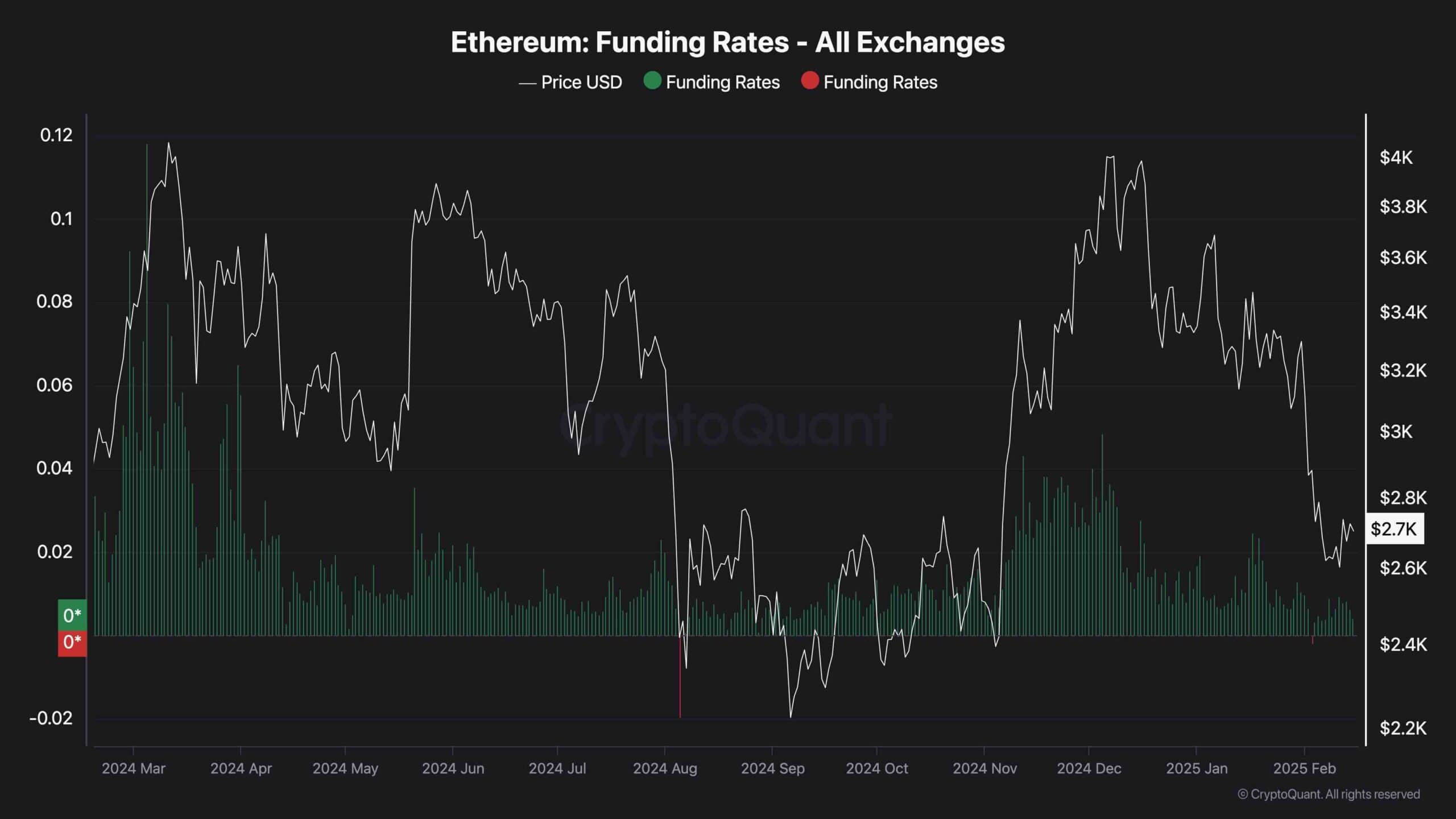

The futures market has been very influential on the Ethereum sign action all the arrangement in which by the previous few years. The funding rates metric is one of many largest indicators of its sentiment, exhibiting whether the investors or sellers are executing their orders extra aggressively.

As the chart suggests, the funding rates were lowering persistently amid the most contemporary fall in sign. This implies that the futures market is now not any longer overheated, and with ample impart interrogate, the market will likely recover.