Ethereum collapses 32% in per week, with an 18% drop in the final 24 hours alone, because the crypto market as a whole records its largest dip this One year.

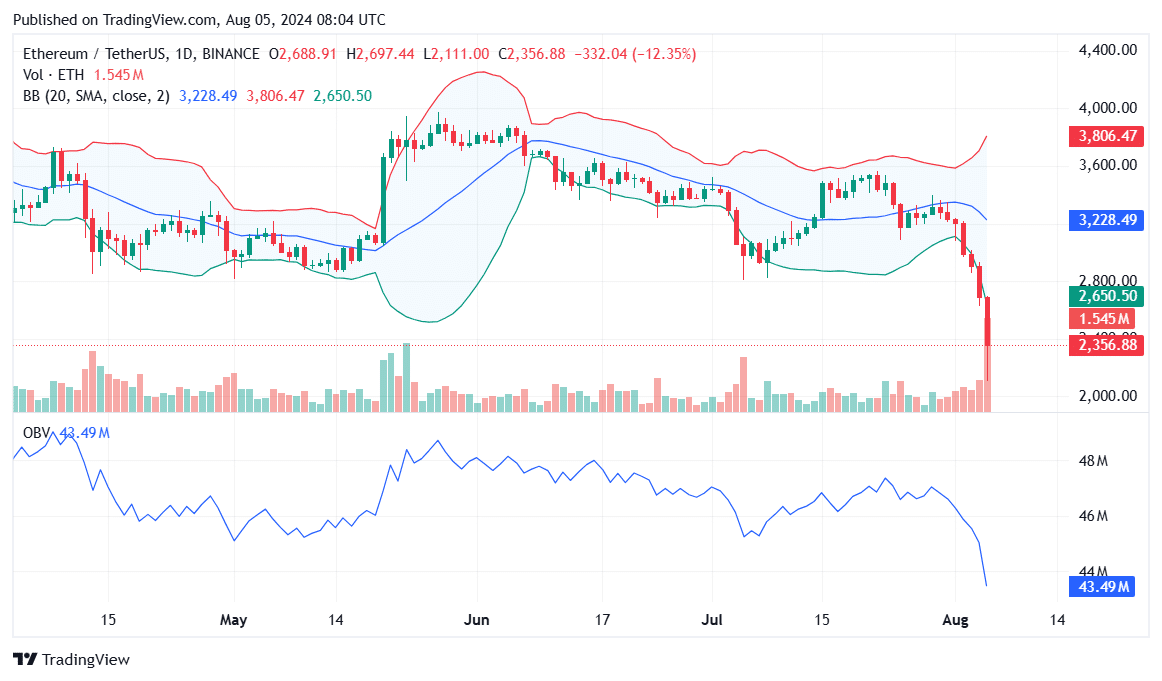

The Ethereum (ETH) set action on the daily chart displays a dramatic decline with the present set at $2,350 down by 12.35% for the day. This drop has pushed Ethereum below the decrease Bollinger Band, for the time being at $2,650, a key index for indicating that the asset could well perhaps perhaps furthermore very properly be oversold.

The Bollinger Bands designate heightened volatility, with the bands expanding vastly. Ethereum’s area below the decrease band every so regularly suggests the asset is oversold and would be due for a leap wait on, indicating bearish stress if the payment would now not recuperate soon.

ETH’s On-Balance Volume (OBV) confirms this bearish sentiment. The OBV for the time being stands at 43.49 million, having declined sharply in tandem with the payment drop, suggesting that promote stress is substantion.

As extra volume is associated with downward set movements, if ETH’s OBV continues to decrease, this will seemingly designate power selling and attainable for additonal declines in Ethereum’s set.

ETH weekly chart at serious situation

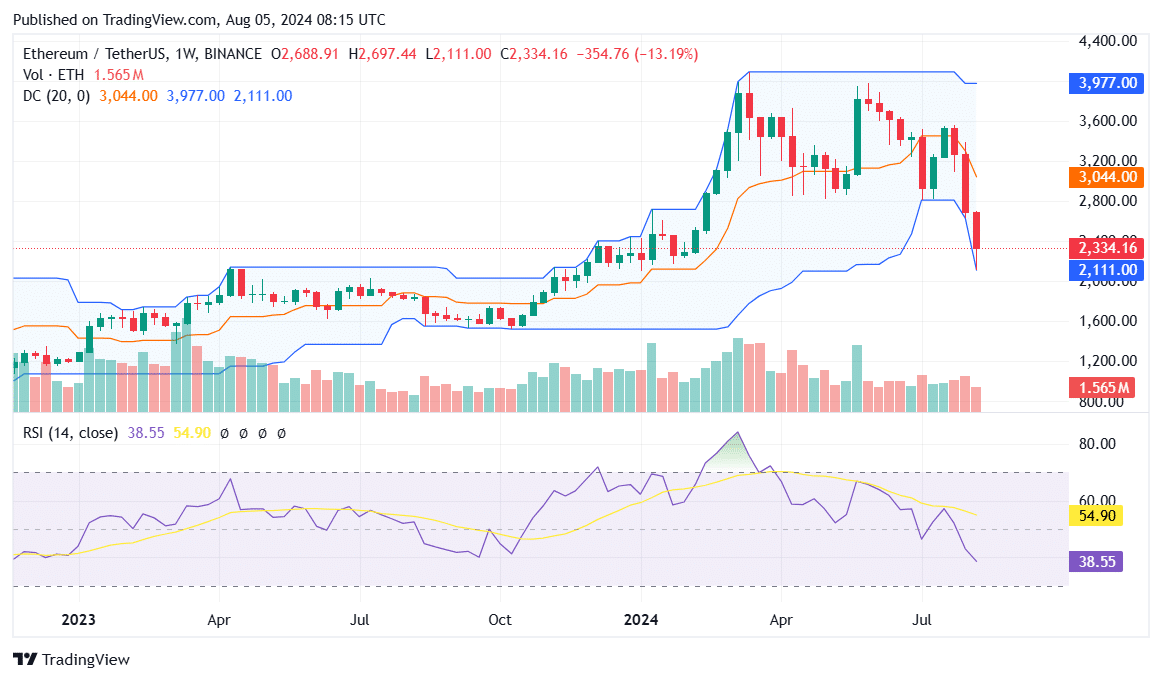

The weekly chart displays Ethereum’s scheme back would now not gape primary better. The value has broken below the decrease Donchian Channel, which is at $2,111. Presently, the upper and middle Donchian Channels are at $3,977 and $3,044, respectively.

This breach of the decrease channel indicates a formidable bearish pattern, because it displays the payment has reached fresh lows now not viewed in the previous 20 procuring and selling intervals. A weekly shut below this stage could well perhaps perhaps furthermore signal extra scheme back threat.

Furthermore, the Relative Strength Index (RSI) on the weekly chart for the time being stands at 38.55, down from a recent excessive of 54.90. If the RSI drops extra below 30, it could perhaps actually well perhaps well verify an oversold situation, doubtlessly ensuing in a short-timeframe leap at or above the $2,800 label.

Nonetheless, the present pattern displays weakening momentum, and unless there could be a formidable reversal, ETH’s downward stress could well perhaps perhaps furthermore persist.

What subsequent for Ethereum?

Taking a look ahead, Ethereum’s instantaneous future largely is dependent on its skill to reclaim key enhance ranges. On the daily chart, a recovery above the decrease Bollinger Band at $2,650 could well perhaps perhaps furthermore stabilize the payment.

Meanwhile, on the weekly chart, a circulation wait on within the Donchian Channels, in particular above the center band at $3,044, would be a obvious signal.

Nonetheless, if the present bearish momentum continues, we could well perhaps perhaps furthermore query Ethereum checking out decrease enhance ranges around $2,000, with a probability of additional declines if broader market stipulations remain unhealthy.

Analyst Benjamin Cowen argued that Ethereum could well perhaps perhaps furthermore stabilize around its present ranges in the short timeframe before doubtlessly experiencing one other leg down, in particular if macroeconomic stipulations, corresponding to rate cuts, play out similarly to previous market cycles.

#ETH is wait on all the scheme in which down to this pattern line

If it follows 2019, this will seemingly well perhaps perhaps furthermore wait on these ranges for about a weeks, after which destroy down over again after the Fed cuts rates

No ensures, just following essentially the most helpful analog that has been one of the best possible files thus a ways this One year.

Frequently helpful to hedge pic.twitter.com/jsSTce8lOl

— Benjamin Cowen (@intocryptoverse) August 5, 2024

Also, market former Peter Brandt means that Ethereum is shut to hitting its ground. With a rectangle pattern ranging from $4,500 to $2,814, the analyst calculates the scheme back bottom to be around $2,000, suggesting that this purpose is practically fulfilled.

The scheme back purpose from the rectangle high has practically already been met. But pointless to negate, each person knows charting would now not work. $ETH pic.twitter.com/oQONPEGaBS

— Peter Brandt (@PeterLBrandt) August 5, 2024