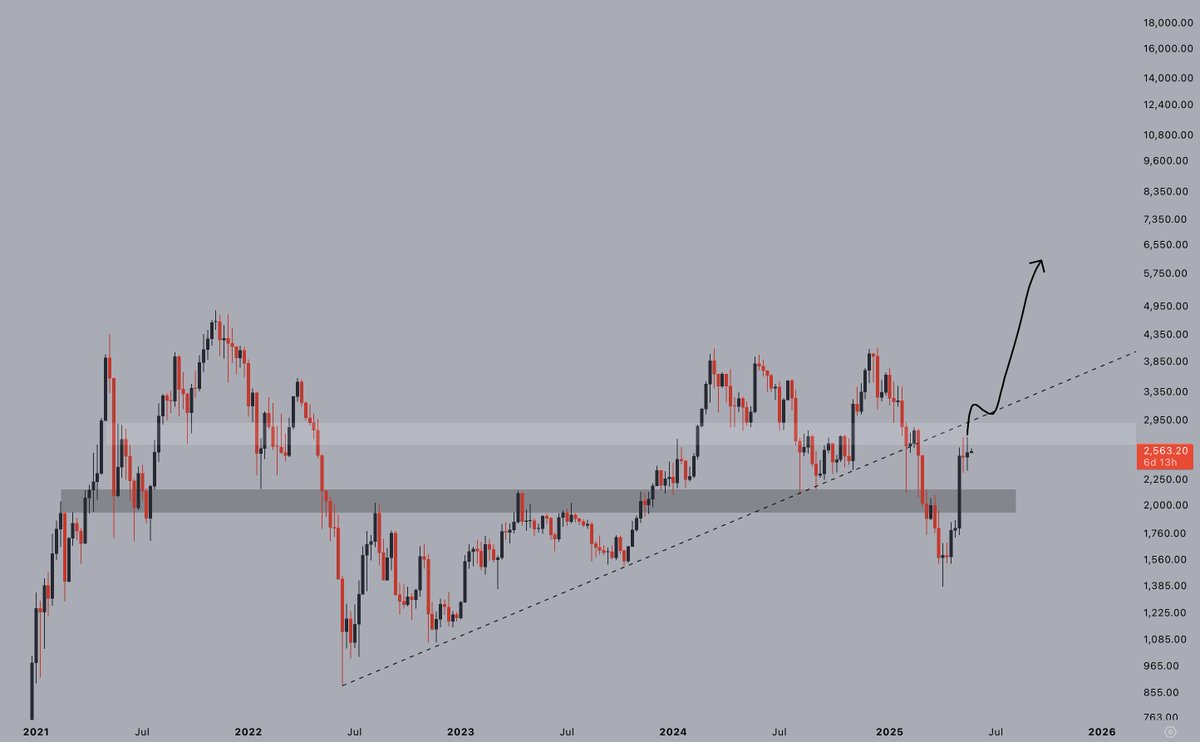

Ethereum is procuring and selling above $2,600 after a unstable stretch that seen bulls obtain momentum and push the worth correct into a key resistance zone. The contemporary rebound has introduced renewed optimism to the market, with ETH now flirting with a probably bullish continuation. Aloof, the path forward stays dangerous, as analysts warn of a that it is probably you’ll maybe maybe deem retracement earlier than any fundamental breakout can take shape.

Over the final few days, ETH has proven strength, bouncing off native increase and reclaiming temporary transferring averages. This switch has shifted sentiment, but it undoubtedly hasn’t been adequate to fully flee the risk of a transient pullback. Some market watchers argue that a healthy retrace from contemporary levels would be long-established earlier than any sustainable rally above resistance.

Top analyst Jelle added to the dialog with a easy but compelling perception: “If ETH goes advantage above $3,000, the right fun begins.” The $3,000 level has acted as a psychological and technical barrier at some level of this cycle, and reclaiming it may well maybe maybe maybe seemingly ignite broader market momentum.

Ethereum Leads Altcoins As $3,000 Becomes The Key Battleground

Ethereum is exhibiting well-known strength amongst altcoins, leading the market with renewed momentum as bulls continue to push for a brand new bullish segment. After reclaiming the $2,600 level, ETH has been progressively constructing increase and gaining traction, atmosphere the stage for what many analysts deem is seemingly the starting of a broader altcoin resurgence.

On the other hand, for a reputable altseason to materialize, Ethereum must first reclaim and keep above the $3,000 level. This threshold is more than good a psychological milestone—it has traditionally acted as a pivot for stable market-huge rallies. Many experts agree that ETH wants to spoil thru this resistance to substantiate leadership and spark confidence all the perfect scheme thru the altcoin sector.

Hope stays excessive, in particular amongst analysts who see Ethereum following Bitcoin’s lead. As BTC continues to check its all-time highs, some deem that after its contemporary bullish impulse cools off, capital will rotate into ETH and other huge-cap altcoins. This rotation may well maybe maybe back as the ignition level for a market-huge rally.

Jelle supports this glimpse, declaring that if Ethereum reclaims $3,000, a bullish impulse will happen. Essentially essentially based on his evaluation, a confirmed breakout above this level would brand the launch of a highly effective continuation segment, seemingly sending ETH rapidly toward $3,400 and past.

Till then, Ethereum stays in an predominant express—stable adequate to lead, but nonetheless facing key resistance. If bulls defend momentum and reclaim $3,000 with conviction, the stage will seemingly be field no longer most intriguing for Ethereum’s subsequent leg up but for a full-scale altseason all the perfect scheme thru the market. The upcoming days may well maybe maybe picture decisive.

ETH Consolidates Below 200-Day SMA

Ethereum (ETH) is currently procuring and selling at $2,634 on the everyday chart, consolidating good beneath a key resistance zone marked by the 200-day SMA at $2,699.60. After a intriguing switch up earlier in Can also honest, ETH has entered a sideways construction, with bulls defending the $2,500–$2,600 zone while attempting to spoil above the $2,700 level. Impress action reveals a tightening differ, continuously a precursor to a breakout or breakdown.

ETH is preserving above the 34-day EMA ($2,513) and all shorter-time period transferring averages (50- and 100-day SMAs), signaling that bullish momentum stays intact in the quick to mid-time period. The proven truth that Ethereum is consolidating above key increase levels as a substitute of correcting sharply is a constructive signal for bulls.

Volume stays pretty stable for the length of this segment, suggesting neither merchants nor sellers trust fully dedicated yet. A clear everyday close above the 200-day SMA with volume may well maybe maybe field off the following bullish impulse, focusing on the psychological $3,000 level.

On the other hand, failure to spoil resistance may well maybe maybe well honest consequence in a transient pullback toward the $2,450–$2,500 increase dwelling. Ethereum holds a bullish posture for now, but affirmation is wished to withhold upside continuation. The upcoming days will seemingly be key in defining ETH’s subsequent directional switch.

Featured characterize from Dall-E, chart from TradingView