Ethereum’s designate has been step by step declining after the rejection from the $4,000 resistance stage.

But, issues may lastly switch rapidly as the asset bounced off the $3,000 toughen.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day after day Chart

On the day to day chart, the asset has been making decrease highs and lows over the past few weeks after getting rejected from the $4,000 resistance zone. The $3,500 stage has moreover been misplaced, as the market has corrected the total means again to $3,000 and the 200-day transferring real looking, located round the equivalent designate keep.

But, this stage has supported the finest altcoin, pushing it again bigger to retest the $3,500 stage. If the market can smash above this arena, a rally toward the $4,000 resistance zone may be expected.

The 4-Hour Chart

Taking a study the 4-hour timeframe, ETH has been forming a descending channel over the past few weeks. With the market already rebounding twice from the decrease trendline, the rate is now sure to check the bigger boundary of the sample.

With the RSI moreover exhibiting values above 50%, the momentum is in desire of a bullish continuation above the sample and doubtlessly toward the $4,000 arena.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

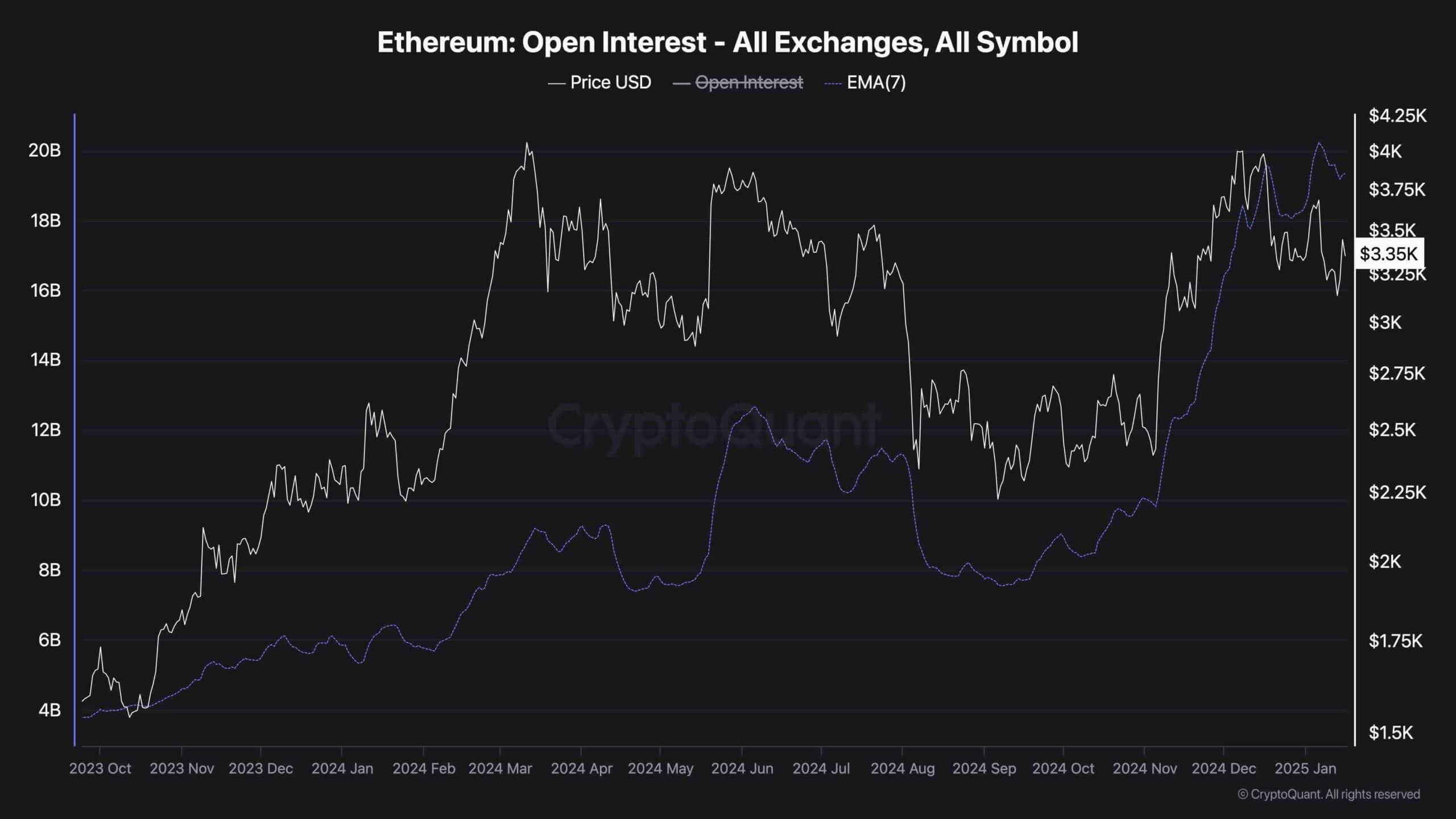

Ethereum Begin Hobby

Ethereum’s designate has been going by means of a correction over the final month, and traders are wondering whether or not a sustainable rally will rapidly come or whether or not more volatility and uncertainty may be expected.

This chart items the starting up curiosity metric, which measures the option of starting up futures contracts across all exchanges. Better values are most ceaselessly associated with more volatility as the chance of snappily liquidation cascades will improve.

The chart demonstrates that the starting up curiosity metric has been rising consistently over the most modern weeks. This implies that more liquidations may mute be expected, and the volatility has but to diminish.