The cryptocurrency market has viewed a solid uptrend following President Trump’s election, with Ethereum experiencing a important surge as patrons draw shut support an eye on.

On the different hand, the market now looks ready for a correction phase to allow consolidation before extra beneficial properties.

Technical Diagnosis

By Shayan

The Each day Chart

The influx of most up-to-the-minute individuals and investors on the on daily basis chart has resulted in an impulsive uptrend, driving Ethereum’s rate above the 100-day and 200-day inspiring averages. This momentum resulted in a decisive atomize above both the 200-day MA at $2.9K and the psychological $3K resistance level, a clear indicator of a bullish shift as the market flushes out short positions.

On the different hand, Ethereum is now drawing arrive basically the most important resistance location around $3.6K, a level with important provide and probably earnings-taking. Given the energy of this resistance, there’s a excessive likelihood of a transient corrective phase to ease buying for strain, probably pulling help in direction of the 200-day MA to set a extra sustainable uptrend.

The 4-Hour Chart

The 4-hour chart unearths the intensity of basically the most up-to-the-minute surge, which began at the bearish flag’s decrease boundary shut to $2.4K. The influx of buying strain resulted in a breakout above the flag’s higher boundary, pushing Ethereum past the serious $3K impress and invalidating the old bearish continuation pattern.

This surge reveals a clear shift in market sentiment, but because of the the impulsive nature of the rally, a consolidation phase is anticipated. A pullback in direction of the flag’s higher boundary and the $3K beef up level would allow the market to stabilize, giving individuals a probability to lock in profits and provide entry gains for impress recent patrons.

The recent technical setup suggests that Ethereum would perhaps well even quit its bullish momentum within the short time duration. A correction in direction of $3K would beef up a extra wholesome continuation of the uptrend, giving the market time to recalibrate before attempting to interrupt higher.

Onchain Diagnosis

By Shayan

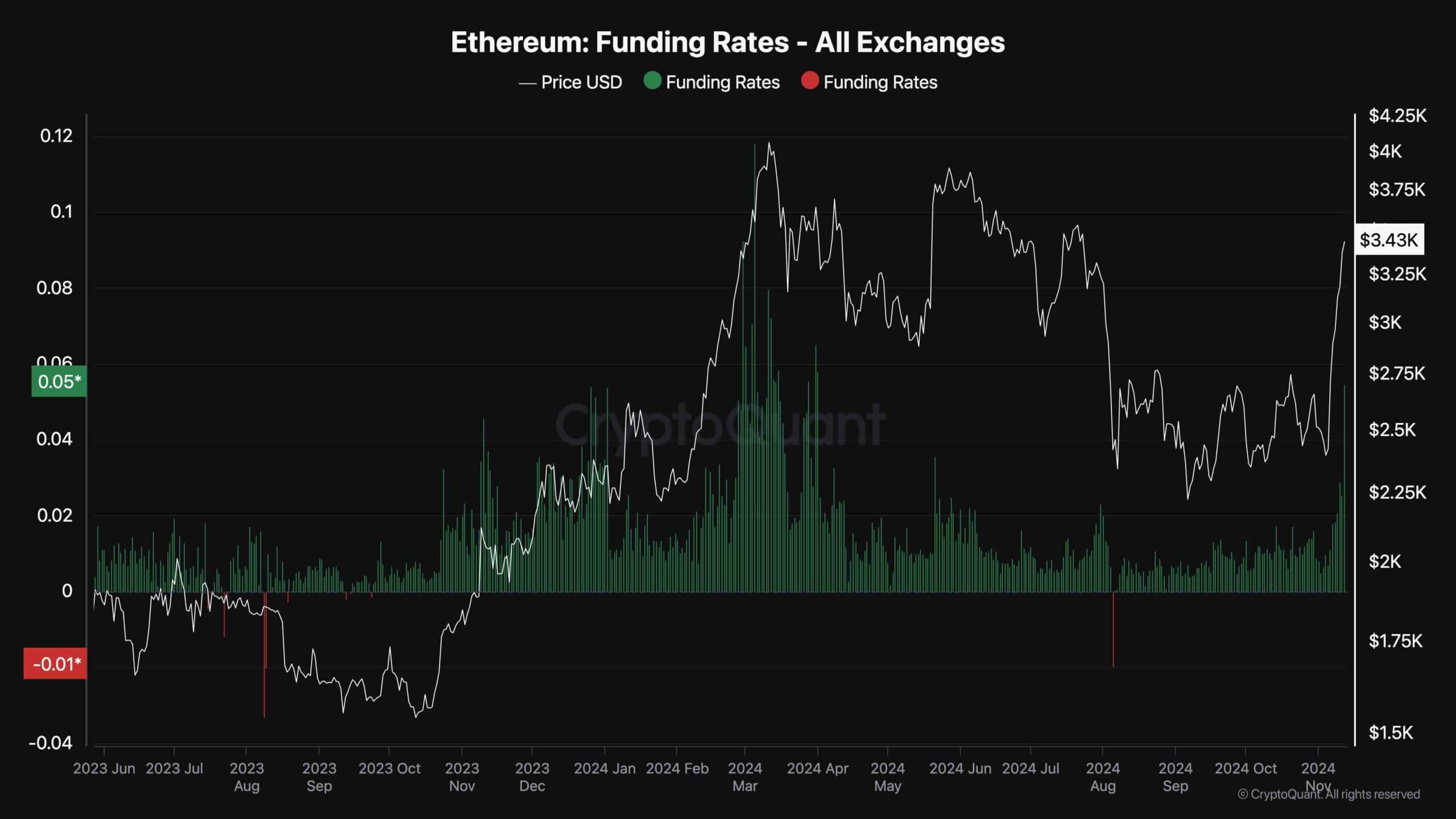

Ethereum’s most up-to-the-minute surge to a recent yearly excessive has renewed optimism among market individuals, with hopes that a recent rally in direction of an all-time excessive will probably be underway. On the different hand, examining futures market sentiment can provide wanted insights into probably transient fluctuations.

Analyzing the funding rates for ETH futures, it is also observed that the metric has remained particular in most up-to-the-minute weeks, signaling a bullish sentiment available within the market. This optimism spiked sharply when Ethereum crossed the $3K threshold, a pattern such as the rally in March 2024 that also resulted in an ATH.

Even despite the indisputable reality that particular funding rates in general signify wholesome put a question to in a bullish market, elevated funding rates in general is a red flag. They level to an overheated futures market, which will develop stipulations ripe for long liquidation cascades if the rate encounters resistance or experiences a pullback.

Within the recent market climate, with funding rates at heightened ranges, the threat of increased volatility and probably corrections rises. An overheated market would perhaps well even result in fleet sell-offs, especially if liquidations are triggered by earnings-taking or minor corrections. Subsequently, investors must always light prepare threat carefully, awaiting transient fluctuations and preparing for probably volatility.